NGI The Weekly Gas Market Report | Markets | NGI All News Access

Volatile Week for NatGas Forwards Leaves West Texas Sharply Lower as GCX Fills, Production Surges

It was a volatile week for some natural gas forward markets as pipeline operations took a back seat to weather demand for the Oct. 17-23 period. November prices were up just a penny on average, but some pricing hubs saw the prompt month swing more than a quarter, according to NGI’s Forward Look. December dropped 9 cents on average, while the full winter strip (November-March) slid 8 cents on average.

While there were quite a few standouts among the pack, Nymex futures drove the price behavior for the majority of market hubs across the United States. The November gas futures contract fell a modest 4 cents to reach $2.282 by Wednesday, while December dropped 9 cents to $2.427 and the winter slid 8 cents to $2.429. Smaller losses of less than a nickel were seen beyond the prompt winter.

While a series of cold weather systems has already begun sweeping through the country, the lack of sustained cold after the first week of November was at the heart of steeper losses beyond the November contract. The latest weather data had only minor changes, and models are in general agreement that warmer conditions may arrive beyond the 15-day outlook.

“The Pacific side of the pattern still suggests some cold risks in the northern/central United States, however, so we may still see model runs jump around some in the medium range,” Bespoke Weather Services said.

The firm said that although cash prices were weak on Thursday, the coming cold could firm up the spot market over the next several days, “possibly supporting at least prompt-month prices, but if our forecast for moderation/warming is correct after early November, price risks are certainly skewed to the downside.”

The weakening gas price environment has continued to aggressively displace coal consumption, according to Genscape Inc. For the week ended Oct. 17, the firm estimates that gas demand fell week/week due to a large decline in cooling degree days driving a large decline in power demand/thermal generation.

“However, the decline in gas demand was less than the overall decline in power demand would have suggested, due to the decline in gas prices pushing additional coal generation off the stack,” Genscape senior natural gas analyst Eric Fell said. “Coal generation fell by more than gas generation for the third week in a row, driven by average cash prices falling to the lowest levels since August.”

The last several weeks have provided “a great illustration” of the sensitivity of gas demand versus price in the power stack, according to Genscape. This is a continuation of a trend that has been in place for years, but has really accelerated this year.

As a result, consumption of coal for power generation continues to plummet to new record lows. Power generators consumed just 117 million short tons of coal in 2Q19, according to the U.S. Energy Information Administration (EIA). This is the lowest amount consumed since at least the year 2000.

The increased use of gas for power generation has proven to be no match for production, however. Lower 48 production hit a record 95 Bcf over the weekend and then climbed to a new 95.3 Bcf on Thursday. Output was poised to reach another peak on Friday, as early data suggested a higher starting point, according to Bespoke.

“While this week’s balance data looks tighter versus recent weeks, that’s still not saying much, as the market has been so loose over the last few weeks,” the forecaster said. “Our view is that we still need to see more tightening to avoid price declines, unless we see sustainable cold deeper into November than what we think will occur.”

Rampant production growth has also been instrumental in the refilling of depleted storage inventories following last winter, and the latest EIA data reaffirms the overall bearish influence production has had in the market.

The EIA reported an 87 Bcf injection into natural gas storage inventories for the week ending Oct. 18, coming in much higher than last year’s 62 Bcf build and the 73 Bcf five-year average.

Broken down by region, the Midwest added 25 Bcf to storage stocks, and the East added 18 Bcf, according to EIA. Inventories in the Mountain and Pacific regions grew by a combined 4 Bcf, while South Central stocks grew by 41 Bcf, which included a 22 Bcf injection into salt facilities and a 19 Bcf build into nonsalts.

Despite the ramped-up pace of injections in the South Central region over the last couple of weeks, regional inventories remain 35 Bcf below the five-year average, EIA data show.

Total working gas in storage as of Oct. 18 stood at 3,606 Bcf, 519 Bcf above year-ago levels and 28 Bcf above the five-year average, according to EIA.

Meanwhile, current seasonal outlooks point to a warmer winter this year compared to last. Maxar’s Weather Desk expects near-seasonal temperatures this November for the U.S. East and above-normal temperatures for the West.

For the heart of winter — December through February — the forecaster calls for above-normal temperatures in the Southwest and below-normal temperatures along the northern tier of the United States. Maxar projects that from December to February, U.S. gas-weighted heating degree days (GWHDDs) will total 2,635. The forecast this season is near the 30-year normal but significantly higher than the 10-year normal. It is also colder than last winter.

Even with El Nino conditions expected to remain neutral through the winter, Maxar’s Weather Desk predicts that other factors may lead to colder temperatures.

“One of those factors is just west of the typical El Niño/La Niña monitoring area, near the International Dateline in the tropical Pacific, where waters have been record warm in recent months,” Maxar lead meteorologist Bradley Harvey said. “This will be a region to watch for enhanced storminess and energy transfer toward the middle latitudes this winter. Historically, the region has been a cold influence for the eastern half of the United States in winter, especially in the second half of the season.”

Meanwhile, heating demand may linger a bit in the Northeast, with March 2020 temperatures forecast to average below normal. “In recent years, because of the noticeable shift of colder temperatures developing later in the winter, the early parts of spring have resulted in colder than normal anomalies lingering,” Maxar said.

What a difference a month makes.

After Kinder Morgan Inc. brought into full service its Gulf Coast Express (GCX) last month, Permian Basin producers rejoiced as they finally had an outlet for their stranded associated gas volumes. Cash prices in the region surged to their highest levels in months, nearing the $2 mark after plunging as low as minus $9 this past spring.

Fast forward one month later, and cash prices have returned to the negatives just days after Kinder Morgan executives reported that GCX was already running full. Apache Corp. is one of the customers now flowing gas on the fully subscribed 2 Bcf/d pipeline. It had shut in about 250 MMcf/d gross production from the Alpine High play in West Texas this summer because of extremely low gas prices at Waha.

With GCX already at capacity, the news of Kinder Morgan’s delay for its second Permian takeaway project, Permian Highway, reverberated through the markets. The 2 Bcf/d pipeline’s proposed route takes it through the Texas Hill Country, where stark opposition has grown and has led to regulatory holdups, according to management.

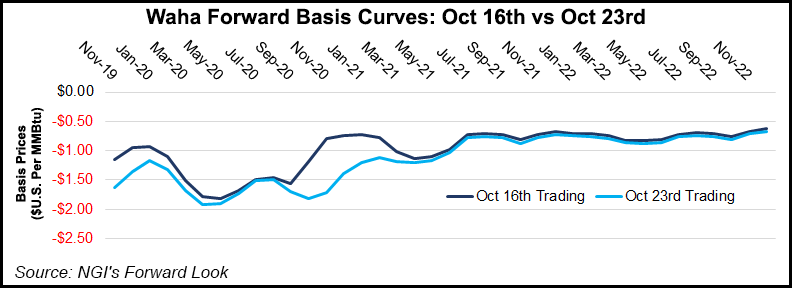

With associated gas volumes once again bottlenecked and no new outlets seen until early 2021, Waha prices plunged across the curve, Forward Look data show. November tumbled 37 cents from Oct. 17-23 to average just 64.7 cents, and winter 2019-2020 plunged 31 cents to average 99 cents. Prices for next summer averaged $1.26 after falling 22 cents, but the winter 2020-21 strip averaged just 76 cents after shedding 20 cents on the week.

Analysts appear to have differing opinions over the impacts the Permian Highway delay may have on production. Genscape said that although forward prices in the Permian have been hit hard by the news, the delay does not impact its production outlook for the basin.

“For the moment, we continue to forecast Permian production will grow by 1.2 Bcf/d in 2020 to reach nearly 13.85 Bcf/d by year’s end,” Genscape senior natural gas analyst Rick Margolin said. “We are expecting this growth to be facilitated by debottlenecking from the initiation of service of Mexico’s Wahalajara pipeline system sometime around late 1Q2020, followed by the Samalayuca-Sasabe system around May 2020.”

Although Kinder Morgan did not specify a month that Permian Highway could be in service, Genscape is modelling operations to begin in March 2021.

Goldman Sachs, on the other hand, reduced its 4Q2020 and Calendar Year 2021 production forecasts by 0.5 Bcf/d and 0.7 Bcf/d, respectively, leaving the market less oversupplied than previously expected. “These numbers include a subsequent impact we expect on the production ramp up associated with the start-up of the Whistler pipeline in October 2021, as we implicitly assume max 200 MMcf/d month-on-month growth in gas production.”

Goldman noted, however, that seasonal support to demand and exports to Mexico could offer some relief, as would slower oil production growth.

Interestingly, while Permian pricing was under pressure from the pipeline developments, Midcontinent area prices moved sharply higher for the Oct. 17-23 period, according to Forward Look. NGPL Midcontinent November prices shot up 24 cents to $1.795, while winter strip prices rose 8 cents to $2.06. The rest of the curve hardly budged.

Similar gains were seen throughout the region.

New England prices also saw quite a bit of volatility, which is not unusual during the winter season. However, with a lack of significant demand seen beyond early November, Algonquin Citygate plunged 29 cents at the front of the curve for the Oct. 17-23 period, Forward Look data show. The steep sell-off continued through the winter strip, which dropped nearly a quarter to $6.18.

On the pipeline front, Nexus Gas Transmission is scheduled to conduct a line replacement pipeline outage while simultaneously conducting detailed investigations on the entire pipeline that will reduce the capacity through Wadsworth Station to zero from Nov. 5 through Nov. 11. The line replacement is necessary for NEXUS to reach its full design capacity, and the investigations were scheduled to overlap with this major event so that no additional restrictions would be necessary, according to Genscape.

“If the investigations last longer than the line replacement outage, the worst-case scenario provided by Nexus is that flow through Hanoverton Station could be reduced to zero for an undetermined amount of time,” Genscape analyst Anthony Ferrara said.

Over the past 30 days, flows through Wadsworth have averaged 1.18 Bcf/d and maxed at 1.21 Bcf/d, according to Genscape.

Most of the supply on Nexus is received from Texas Eastern Transmission (Tetco), but this outage will prevent all that gas from flowing onto Nexus, the firm said. Without Nexus able to flow gas northbound to Michigan and Canada, there could be bullish pressure on demand hubs in the Midwest such as Michigan Consolidated and Dawn.

“However, Dawn storage is currently setting five-year highs for inventory levels, which could potentially mitigate some price effects in the area,” Ferrara said.

Indeed, the planned work only had a minor impact on nearby Michigan Consolidated prices. November rose 4 cents from Oct. 17-23 to reach $2.179, while December slipped 8 cents to $2.27 and the full winter strip dropped 7 cents to $2.29, according to Forward Look.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |