Infrastructure | NGI All News Access

IEnova CEO Hails ‘Win-Win’ Revision of CFE Pipeline Contract

The renegotiated supply contract for the 2.6 Bcf/d Sur de Texas-Tuxpan natural gas pipeline was a “win-win” for all parties involved, Infraestructura Energética Nova (IEnova) CEO Tania Ortiz Mena said Thursday.

IEnova developed the 42-inch diameter pipeline in a 50/50 partnership with TC Energy Corp.

The pipe’s anchor customer is Mexican state power utility Comisión Federal de Electricidad (CFE), which awarded the project’s construction and operation to IEnova and TC Energy (then known as Transcanada Corp.) in 2016 under a 25-year take-or-pay contract for the pipe’s full capacity.

After President Andrés Manuel López Obrador took office last December, he and CFE general director Manuel Bartlett DÃaz called the contract terms unfair and abusive, and demanded their renegotiation, threatening to bring the dispute to international arbitration.

The parties announced in late August that they had reached an agreement, allowing the pipe to begin flowing commercial volumes of gas.

The new arrangement is “IRR [internal rate of return] neutral,” Ortiz told analysts Thursday during IEnova’s third-quarter 2019 earnings call.

The new terms extend the contract tenor to 35 years, and establish a levelized tariff for the entire period.

For the seven-day period from Oct. 17-23, injections into the subsea pipeline averaged 622.5 MMcf/d, according to the pipe’s electronic bulletin board.

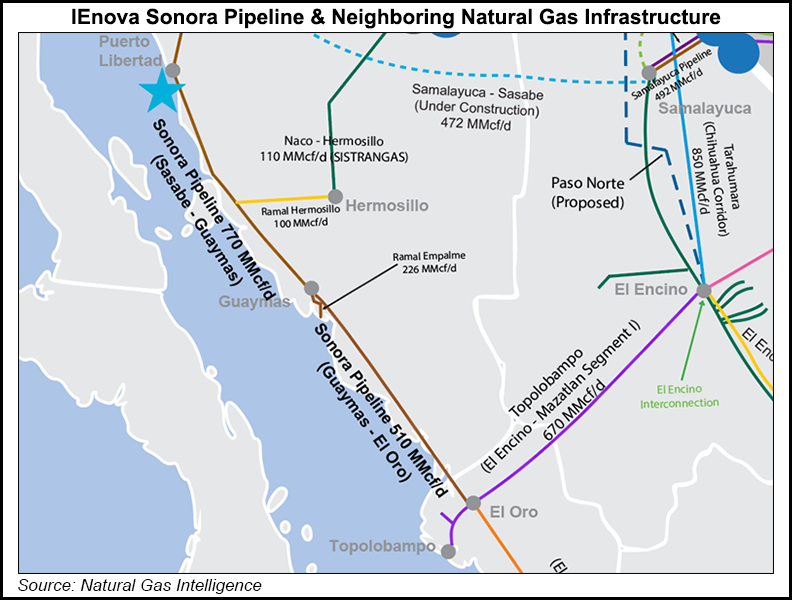

“As part of the agreement, the government is committed to supporting the resolution of the dispute on the second segment of the Sonora pipeline,” Ortiz said, referring to the Guaymas-El Oro pipeline.

The 510 MMcf/d pipeline in Sonora and Sinaloa states has been out of commission since August 2017 amid opposition from one of the eight factions of the local Yaqui indigenous tribe.

The other seven Yaqui groups have formally expressed support for the project.

Ortiz did not provide a timeline for the pipe’s return to commercial operations, but said that, “the new administration is very engaged and directly involved, all the way up to the secretary of the interior, to find a solution.”

She said that IEnova is holding meetings with the government “at least once a week” to discuss a strategy for the pipe’s reopening.

Since the pipeline’s forced shutdown was considered a force-majeure event, IEnova had been receiving regular capacity payments from CFE for the last 10 years.

However, the force majeure clause expired in August, Ortiz said, meaning that IEnova is no longer receiving payments.

Ortiz said that IEnova expects to reach a final investment decision (FID) in early 2020 for the EnergÃa Costa Azul (ECA) liquefied natural gas (LNG) export terminal in Baja California state.

The project is meant to receive pipeline shipments of gas from the U.S., before liquefying and exporting that gas to global markets, namely Asia.

IEnova is negotiating the final offtake agreements with customers Total SA, Mitsui & Co., and Tokyo Gas Co., with which IEnova signed a heads of agreement last November for the entirety of ECA’s phase one capacity, which will total about 2.4 million tons/year.

IEnova is also awaiting approval of a natural gas export permit from Mexico authorities, Ortiz said.

The project will require construction of a new pipeline in Mexico as well, which IEnova will have “more than enough time” to execute, Ortiz said.

IEnova reported a third quarter profit of $111 million (7 cents/share), down from $112 million (7 cents) in the same period a year ago.

The company attributed the decline to “the revenue deferment at the Guaymas-El Oro pipeline and the 2018 one-time natural gas distribution rates true-up from prior years at Ecogas Mexicali, partially offset by the start of operation of the South Texas-Tuxpan pipeline, Pima and Rumorosa solar power generation facilities.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |