Markets | Infrastructure | NGI All News Access

EIA Storage Report Offers No Surprises, Natural Gas Futures Slip

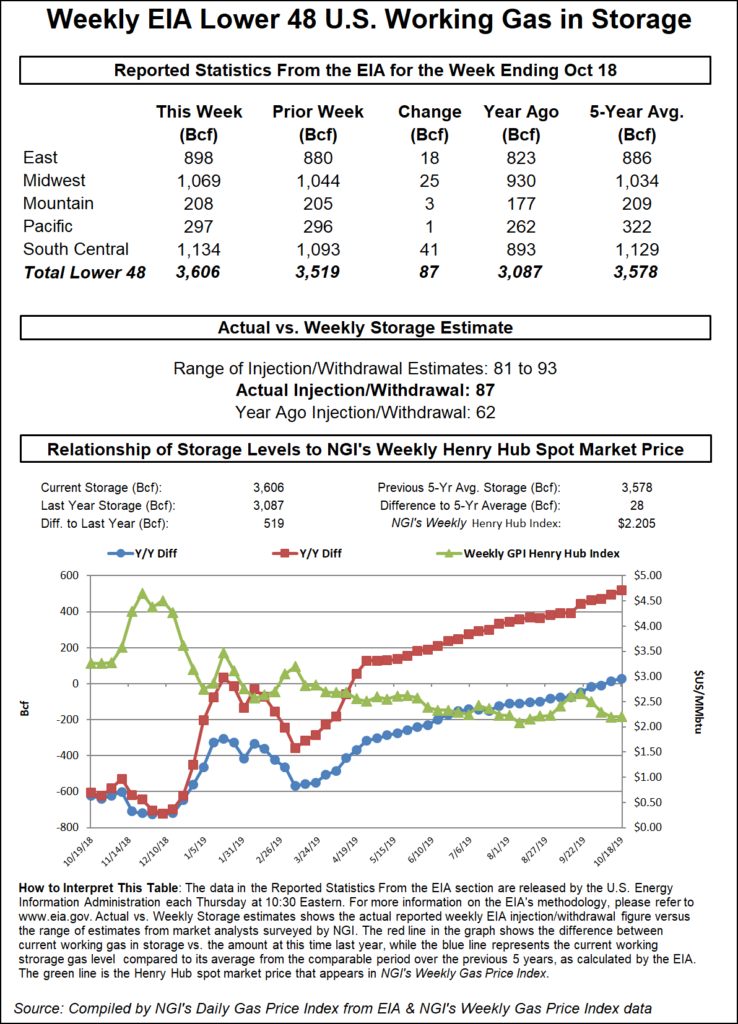

The Energy Information Administration (EIA) reported an 87 Bcf injection into natural gas storage inventories for the week ending Oct. 18, coming in well within the range of expectations although much higher than last year’s 62 Bcf build and the 73 Bcf five-year average addition.

With no huge surprises in the storage data, prices only briefly bounced after the EIA report was released. The November Nymex gas futures contract was trading a hair below $2.30 ahead of the 10:30 a.m. ET report and then bumped up to $2.304 as the print hit the screen. By 11 a.m., however, the prompt month was at $2.281, off one-tenth of a cent day/day.

“Balance wise, this still reflects very loose balances, given the weather demand we had in place,” said Bespoke Weather Services chief meteorologist Brian Lovern. “But more attention will likely be placed on next week’s number as we do appear to have tightened somewhat this week, but in our view, not to a bullish level, barring durable cold.”

Ahead of the report, market expectations ranged between an 81 Bcf injection and a 93 Bcf build. NGI projected a 93 Bcf build.

Broken down by region, the Midwest added 25 Bcf to storage stocks, and the East added 18 Bcf, according to EIA. Inventories in the Mountain and Pacific regions grew by a combined 4 Bcf, while South Central stocks grew by 41 Bcf, which included a 22 Bcf injection into salt facilities and a 19 Bcf build into nonsalts.

For the second week in a row, the South Central injection was slightly higher than expected. Despite the ramped-up injection pace in the last couple of weeks, regional inventories remain 35 Bcf below the five-year average, EIA data show.

Total working gas in storage as of Oct. 18 stood at 3,606 Bcf, 519 Bcf above year-ago levels and 28 Bcf above the five-year average, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |