Markets | NGI All News Access | NGI Data

Lackluster Demand, Stout Supply Pressures Weekly Natural Gas Prices

A mostly mild weather scenario across the United States this week sent natural gas prices lower in much of the country, with Permian Basin production growth quickly pushing markets in West Texas near the bargain-basement levels seen this summer. Strong demand and tight supplies out West, however, lifted prices there, sending the NGI Spot Gas Weekly Avg. down 8.0 cents to $1.780.

With Kinder Morgan Inc.’s Gulf Coast Express unleashing associated gas volumes from the Permian into the market, the turn to more fall-like temperatures across Texas and in neighboring regions left little demand to soak up the deluge of supply. After starting the week on solid footing above $1, Waha sank as low as just 10 cents on Friday. Prices ultimately fell 51 cents on the week to average 76.5 cents.

Prices across other areas in Texas fell mostly less than 15 cents for the week, which was in line with losses seen across the Midwest. Chicago Citygate dropped 8.5 cents to $1.72, and Dawn fell 10.5 cents to $1.70.

Some markets in the Midcontinent posted more substantial declines as producers aimed to compete with the Permian. OGT plunged 28 cents on the week to average $1.065.

Over in Appalachia and the Northeast, most markets shifted less than a dime week/week. Dominion South fell slightly more as it shed 11.5 cents to $1.19.

On the West Coast, ongoing pipeline work on Westcoast Transmission combined with strong demand in Canada and south of the border in the Rockies to boost prices in the region. As if the Westcoast work wasn’t enough, the Jackson Prairie storage facility in Washington was also unavailable as it was in the midst of a scheduled three-week outage.

Northwest Sumas shot up $1.345 to average $4.295, although trades were seen as high as $7.50.

In California, PG&E Citygate weekly prices rose 18 cents to $3.20, in line with other pricing hubs in the northern part of the region. The gains are impressive considering Pacific Gas & Electric (PG&E) preemptively shut off power to much of its territory due to wildfire risk beginning Wednesday. By late Thursday, however, the utility had restored power to about 426,000 customers, with about 312,000 still without power. The utility posted an update to social media Friday afternoon stating that it had restored power to 74% of customers affected by the safety shutoff.

The strength in prices despite the shutoff is likely due to a planned maintenance event that began Thursday along PG&E’s Redwood Path, which was scheduled to run through the end of October and would limit natural gas import capacity along the route by as much as 0.5 Bcf/d.

Natural gas futures failed to maintain the momentum they had earlier this month, ending the day lower on each of the past five trading sessions. With bursts of heating demand lacking staying power, production continues to easily overwhelm the market.

“Each day this week finished with declines at the front of the curve and since Sept. 10, there have only been four positive day/day changes for the prompt-month contract,” Mobius Risk Group said. “While it is reasonable to view the market as ”oversold’, a change in weather model output (cooler Northern tier) may be needed before momentum changes.”

With prices already at multi-year lows, losses this week were fairly small, capped at around a nickel or so on any given day. The November Nymex futures contract ultimately slid 8.9 cents from Monday to settle Friday at $2.214. December lost just 4.3 cents to hit $2.457.

Noting the small declines on Thursday following government storage data that was seen as bearish, EBW Analytics Group said that a test of support for the November contract at $2.18 would not be surprising. As space heating demand begins to ramp up (albeit modestly), natural gas may be close to a near-term bottom.

“The key remains late October/early November weather. No clear signal has yet emerged. Until this changes, price movements may be small,” EBW said.

Indeed, Friday’s net loss for the November contract was a modest four-tenths of a cent.

The latest weather outlooks are starting to hint at the return of cold, teasing a chillier pattern trying to push into the northern United States to close out October, but with more evidence needed, according to NatGasWeather.

“It’s possible the natural gas markets notice a few heating degree days being added overnight, but more importantly could notice the latest data trying to hint at a colder air into the northern United States Oct. 25-30. Clearly, the onus is on widespread cold arriving and lasting if weather sentiment is to be considered bullish, but the data took a small step in that direction.”

Regardless of the potential for cold, the market appears content with production and storage easily being able to meet demand this winter. Genscape Inc. estimated that on Wednesday, Lower 48 production returned above the 92 Bcf/d mark for the first time in nine days. With Wednesday’s output estimated at 92.49 Bcf/d, month-to-date production now appears to be averaging 91.57 Bcf/d, which is less than 0.1 Bcf/d below the firm’s forecast.

Rampant supply growth has played a major role in the rapid pace of storage refilling over the summer, quickly erasing the substantial deficits seen in the spring and elevating stocks to a hefty surplus over year-ago levels.

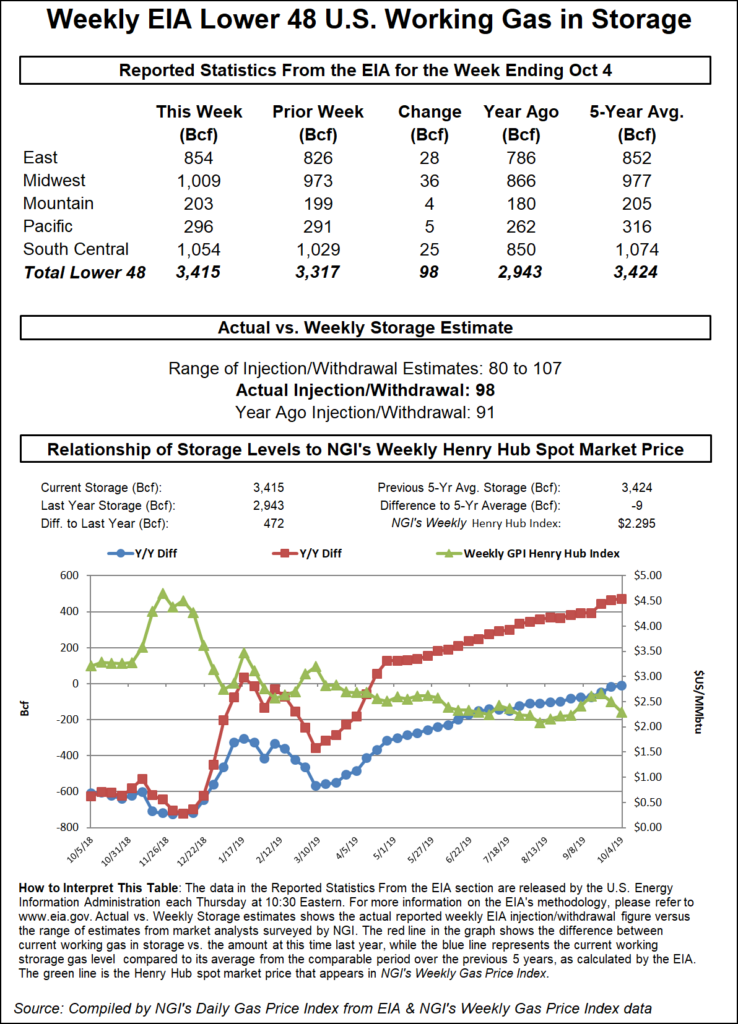

On Thursday, the Energy Information Administration (EIA) reported a 98 Bcf injection into storage, boosting inventories to 3,415 Bcf, up 472 Bcf over last year and just 9 Bcf below the five-year average.

Market observers were quick to point out that inventories are already at the levels some expected would be reached at the end of October. The fast-paced refill also occurred despite widespread heat that lasted from July through September and low prices.

There are a few supportive factors for the market. Pipeline exports to Mexico have been surging over the past month to repeated record highs, as volumes slowly ramp higher on the 2.6 Bcf/d Sur de Texas pipeline.

During 3Q2019, while legal issues over the pipeline were still being resolved, year/year growth was only 0.4 Bcf/d, less than half the 1.0 Bcf/d of year/year demand growth in 3Q2018, according to EBW. In 4Q2019, however, the increase in flows on the Sur de Texas is projected to yield 0.85 Bcf/d of year/year demand growth, more than the 0.7 Bcf/d of year/year growth last year.

“Although bullish pipeline export data has been overshadowed by growing production and bearish EIA Weekly Storage Reports, rising exports remain a bright spot in a sea of bearish fundamental data,” EBW said.

Furthermore, liquefied natural gas exports continue to ramp. Kinder Morgan Inc. announced on Thursday that it had begun commercial operations at the first of its 10 planned production units at the Elba Elba Liquefaction project near Savannah, GA.

Startup activities are underway on the second and third units, the commissioning of units four through six is ongoing and construction on the remaining units is largely complete, according to Kinder Morgan. Under full development, the $2 billion Elba Island Liquefaction facility is expected to have a total capacity of about 2.5 million metric tons/year of LNG for export, which is equivalent to approximately 350,000 Mcf/d of natural gas.

Feed gas deliveries to U.S. LNG export terminals continue to hover around the 6 Bcf/d mark as the Cove Point terminal has yet to return from an extended planned maintenance and flows to Freeport remain volatile, according to Genscape. Total feed gas deliveries were estimated at 5.9 Bcf/d on Thursday.

“While this is in line with the October month-to-date and September averages, it is about 0.7 Bcf/d below September’s peak day,” the firm said. “Volumes should start ticking back up soon, though.”

Indeed, the ramp-up in liquefaction at Cameron, Freeport and Elba started slowly but is gathering pace. Energy Aspects expects the terminals to add 2.35 million metric tons (mmt) to global supply in 1Q2020, on top of a year/year liquefaction capacity increase elsewhere of 5.75 mmt year/year.

“We anticipate demand growth outside of Europe only absorbing 4.09 mmt year/year, leaving around 3.79 mmt more for Europe to take,” the firm said.

Spot prices headed lower for the most part Friday, including a double-digit decline for benchmark Henry Hub, which averaged $2.075.

A taste of winter for the central Lower 48 Friday did little to stoke buying interest. Northern Natural Ventura skidded 11.5 cents to $1.680, while Northern Natural Demarc dropped 10.5 cents to $1.700.

The National Weather System (NWS) called for an “early season major winter storm” to continue impacting the Northern Plains into Friday night as an “anomalously cold air mass” was expected to remain over the central part of the country.

“Heavy snowfall across the Northern Plains will continue” Friday night “into Saturday as the storm system will slowly exit the region,” the NWS said. “…A very cold air mass has spread across the Western and Central U.S., and widespread record lows remain likely again on Saturday morning for many locations from the Southern/Central Plains to the Great Basin.”

In the Midwest, Dawn fell 8.5 cents to $1.645.

Working gas in storage at the Dawn Hub reached a record five-year high at 261 Bcf Thursday, 15 Bcf above year-ago levels, according to Genscape analyst Anthony Ferrara, who said this tops the previous five-year high of 260 Bcf recorded in November 2017.

“Storage levels blew past the five-year average back in mid-August,” the analyst said. “…Dawn has had an incredibly strong injection season so far this year, with potentially more to go. Withdrawals from Dawn historically begin in the late October to early November time frame.”

In the Northeast, where Maxar’s Weather Desk was looking for near-normal conditions over the weekend and into Monday, including average temperatures in the upper 50s to low 60s in Boston and New York City, prices fell sharply.

Algonquin Citygate tumbled 45.5 cents to $1.305.

In the West, discounts were widespread as prices continued to moderate following weather-driven gains earlier in the week. Opal plunged 51.5 cents to $1.760 heading into the weekend, while PG&E Citygate, subject to import restrictions from maintenance this month on its Redwood Path, eased 8.5 cents to $3.110.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |