Infrastructure | E&P | NGI All News Access

One Natural Gas Rig Exits Patch as Oil Count Sees Small Gain

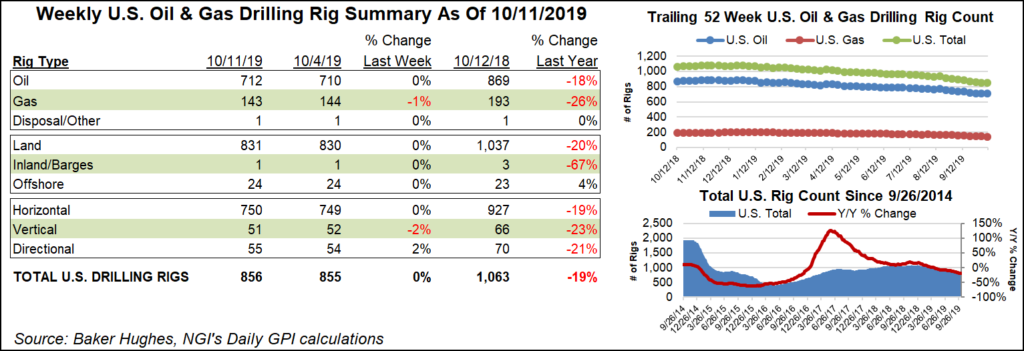

The U.S. natural gas rig count fell one unit to 143 for the week ended Friday (Oct. 11), while a small uptick in oil activity pushed the combined domestic count higher for the first time in nearly two months, according to data from Baker Hughes, a GE Company (BHGE).

Coming off a seven-week losing streak, the overall U.S. rig count stopped the bleeding — at least for now — adding one rig to climb to 856 owing to a two-rig increase in oil-directed activity.

The United States finished the week with 207 fewer active rigs than at this time last year. BHGE’s overall U.S. rig count had posted a net decline each week since mid-August, and drilling activity has been on a broader downtrend since late 2018.

The Canadian rig count added two overall to reach 146 for the week, with the addition of five gas-directed rigs offsetting the departure of three oil-directed. During the same period last year, Canada had 195 active rigs.

The combined North American rig count finished the week at 1,002, down from 1,258 in the year-ago period.

Among major plays, the Permian Basin saw the largest net gain for the week at six, bringing its total to 421, versus 489 a year ago. The Haynesville Shale picked up two rigs on the week to reach 52, up from 50 a year ago.

Meanwhile, the Cana Woodford saw three rigs pack it in for the week, dropping its total to 33, down from 64 at this time last year. One rig each exited from the Marcellus and Utica shales, according to BHGE.

Among states, Texas added six rigs for the week. West Virginia added three rigs, while two returned to action in Louisiana.

On the other side of the ledger, four rigs departed in Pennsylvania, while one each exited in Alaska, New Mexico, Ohio and Oklahoma.

The U.S. offshore proved to be a bright spot for oil and natural gas permitting during September, while the Lower 48 reported sharp declines in several major plays, according to Evercore ISI’s monthly overview of permitting data.

Lower 48 oil drilling permitting declined by 32% from August to 2,890, mostly on a shortfall in Texas, down 26%, and in Wyoming, off 35%.

“Weaker activity” was seen in the Permian, with permits declining by 238 from August, as well as the Eagle Ford Shale, down by 13. Partially offsetting the decline in the big Texas plays was an uptick in the Barnett Shale, with four more permits than in August, and in the Granite Wash formation, up by eight.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |