Natural Gas Demand No Match for Lower 48 Production; Forwards Slide

It was another down week for natural gas forward prices across the United States, but some supply regions fell substantially more than other market hubs as production continued to overwhelm the market.

Meanwhile, pipeline and storage restrictions in one of the only strong demand markets in recent days boosted prices there. Overall, November forward prices fell an average 8 cents from Oct. 3-9, and December dropped a nickel, according to NGI’s Forward Look.

With New York Mercantile Exchange futures leading the way, forward prices plunged by the double-digits across most regions — and as much as 58 cents in New England — as a lack of sustained cold and near-record production continued to dominate the market. There have been bouts of strong demand because of chilly temperatures, but cold snaps were fleeting, and current outlooks showed more of the same in the near term.

The November Nymex gas futures contract fell 9.5 cents from Oct. 3-9 to reach $2.234/MMBtu, and December dropped 6.4 cents to $2.436. The full winter strip (November-March) was also down about 6 cents to $2.45, and next summer (April-October) was down 3 cents to $2.31.

Genscape Inc. estimated that last Wednesday (Oct. 9), Lower 48 production returned above the 92 Bcf/d mark for the first time in nine days. The estimate was revised up by nearly 1.7 Bcf/d when llate-cycle nomination data was incorporated.

“Revisions of this magnitude are common during shoulder seasons and, thus, require caution when dealing with top-day estimates,” Genscape senior natural gas analyst Rick Margolin said.

The largest revisions (by far) this fall have been in the East, followed by the Rockies and Gulf Coast areas, according to Genscape. With Wednesday’s output estimated at 92.49 Bcf/d, month-to-date production appeared to be averaging 91.57 Bcf/d, which is less than 0.1 Bcf/d below the firm’s forecast.

Robust production has been at the forefront of a rapid refilling of storage inventories that sat more than 700 Bcf below historical levels this past spring. As RBN Energy LLC analyst Sheetal Nasta pointed out in a recent blog, there have been no fewer than nine triple-digit (100 Bcf or greater) injections reported by the Energy Information Administration (EIA) since April, compared with only one each in the past two years and zero in 2016.

“The only other time this decade that there were that many triple-digit injections during the April-October period was in 2014.”

On Thursday, the EIA reported a 98 Bcf injection into inventories, which compared with last year’s 91 Bcf build and the five-year average injection of 89 Bcf.

“This is probably the most straightforward, no surprise report we’ve had in a while,” said Het Shah, managing director of industry chat platform Enelyst.com. Genscape, which correctly called the 98 Bcf storage injection, said the figure is about 5 Bcf/d looser than the five-year average.

Broken down by region, the Midwest added 36 Bcf into storage stocks, while 28 Bcf was injected into East facilities, according to EIA. South Central inventories rose by 25 Bcf, including 16 Bcf into nonsalt facilities and 9 Bcf into salts.

Shah noted that salt inventories continue to sit below the five-year average of 278 Bcf, “but overall, South Central storage levels look quite healthy going into the winter.” Total working gas in storage rose to 3,415 Bcf, which puts inventories at a 472 Bcf surplus over last year and just 9 Bcf below the five-year average, according to EIA.

Overall levels were at 3,415 Bcf, which is “where the market expected we’d end up on Oct. 31 at the beginning of this summer. We hit that by week ending Oct. 4,” Shah said.

The rapid refill of storage inventories came amid “epic heat” that enveloped much of the United States from July through September, not to mention multi-year price lows, Bespoke Weather Services chief meteorologist Brian Lovern said. “And yet end-of-season estimates have risen 150-200 Bcf since late June despite all of that.”

Shah agreed that many factors shook the market this summer, but “production took the prize.”

There will be implications for the subsequent two EIA reporting periods since the Oct. 11 storage week, set to be issued on Thursday (Oct. 17) is predicted to conclude with 10 fewer population-weighted degree days, and the storage week reported on Oct. 24 is forecast to be flat to the current week, according to Mobius Risk Group.

“The case is being made by market bears that triple-digit builds will extend through late October,” Houston-based Mobius said. “Any crack in this theory will likely bring a bid back to the market.”

Weather models overnight Thursday moved slightly cooler, mostly thanks to trending toward a possible new shot of colder air at the very end of the 11- to 15-day period, something seen in both the American and European ensembles, according to Bespoke. The firm still did not consider it to be a “bullish” forecast as “it needs to roll forward in the forecast some in order to gain credibility, and it could wind up being just another push of colder air into the central United States, not impacting the population centers in the East in an appreciable way, similar to the current shot of colder air into the nation’s midsection.

“Nonetheless, it may be enough to impact the market’s weather sentiment if it shows up again on the midday runs,” Lovern said. “We suspect that, once the smoke clears, we will remain in a base state that favors generally below-normal demand amidst any variability in the pattern.”

With the market is in the throes of the shoulder season, producing regions appeared to be pricing themselves to incentivize buyers.

After a short-lived rally following the full in-service of Kinder Morgan Inc.’s Gulf Coast Express (GCX), which moves gas from the Permian Basin to the Gulf Coast, forward prices resumed their downward trajectory as pockets of demand are few and far between. Waha November prices fell 14 cents from Oct. 3-Oct. 9 to reach only 96.4 cents, according to Forward Look. December fared better as it dropped 7 cents to $1.434, while the winter slid 8 cents to $1.26.

With GCX expected to fill quickly, and production again seen overwhelming the market ahead of the next Permian gas takeaway project coming online next year, Waha summer prices averaged only 74 cents as of Wednesday, after slipping 3 cents on the week.

Forward gas prices in the Midcontinent also posted solid decreases across the front of the curve. NGPL Midcontinent November tumbled 21 cents from Oct. 3-9 to reach $1.496, December fell 12 cents to $1.903 and the winter strip dropped 13 cents to $1.93, Forward Look data show. Next summer was down 4 cents to $1.78.

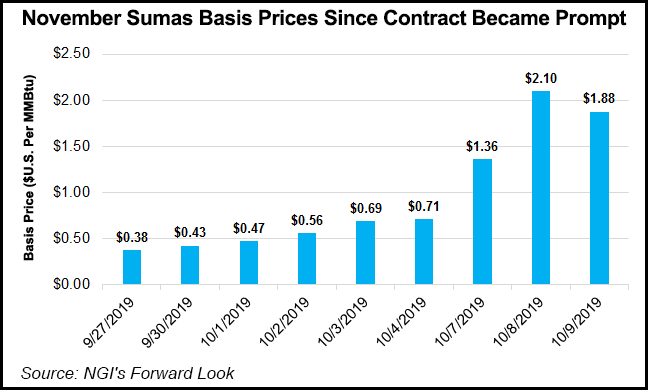

The softer prices were common across the country, but gas import restrictions across the border in Canada made for a volatile week for a key location in the Rockies. Northwest Sumas November shot up by more than $1.00 — $1.09 to be exact — from Oct. 3-9 to reach $4.11, according to Forward Look. December jumped an impressive 73 cents to $4.607, while the full winter strip climbed 55 cents to $3.85. Next summer was up only 2 cents to $1.70.

The stark gains occurred as cash prices have responded to strong demand from early season cold in the region, lower imports and the inability to tap into storage. Northwest Sumas cash prices averaged close to $5 on Wednesday but the hub traded well above $6, boosting basis to $2.71, “the highest level since the tail end of the multi-week rally in February and March that saw an unprecedented single-day average of $158/MMBtu at Sumas,” according to Genscape analyst Joseph Bernardi.

Normally, Northwest Pipeline (NWPL) would increase its storage withdrawals to help manage increased demand, but the Jackson Prairie storage facility in Washington state is in the midst of a planned three-week shutdown, which began on Oct. 1. Inventory changes dropped essentially to zero since Oct.1 after posting an average withdrawal of 147 MMcf/d on days with net withdrawals in September, Genscape said.

Imports to the Pacific Northwest have also been disrupted with supply availability tighter both from British Columbia (BC) and from the Rockies. Deliveries from Westcoast Transmission to serve demand in southern BC have been steadily increasing over the last several weeks even as Westcoast’s total southbound flow capacity has dipped, according to Genscape. That has resulted in lower imports at Sumas.

Maintenance on NWPL at the Rangely Compressor was also cutting imports from the Rockies to the region by about 75 MMcf/d, although the work was expected to end Saturday. Westcoast expects its southbound flow capacity toward Sumas to remain essentially the same for the rest of the month, and the Jackson Prairie shutdown was to remain in place for at least another week.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |