Infrastructure | NGI All News Access | Permian Basin

Permian’s Flared Natural Gas Needs Infrastructure Beyond GCX, Says Goldman

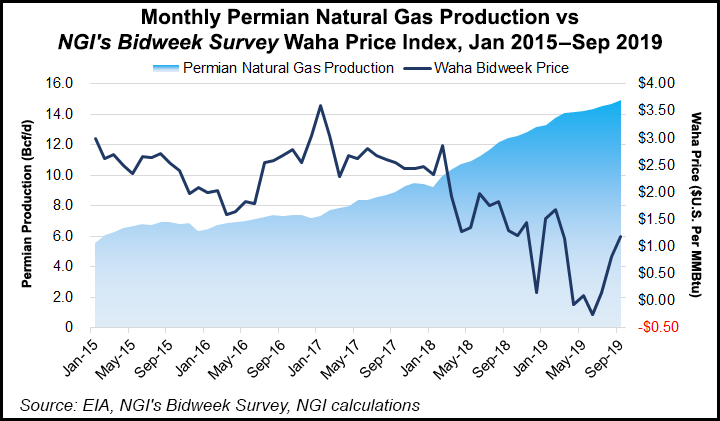

Venting and flaring natural gas in the Permian Basin continues to dog operators in New Mexico and Texas, but as more pipelines come into service the excess is expected to slowly be recovered.

Goldman Sachs analysts did a deep dive on venting/flaring activity in the Permian and said more infrastructure should alleviate the problem — but it will take time.

“Our analysis of Permian flaring activity identifies 0.6 Bcf/d of potential production that could be recovered as new pipeline capacity comes into service,” said Goldman analysts led by Damien Courvalin.

“Granular daily flaring data suggests that 0.15 Bcf/d of this potential production has so far come online, with the rest set to support marketed production growth in coming months.”

Goldman’s activity tracker corroborates commentary by Apache Corp. management that it restarted 0.25 Bcf/d of shut-in Alpine High gas production this summer as the 2 Bcf/d Gulf Coast Express (GCX) pipeline began to flow. GCX ramped last month.

Permian gas production is difficult to track given the intrastate nature of offtake pipelines, Courvalin noted, but it should be increasing in the coming weeks as local pipeline maintenance also comes to an end.

“This also suggests that the recent pattern of higher than expected weekly storage injections could be due to underestimated Permian output,” he said.

Beyond the potential underestimated volumes, Goldman analysts said 1.15 Bcf/d of supply growth needs to come from new wells to meet their forecast that Permian production will increase by 2.0 Bcf/d into next year, enabled by GCX.

“Our flaring work and oil production growth forecast lead us to adopt a slightly more moderate pace of Permian gas production growth than previously, reaching 2.0 Bcf/d in nine months instead of six previously,” Courvalin said. “This does not, however, change our fundamental gas forecasts for 2020 nor our view that Permian gas production will continue to grow even as oil activity slows.”

Through the medium term, Goldman expects “excess” associated gas flaring to subside in the face of looser state and federal regulations. More pipeline capacity is coming online in the Permian over the next year, and operators are aware of the “economic loss associated with such flaring.” In addition, “increased investor and producer focus on reducing emissions” is in producers’ line of sight.

Meanwhile, Rystad Energy said Permian flaring remains near record highs. Analysts estimated that flaring/venting in the basin has stabilized at 600-650 MMcf/d based on preliminary data for 3Q2019. Venting is releasing gas without consumption, whereas flaring is burning excess capacity.

“In New Mexico, vented and flared gas is reported separately and our research indicates that, on average, 5-15% of total flared and vented production stream is vented,” Rystad analysts said.

“In particular, reported data from recent quarters shows a significant decrease in the frequency of venting relative to flaring, with only 8% of waste gas being vented. In the case of Texas, flaring and venting are reported as a lump sum.”

GCX should provide more takeaway capacity in the fourth quarter, reducing the burn offs.

“However, it should be noted that the significant number of new well connections in the second half of 2019 might result in a sustained high flaring level, because from an operational perspective, associated gas flaring is normal in the first two weeks following an oil well completion,” said Rystad’s Artem Abramov, head of shale research.

Reported data is available through July for New Mexico and Texas, but Rystad’s team said the flaring/venting figures appear to be underreported. New Mexico data is nearly complete for the first half of 2019, but Texas “still exhibits significant underreporting for the second quarter and minor underreporting for the first quarter of the year.”

Rystad’s model is designed to take the latest reported data and activity trends/well productivity metrics to produce a “best possible final estimate” for flaring in the Permian for each county and operator.

Beyond the Permian, exploration-driven gas flaring and venting in the Lower 48 is generally low, except for the Bakken Shale in North Dakota, Rystad noted. Data from North Dakota indicated that 22-23% of produced gas was flared during the summer, which is twice the amount the state has asked operators to achieve.

“Such a high level of flaring has never been seen before,” Abramov said. “The volumes are high not only in absolute terms, but also corresponding to the record high flaring-to-production ratio in recent history.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |