Markets | Infrastructure | NGI All News Access

NatGas Futures Trim Gains After EIA’s ‘Most Straightforward, No Surprise Report’

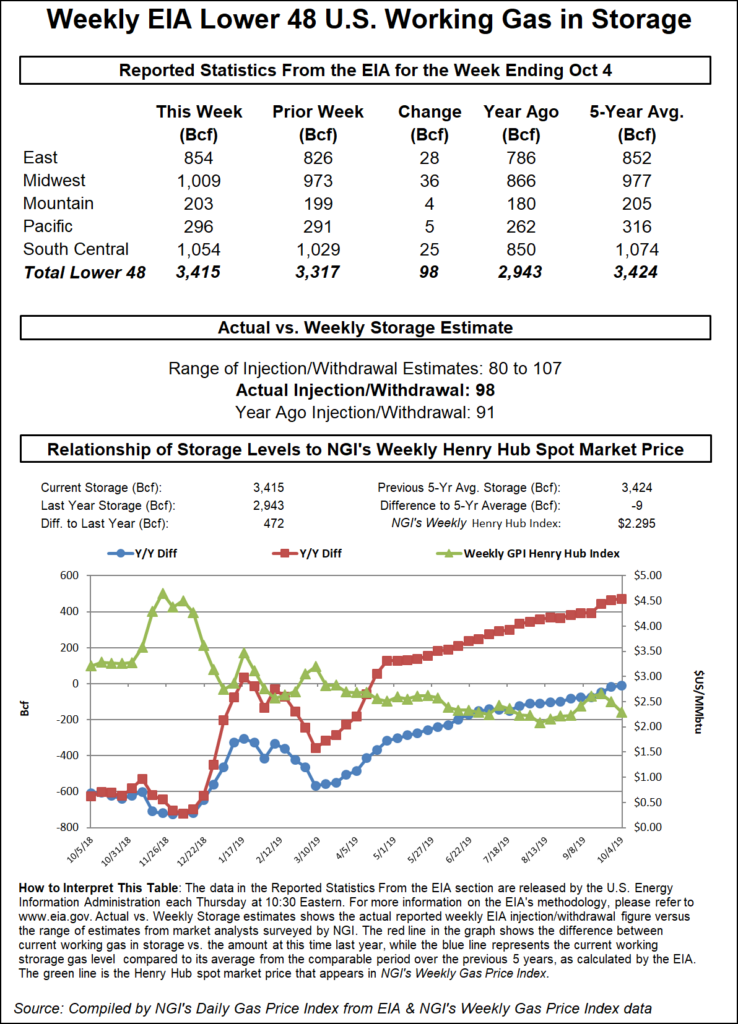

The Energy Information Administration (EIA) reported a 98 Bcf injection into storage facilities for the week ending Oct. 4, falling well within the wide range of expectations.

The reported injection was several Bcf above last year’s 91 Bcf as well as the five-year average of 89 Bcf, according to EIA.

“This is probably the most straightforward, no surprise report we’ve had in a while,” said Enelyst managing director Het Shah.

Natural gas futures action reflected that sentiment, moving only slightly lower after the print hit the screen. The November Nymex contract was trading about 2.5 cents higher day/day at $2.260 in the minutes leading up to the 10:30 a.m. ET report, but then slipped to $2.252, up 1.8 cents, immediately after the release. By 11 a.m., the prompt month was barely holding in positive territory, trading only fractionally higher at $2.238 after briefly dipping into the red.

Broken down by region, the Midwest added 36 Bcf into storage stocks, while 28 Bcf was injected into East facilities, according to EIA. South Central inventories rose by 25 Bcf, including 16 Bcf into nonsalt facilities and 9 Bcf into salts.

Shah noted that salt inventories continue to sit below the five-year average of 278 Bcf, “but overall, South Central storage levels look quite healthy going into the winter.”

Total working gas in storage rose to 3,415 Bcf, which puts inventories at a 472 Bcf surplus over last year and just 9 Bcf below the five-year average, according to EIA.

“Overall levels at 3,415 Bcf — that’s where the market expected we’d end up on Oct. 31 at the beginning of this summer. We hit that by week ending Oct. 4,” Shah said.

The rapid refill of storage inventories following a prolonged 2018-19 winter that left stocks at steep deficits to historical levels continues to astound market observers.

Bespoke Weather Services chief meteorologist Brian Lovern pointed to the epic heat that enveloped much of the United States from July through September, not to mention multi-year price lows. “And yet end-of-season estimates have risen 150-200 Bcf since late June despite all of that.”

Shah agreed that many factors shook the market this summer, but “production took the prize.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |