Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Pent-Up Permian Natural Gas Set for Another Mexican Outlet with Interconnect, Storage Project

San Antonio, TX-based Mirage Energy Corp. announced the signing of an interconnect agreement between its subsidiary WPF Transmission and Whistler Pipeline LLC, providing Permian Basin gas producers the opportunity for further access to Mexican markets.

The interconnect will occur at the Agua Dulce hub in South Texas. WPF’s planned 42-inch Concho-Progreso cross-border pipeline would travel south from there and connect with Mexico’s Sistrangas national pipeline grid at the Estación 19 (Station 19) and Los Ramones interconnection points in northeastern Mexico.

Whistler will consist of 475 miles of 42-inch pipeline, and would move 2 Bcf/d of natural gas from Waha, TX, to Agua Dulce.

“This gives us the ability to provide gas from Waha to Mexico at much cheaper prices than the current market. That’s the significance of this,” Mirage CEO Michael Ward told NGI’s Mexico GPI. “We are putting Mexico customers in contact with producer and processing plants in Texas.”

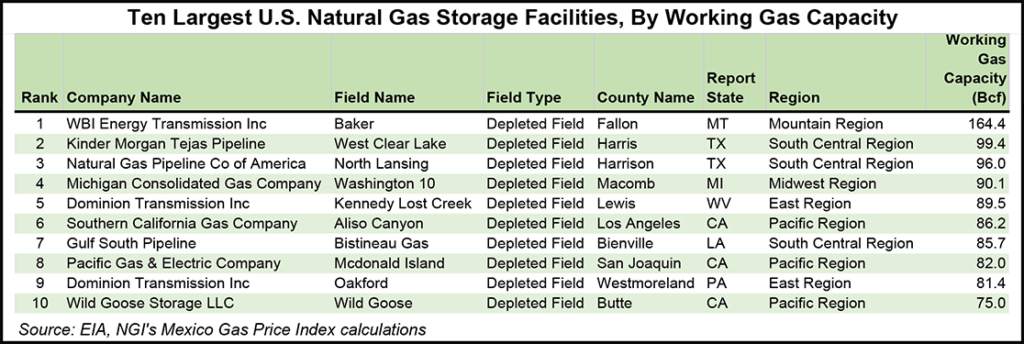

The Concho pipe would also have an interconnect to a planned underground natural gas storage project at the depleted Brasil gas reservoir in northern Mexico, a first of its kind project also being developed by Mirage. The planned facility would have initial storage capability of 25 Bcf, growing eventually to 52 Bcf, and would be Mexico’s first underground storage site.

Mexico relies on imported liquefied natural gas (LNG) for system balancing. In March 2018, energy ministry Sener published a natural gas storage policy calling for 45 Bcf of strategic inventories to be operational by 2026. A storage construction site was nominated for the first 10 Bcf at the depleted Jaf dry gas field.

The new administration in Mexico, however, has not indicated whether the energy ministry will give the order to proceed with the tender, and many analysts suggest this puts the country in a position of significant vulnerability.

“Mexico’s lack of large-scale natural gas storage capacity puts the gas system, and economic activity as a whole, at risk,” said energy expert Eduardo Prud’homme. “Cenagas, the independent operator of national pipeline system Sistrangas, only has at its disposal line packing to alleviate daily imbalances. Even if supply options were diversified, and domestic production increased, the stochastic nature of consumption means gas flow is never secure. Natural gas shortages can lead to failures in the electric power system and have serious impacts on economic activity.”

Mirage said earlier this year that it expected U.S. and Mexico permits and authorizations for the storage project in 3Q2019. The company has completed the necessary engineering and design for the pipeline and gas storage field.

It has also secured a memorandum of understanding (MOU) to fund all of its planned 250-mile Concho-Progreso pipeline system along with the storage project.

Meanwhile in June, a trio of backers, including MPLX LP, WhiteWater Midstream and a joint venture between Stonepeak Infrastructure Partners and West Texas Gas Inc., reached a final investment decision to move forward with the Whistler project. The line is expected to be in service in the third quarter of 2021, pending the receipt of customary regulatory and other approvals.

New infrastructure would be welcome news to Texas producers, as well as the Mexican market. The natural gas supply glut has been so extreme in the Permian recently that this past spring producers paid as much as $9.00/MMBtu for customers to take the gas as rampant growth in associated output from the oil-rich basin outstripped takeaway capacity.

Kinder Morgan Inc. (KMI) ramped full operation of its 2 Bcf/d Gulf Coast Express natural gas pipeline in September, easing some of this strain. Meanwhile, the KMI-led 2 Bcf/d Permian Highway Pipeline gas pipeline is set to start up in the fall of 2020, sending gas through a 430-mile pipeline from Waha to Katy outside of Houston, with connections to the Gulf Coast and Mexico markets, followed by Whistler the year after that.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 1532-1266 |