Stout Storage, Production Bears Down on Natural Gas Forwards

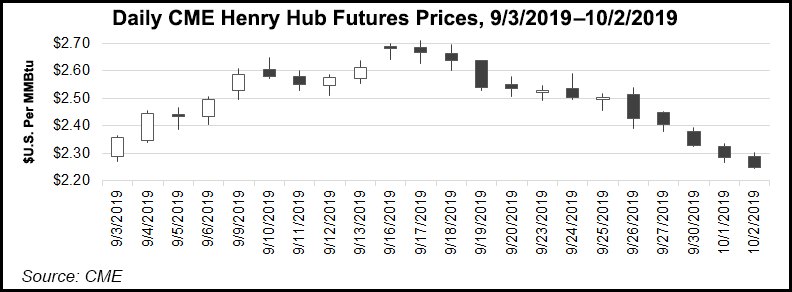

A losing streak that continued for 12 consecutive days in the natural gas futures market weighed heavily on regional forward prices, with lackluster demand and strong production growth pushing prices down considerably at some pricing hubs.

November prices plunged an average 20 cents, while the winter 2019-2020 (November-March) strip dropped an average 13 cents, according to NGI’s Forward Look. Smaller losses were seen further out the curve, with summer 2020 (April-October) slipping less than a nickel.

The steep losses are not surprising given an extended slide in Nymex futures prices that quickly erased the positive momentum seen in the first part of September. While prices could chop around in the coming weeks, analysts see more downside risk as light shoulder-season demand, robust production growth and a healthy storage situation provide major headwinds to the market.

The November Nymex contract tumbled 19 cents from Sept. 27 to Oct. 2 to reach $2.247. The winter strip was down 14 cents to $2.46, and summer 2020 was down just 3 cents to $2.33.

Considering West Texas Intermediate crude oil prices have fallen back comfortably below the $55/bbl mark, and the spread to Brent has remained relatively stable, it would stand to reason that both Nymex crude and natural gas are sending a strong enough signal to slow production growth, according to Mobius Risk Group. However, in the natural gas market, shoulder seasons are not as likely to react to a change in supply even if it were to occur in short order. Instead, shoulder seasons are dominated by the transition, or lack thereof, from cooling season to heating season or vice versa.

Overnight weather models into Friday showed some reduction in forecast demand when compared to Thursday’s runs, according to Bespoke Weather Services. Nevertheless, models showed hints that another push of colder air could come into the eastern United States at the end of the 11- to 15-day period, preventing the outlook from being bearish.

Global wind patterns appear to reflect some variability in the long-term forecast, and Bespoke is projecting total demand over the next couple of weeks to be slightly below normal overall.

“At this time, we are not expecting to see demand rise to the same levels as we saw starting in the middle of October last year,” Bespoke chief meteorologist Brian Lovern said.

However, the firm acknowledged some colder/higher demand risks to its forecast in the 11- to 15-day period based on the latest model projections.

The midday Global Forecast System data added demand by trending colder with a weather system into the United States Oct. 11-15, according to NatGasWeather. “The data is struggling with exactly how much cold air will arrive with this system, but the data has added demand since the start of the week.”

Without sustained demand in the coming weeks, the streak of triple-digit storage injections — now at two including Thursday’s government data — could persist, and material heating degree day accumulation would be delayed until November, Houston-based Mobius said. As a result, price-elastic power demand and salt storage capacity holders would be relied upon to soak up excess supply.

The Energy Information Administration (EIA) on Thursday reported a 112 Bcf injection into storage inventories for the week ending Sept. 27, coming in on the high side of estimates that ranged from 95 Bcf to a 118 Bcf build. The reported build was far above both last year’s 91 Bcf injection and the five-year average build for the week of 83 Bcf.

Broken down by region, the Midwest reported the largest week/week injection of 39 Bcf, while the East added 32 Bcf, according to EIA. The two regions’ combined 71 Bcf build is on par with the peak weekly observation from the past nine years, Mobius noted.

South Central inventories rose by 31 Bcf, including 13 Bcf into salt facilities and 19 Bcf into nonsalts. Salt storage as of Sept. 27 was 40 Bcf ahead of last year, which importantly marked a six-year low, according to Mobius. In order for salt storage to reach late 2016 highs, there would need to be 20 Bcf/week injected between now and the end of November.

“For reference, this would equate to 80% of the peak weekly observation from the past nine years being replicated for 10 consecutive weeks,” Mobius said.

Meanwhile, the recent freefall in Nymex futures prices has masked the strengthening in gas export data, according to EBW Analytics Group. Intake at the Freeport liquefied natural gas (LNG) terminal briefly reached full capacity at 0.75 Bcf/d on Monday, its highest on record, while LNG exports have averaged 6.25 Bcf/d over the past week despite maintenance at the Cove Point facility.

“As Cove Point likely returns to full operations by the end of next week, LNG demand could soon surpass 7.0 Bcf/d,” EBW said. “…Exports on the Sur de Texas pipeline may be slowly increasing gas sent south of the border, furthering support for physical Lower 48 supply/demand balances.”

Nevertheless, production continues to overwhelm, even more so since Kinder Morgan Inc. brought online its Gulf Coast Express (GCX) gas pipeline. Output could improve even more later this fall by a traditional seasonal ramp in output by Appalachian producers, EBW said.

The deeper into the fall, the higher the risks of unanticipated weather shifts driving sharp price changes, with the memory of November 2018’s price spike firmly in mind, according to the firm. “Nonetheless, as the year/year surplus expands, downward price pressure remains the most-likely scenario.”

Despite the strengthening that the GCX in-service has brought to West Texas cash markets, the Sept. 27-Oct. 2 period brought a second straight week of steep declines for forward prices in the region.

That’s likely because demand across Texas is already weakening despite continued 90-degree temperatures, with more softness ahead due to cooler weather in the forecast. A cold front sliding to the Southwest will act as the first cooling mechanism this weekend, according to AccuWeather. Although heat is set to linger this weekend, increased cloud cover will prevent highs from surging into record territory.

“A vigorous cold front that will first bring beneficial rainfall to the drought-stricken South from Monday into Monday night will then usher in the unofficial start to autumn by midweek,” the firm said. “Behind this front, low humidity is expected to accompany high temperatures generally in the 70s and 80s from the Tennessee River Valley to the Gulf Coast.”

With Permian Basin gas now flooding the market and demand set to decline, Waha posted the largest decline across North America. November tumbled 46 cents from Sept. 27-Oct. 2 to reach $1.058. The winter strip dropped 32 cents to $1.32, while next summer fell 11 cents to average just 76 cents, according to Forward Look.

The sub-$1 summer strip is a reflection of what is expected to be a resumption of bottlenecked Permian gas, with GCX seen filling quickly and robust production growth once again outstripping takeaway capacity. Kinder Morgan’s Permian Highway gas pipeline is due online in October 2020.

Over in the Pacific Northwest, early-season cooling has sparked demand in the region, providing support to cash prices. With chillier air set to arrive in the coming weeks, planned maintenance at Northwest Pipeline’s (NWPL) Jackson Prairie storage facility added fuel to forward prices.

Northwest Sumas November prices rose a nickel from Sept. 27-Oct. 2 to reach $2.811, while the full winter strip gained 4 cents to hit $3.15, Forward Look data show. Summer 2020 prices stayed flat at $1.65.

The planned work is already underway, with Jackson Prairie shutting in Oct. 1 for annual testing that is scheduled to continue through Oct. 21. NWPL has noted that this work will limit its balancing flexibility, with both withdrawals and injections unavailable for the duration of the maintenance.

“The turnaround comes as inventories at the facility have reached close to capacity,” Genscape Inc. natural gas analyst Matthew McDowell said.

Current inventory sits at about 24.5 Bcf, within 1 Bcf of the facility’s reported working capacity, according to Genscape. Historically, the switch from injections to withdrawals at Jackson Prairie starts in October, with about half of October days averaging a net withdrawal over the past three years. Withdrawal season begins in earnest at Jackson Prairie at the beginning of November.

Scheduled maintenance on Algonquin Gas Transmission (AGT) took a big bigger toll on forward prices in New England.

An update to Algonquin’s maintenance calendar extended the currently active 26-inch Main Line — Southeast to Cromwell maintenance — to no later than Nov. 15, reducing capacity through the Cromwell, CT, compressor to 728 MMcf/d. Last year, flows at Cromwell reached above this level by mid-October and maxed at 1,224 MMcf/d in November, meaning max curtailments could reach 496 MMcf/d, according to Genscape.

“Should colder temperatures materialize in November, this restriction would be incredibly bullish for Algonquin Citygate prices,” Genscape analyst Josh Garcia said.

The news alone sent Algonquin Citygate November prices up 21 cents from Sept. 27-Oct. 2 to $3.998. The full winter strip was up 9 cents to $6.81, while the summer 2020 strip was down 3 cents to $2.34, according to Forward Look.

In addition, the update indicated that the Brookfield interconnect with Iroquois Pipeline will be limited to 293 MMcf/d in net deliveries for the duration of the maintenance after maxing at 379 MMcf/d month-to-date, Genscape said.

AGT also released an operations update regarding early-winter proactive pressure restrictions due to investigations of pipeline segment that are susceptible to corrosion. This update expands on the AGT side of the recently released Enbridge Inc. shipper presentation outlining its pipeline integrity investigations, which largely focused on Texas Eastern Transmission (Tetco).

These pressure restrictions will result in small capacity reductions of 40 MMcf/d throughout the mainline and G System. The winter capacity through the Burrillville, RI compressor appears significant at 927 MMcf/d, as it is expected to have a winter capacity of 1,080 MMcf/d this year outside of these curtailments, according to Genscape.

“However, it is only a 71 MMcf/d cut compared to last winter’s capacity of 998 MMcf, and since these are early-winter restrictions, it is unclear that Burrillville will reach this winter’s peak capacity before these restrictions are lifted,” Garcia said.

As for Tetco, a recent update included dates assigned for inline inspection (ILI) tool runs and possible response/replacements dates for segments in M3 along the Northern Penn-Jersey Line, according to Genscape. The 10% pressure restrictions from Perulack to Shermansdale Line 12 and Grantville to Bernville Line 19 have been lifted, and pipe replacements are rescheduled to begin on Oct. 10 and 11, respectively. Furthermore, Delmont and Armagh Line 12 will have its ILI tool run on Dec. 17, with possible replacement dates on April 27, 2020.

“There is a chance that winter capacity at Delmont may be returned to normal after the Dec. 17 tool run if positive results are found,” Garcia said.

On the pricing front, Texas Eastern M-3 November plunged 24 cents from Sept. 27-Oct. 2 to reach $1.978, but full winter prices picked up 8 cents to hit $4.31, according to Forward Look. Summer 2020 prices were down a nickel to $1.96.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |