LatAm Oil Production Seen Rising Slightly in 2020 After Half- Decade of Decline

Latin America’s oil production could see a small uptick in 2020 after four consecutive years of hefty declines, according to analysts at Raymond James & Associates Inc.

After averaging around 10 million b/d throughout the first half of this decade, Latin American oil production has plunged since 2015 to an expected average of 8 million b/d this year. To put this into perspective, the United States alone now produces some 4.5 million b/d more than all of Latin America combined.

This decline within four years “for what is a fairly broad, diverse oil-producing region is unprecedented in recent history,” the Raymond James analysts said.

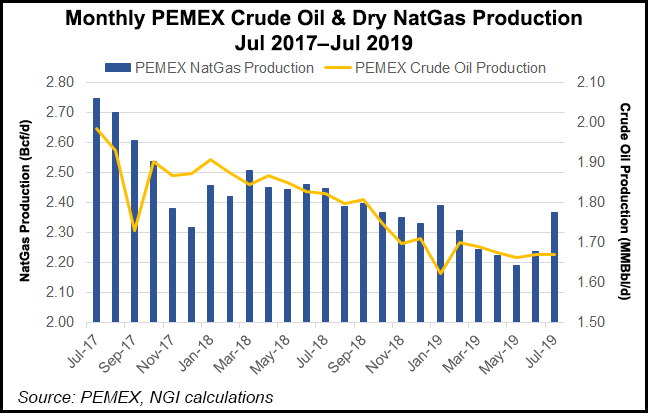

Mexico and Venezuela are principally responsible for the fall. Domestic oil production in Mexico has declined steadily for the past 15 years, falling rapidly from 2.6 million b/d in 2015 to 2.08 million b/d last year. “More recently, production has started to show a degree of stabilization, but we envision another down year in 2020 despite government rhetoric suggesting an increase,” the analysts said.

Raymond James analysts see the Mexican government’s goal of achieving 2.6 million b/d by the end of President Andrés Manuel López Obrador’s term in 2024 as “far too optimistic,” arguing that given state oil company Petreloes Mexicanos’ (Pemex) “notoriously overlevered balance sheet, it is doubtful it has the capability to even keep production flat, much less increase it by nearly 50% from current levels.”

This is generally in line with other analyses. In August, Fitch Ratings estimated Pemex production will continue to decline by about 5% annually over the short- to medium-term as exploration and production capital expenditures remain in line with the past three years’ average.

Analysts have suggested Pemex will need significant outside investments to reach its targets, but the company’s recently released business plan was explicit that the 100% state-owned firm would not seek joint venture partnerships. López Obrador has also suspended bid rounds and farmout tenders.

Venezuela, home to the world’s largest oil reserves and going through one of the world’s worst economic crisis, meanwhile, has seen oil production fall an incredible 65% since 2015, from 2.46 million b/d to about 900,000 b/d today.

“No other major oil-producing country over the past four years has experienced anything like this. Taking a longer historical perspective, the only comparable production declines have occurred as a result of outright war,” the analysts said.

Raymond James suggests the tide might finally turn in 2020 on the back of deepwater field development offshore Brazil and Guyana, increasing private sector participation in Argentina and Mexico, and the expectation of higher oil prices.

All of this should be reflected in greater overall activity. The Raymond James analysts see a compound annual growth rate of 5% to 2021 in the Latin American rig count. “While hardly back to the boom times, this will help countries begin to replace reserves.”

Brazil is expected to see production grow to 3 million b/d in 2020 from 2.7 million b/d last year, while in Argentina, rising unconventional production is offsetting conventional field declines, meaning crude output should reach 620,000 b/d in 2020, from 580,000 b/d in 2018.

In Colombia, oil production can only increase if its unconventional fields are developed, the analysts said, a topic of considerable debate in the country where hydraulic fracturing (fracking) remains illegal. Meanwhile Ecuador, which recently announced it is leaving the Organization of the Petroleum Exporting Countries (OPEC), is seeing its production flatlining at around 500,000 b/d.

But it is Guyana that may well make the difference between 2020 being another down year for the region as a whole, or a slight up year, as Raymond James predicts in its modelling.

“Guyana stands out as the world’s No. 1 deepwater exploration success story of the past decade,” the analysts said, with first production at the offshore Liza field set to start producing in early 2020, only five years after the first hydrocarbons discovery was made.

Five floating, production, storage and offloading (FPSO) vessels totaling 750,000 b/d in capacity are set to be operating offshore Guyana by 2025.

“Still, whether aggregate Latin American production can ever get back to the 10-plus million b/d run-rate of 2011-2015 will largely depend on what happens politically in Venezuela… stay tuned,” the analysts said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |