E&P | NGI All News Access | NGI The Weekly Gas Market Report

Natural Gas Volume Commitments Doubled from Leviathan, Tamar Fields Offshore Israel

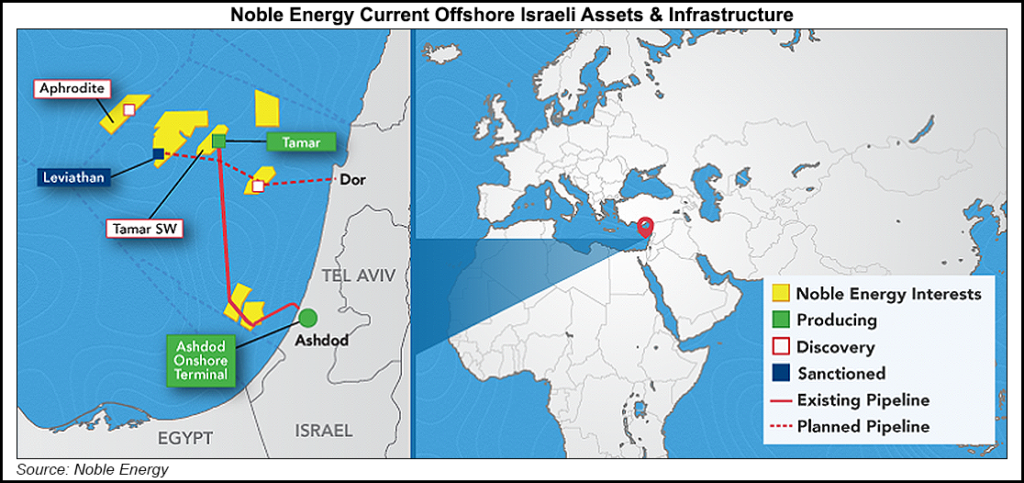

Houston super independent Noble Energy Inc., which is leading the development of two Eastern Mediterranean natural gas fields offshore Israel, plans to double firm volume commitments to Egypt’s Dolphinus Holdings Ltd. and extend the sales terms.

The original sales agreements with Dolphinus were completed in early 2018. The amended agreements to deliver supply from the Leviathan and Tamar fields would provide 3 Tcf total in combined firm contract quantities. In addition, each agreement has been extended by five years to reflect 15-year terms.

“This agreement is a major step for Noble Energy’s Eastern Mediterranean projects, expanding the long-term export demand in the region,” CEO David Stover said. “The supply flexibility between assets will enable Tamar to continue producing at high rates, while Leviathan grows rapidly toward its initial capacity.

“With first gas from Leviathan anticipated by the end of the year, this agreement provides further clarity to our 2020 cash flow profile and beyond.”

The first phase of the estimated 22 Tcf development includes four subsea wells, each capable of flowing more than 300 MMcf/d.

Pending regulatory approval, the amended agreements would supply 200 MMcf/d from the Leviathan field from Jan. 1-June 30. From July 1-June 30, 2022, 350 MMcf/d would be supplied from Leviathan and 100 MMcf/d from Tamar. And from July 1, 2022-Dec. 31, 2034, 450 MMcf/d would be provided from Leviathan and 100 MMcf/d from Tamar.

Until June 30, 2022, Leviathan also would backstop any volume commitment that Tamar is unable to deliver.

The revised contracts replace a previous firm commitment to Dolphinus of 1.15 Tcf from the Leviathan field and interruptible quantity of 1.15 Tcf from the Tamar field. Both contracts, linked to Brent oil prices, include take-or-pay commitments.

Dolphinus is working with gas producers and traders in the United States, Europe and Israel to develop a diversified portfolio to fuel Egypt’s expected economic growth and supply key industrial players.

By the end of the year, Noble and its partners also expect to complete their acquisition of stakes in the Eastern Mediterranean Pipeline, which would move gas to Egypt. In addition, they are considering a floating liquified natural gas vessel that would transport Leviathan volumes.

Noble operates and holds a 39.66% working interest in the Leviathan project with Israel-based Delek Drilling LP (45.34%) and Ratio Oil Exploration LP (15%). Noble also has a 25% stake in Tamar with partners Isramco Negev 2 LP (28.75%), Delek (22%), Tamar Petroleum Ltd. (16.75%), Dor Gas Exploration (4%) and Everest Infrastructures (3.5%).

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |