Regulatory | NGI All News Access | NGI The Weekly Gas Market Report

Cheap Bonds Said Not Enough to Reclaim Oil, NatGas Wells on Federal Lands

Bonds posted by oil and natural gas producers to help prevent orphaned wells on federal lands are too low, with most not high enough to cover the costs of reclamation, according to a report by the U.S. Government Accountability Office (GAO).

GAO’s analysis issued last month found that 84% of the bonds held by the Bureau of Land Management (BLM) would fail to cover the costs of reclaiming the land if an owner were to abandon its wells. The finding, GAO warned, could lead to higher costs for the agency as it would assume responsibility in such cases.

“Without taking steps to adjust bond levels to more closely reflect expected reclamation costs, BLM faces ongoing risks that not all wells will be completely and timely reclaimed, as required by law,” GAO said in its report.

States across the country are confronting similar issues as oil and gas drilling has increased in recent years and outdated bonding requirements have remained. BLM, responsible for managing onshore federal oil and gas resources, oversees private entities operating more than 96,000 wells on leased federal land.

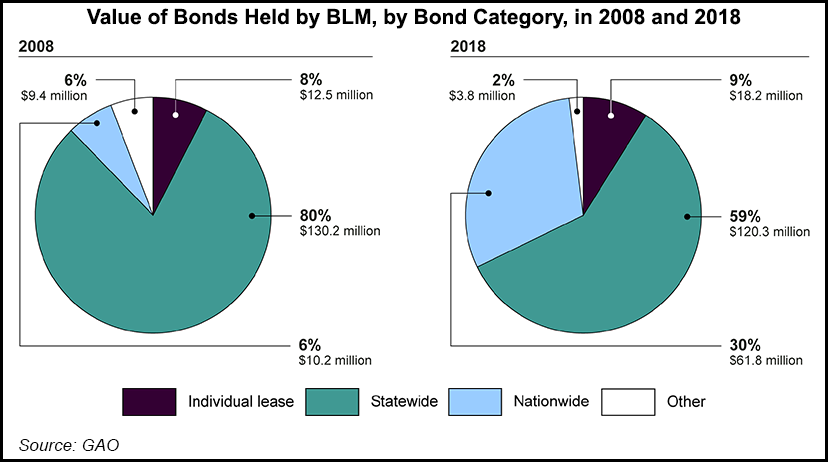

Under current regulations, BLM sets minimum bond values at $10,000 for all of an operator’s wells on an individual lease, $25,000 for all of an operator’s wells in a state and $150,000 for all of an operator’s wells nationwide. Based on BLM estimates, GAO said low-cost wells typically cost roughly $20,000 to reclaim, while high-cost wells run about $145,000 to reclaim. BLM held bonds worth an average of $2,122/well in 2018.

The regulatory minimum values, which have not been adjusted since the 1960s to account for inflation, “have not provided sufficient financial assurance” to prevent orphaned wells, GAO said. The regulatory minimums, the office added, also do not account for variables such as the number of wells they cover or other aspects that impact reclamation costs, such as the depth of a well.

“The oil and gas industry’s boom-and-bust cycles can lead operators to drill wells when prices for oil and gas are high but can contribute to bankruptcies when prices are low,” GAO said. “As a result, operators may not always have the resources to reclaim lands around wells that have been degraded by drilling and production.”

Citing the latest data, GAO said the BLM provided a list of 296 orphaned wells in April, 89 of which were new and not identified on a July 2017 list. Furthermore, BLM estimated that there are $46 million in potential reclamation costs associated with orphaned wells or inactive wells that officials deemed to be at risk of becoming orphaned last year.

BLM already faces a backlog of orphaned wells to reclaim, with 51 dating back at least 10 years, GAO said. Unlike other federal and state programs that obtain funds from industry through fees or dedicated funds, BLM does not do so for reclaiming orphaned wells, primarily because it doesn’t have the authority.

GAO recommended that Congress should consider giving BLM the authority to obtain funds from operators to help reclaim orphaned wells and require the agency to implement a mechanism to do so. GAO also urged BLM to take steps to adjust bond levels to more closely reflect expected reclamation costs, a recommendation that the BLM agreed with.

Last year, GAO recommended that the BLM improve its inactive well review policy to stay ahead of reclamation efforts. The BLM is currently working to implement those changes.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |