Markets | NGI All News Access | NGI Data

Natural Gas Cash, Futures Slide as Weather Can’t Overcome Supply Growth

Lingering heat over the southern United States couldn’t boost demand enough to prop up natural gas spot prices during the trading week ended Sept. 27, while futures continued lower on further signs of oversupply. NGI’s Weekly Spot Gas National Avg. fell 22.5 cents to $2.030/MMBtu.

As comfortable shoulder season conditions set in for the major Midwest and Northeast markets, prices tumbled in those regions during the week. Algonquin Citygate plummeted 55.0 cents to $1.630, while Joliet shed 37.0 cents to $1.900.

Despite unseasonably hot temperatures farther south, discounts spread throughout the Gulf Coast and Southeast on the week. Henry Hub dropped 16.5 cents to $2.495, while Transco Zone 4 dropped 14.5 cents to $2.500.

Conversely, some early season heating demand thanks to cold and snow in the forecast for the Northwest helped push prices higher at a few Rockies hubs. Opal added 6.0 cents to $2.325, while Northwest Sumas added 12.0 cents on the week to average $2.385.

Meanwhile, as traders continued to digest a surprising government inventory report that suggested even more supply growth than previously thought, natural gas futures skidded lower Friday. The November Nymex contract settled at $2.404/MMBtu, down 3.9 cents. The November contract, which took over as the prompt month Friday, fell more than 15 cents on the week, with most of the selling occurring after the Energy Information Administration (EIA) reported an outsized storage build.

“Natural gas prices have now declined each of the last two weeks, with the new prompt month November contract settling just over the $2.40 support level, which also is very close to the contract’s 50-day moving average,” Bespoke Weather Services told clients Friday. “There is the chance that prices pause here,” as recent price declines “could tighten up balances somewhat, and we still have some elevated demand to go through for another week or so.

“But unless balances tighten in a significant way, or the higher demand regime can persist longer, it is likely going to be tough to avoid more downside in prices.”

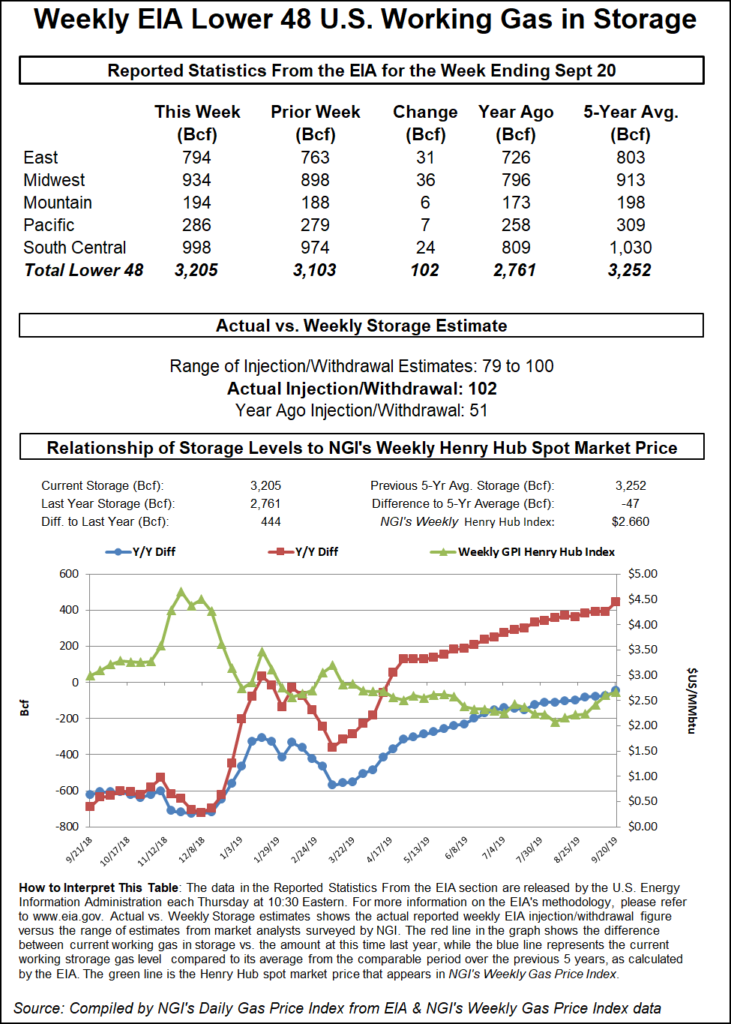

The EIA on Thursday reported a whopping 102 Bcf weekly injection into U.S. natural gas stocks, a figure that topped even the highest estimates among market observers, sending futures prices sharply lower.

The 102 Bcf injection, recorded for the week ended Sept. 20, exactly doubles the 51 Bcf build EIA recorded in the year-ago period. It also easily tops the 74 Bcf five-year average.

Prior to the report, major surveys had pointed to a build in the neighborhood of 89-92 Bcf, with responses ranging from 79 Bcf up to 100 Bcf. NGI’s model had predicted a 90 Bcf injection.

The 102 Bcf number was met with surprised reactions on Enelyst, an energy-focused chat platform. Participants in the weekly gas storage chat remarked on surprisingly large injections in the East, South Central and Pacific regions for the week.

“One thing I hadn’t considered in South Central storage is how much extra utilization may come from people who anticipate rising prices from the additional takeaway coming on,” NGI’s markets analyst Nathan Harrison said during the Enelyst chat. “If you expect prices will rise because of the timeline of takeaway projects and increased liquefied natural gas exports, you might store more gas than if you expected prices to remain steady.”

Total Lower 48 working gas in underground storage ended the week at 3,205 Bcf, 444 Bcf (16.1%) above year-ago levels but 47 Bcf (minus 1.4%) lower than the five-year average, according to EIA.

By region, the Midwest injected 36 Bcf for the week, while the East injected 31 Bcf. The Pacific region refilled 7 Bcf, while 6 Bcf was injected in the Mountain region. EIA recorded a 24 Bcf injection in the South Central region, including 16 Bcf into nonsalt stocks and 7 Bcf into salt.

Analysts at Tudor, Pickering, Holt & Co. (TPH) had been expecting a triple-digit build from this week’s report. The confirmed 102 Bcf injection reflects a market that was about 3 Bcf/d oversupplied after adjusting for weather-related demand, they said.

“While the triple-digit build likely widened some eyes, the primary focus this week” was the start of full in-service on the 2.0 Bcf/d Gulf Coast Express (GCX) pipeline “and how quickly volumes will ramp up,” the TPH team said. “Intrastate reporting issues make gauging flows somewhat difficult, but over the past two days we’ve seen receipt volumes of 0.8 Bcf/d hit the system and production volumes from Texas increase by around 1.0 Bcf/d.”

TPH is forecasting flows on the pipeline to ramp up to around 1.2 Bcf/d near-term and reach capacity by early 2Q2020. A “quicker/slower ramp” could have “material implications for the macro.”

The “startling” injection figure from EIA Thursday could signal gaps in the market’s read on production volumes, according to EBW Analytics Group.

“A single major storage miss is often an anomaly,” EBW analysts said. “The recent pattern suggests, however, that production is running substantially higher than published estimates. This may be due to completion of new intrastate lines and gathering systems, and the return of pipelines from fall maintenance and forced outages.”

The next two or three EIA reports “will be critical to gauge whether production estimates should be raised and, if so, by how much.”

Along the same lines, Genscape Inc. analyst Eric Fell pointed to the lack of visibility on GCX flows as a likely contributing factor in the large bearish miss from EIA.

“Because this is a Texas intrastate pipeline, the market has extremely limited visibility into precisely how much volume the system is moving and where it is sourcing from,” Fell said. “However, since the project’s developer — Kinder Morgan — confirmed full operations began this week, we have seen an increase in our Permian production sample, suggesting GCX has facilitated new and/or previously shut-in production to come online.”

In terms of overall balances, Fell said the 102 Bcf build indicates about 3.9 Bcf/d of looseness versus the prior five-year average when compared to degree days and normal seasonality.

“Gas burn in the power stack decreased by around 1.7 Bcf versus the prior week, driven by lower overall power demand and another week/week increase in coal generation,” the analyst said. “Over the past two weeks, coal generation has increased while gas generation has fallen meaningfully. This coincides with the average Henry Hub cash price increasing from $2.32 three weeks ago to $2.65 for the week just reported.”

In the spot market, despite a near-term forecast for unseasonable heat in the Southeast and chilly temperatures in the Northwest, deep discounts on deals for weekend and Monday delivery were the norm Friday. Spot traders from the Gulf Coast to the Southeast shrugged off a hot forecast, as a 14.0-cent drop at benchmark Henry Hub set the tone for widespread discounts.

The discounts occurred even as NatGasWeather was looking for weather-driven demand to strengthen over the next week.

The forecaster predicted that “high pressure will strengthen to unseasonably strong levels across the southern and eastern halves of the country” over the weekend and into the week ahead, creating “very warm to hot conditions as highs reach the 80s to 90s. It will be hottest from Texas to the Southeast for relatively strong late season demand.

“At the same time, an early season cold shot will advance into the West with valley rain and mountain snow, with lows dropping into the chilly 20s to 40s for modest early season heating demand.”

Southeast locations generally moved lower with Henry Hub Friday. Transco Zone 4 skidded 8.5 cents to $2.405. Further north, where forecasts showed more comfortable temperatures, locations posted even deeper discounts. Some Northeast hubs struggled to hold above the $1 mark. Transco Zone 6 NY averaged $1.080, down 25.0 cents. It was a similar story further upstream in Appalachia, where Dominion South slid 25.5 cents to $1.050.

Meanwhile, hubs in the northwestern portion of the Lower 48 reacted to what the National Weather Service (NWS) called “an early season and major to potentially historic winter storm” expected to hit parts of the Northern Rockies over the weekend.

“This storm will bring very heavy snowfall, high winds” and blizzard conditions, with Western Montana expected to be the hardest hit, the NWS said. “This system will also usher in a very cold air mass, at least for September standards, with daytime highs 20-30 degrees or more below normal. Many daily record low maximum temperature records” were in play over the weekend, “especially across the northern Great Basin/Rockies and California.”

Northwest Sumas rallied 41.5 cents to average $2.625 going into the weekend. Opal added 8.0 cents to $2.275. In California, Malin gained 11.5 cents to $2.365. Further south, prices fell, including at SoCal Border Avg., which finished at $2.285, down 16.0 cents.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |