Infrastructure | E&P | NGI All News Access

Two Natural Gas Rigs Exit as U.S. Drilling Activity Contracts Further

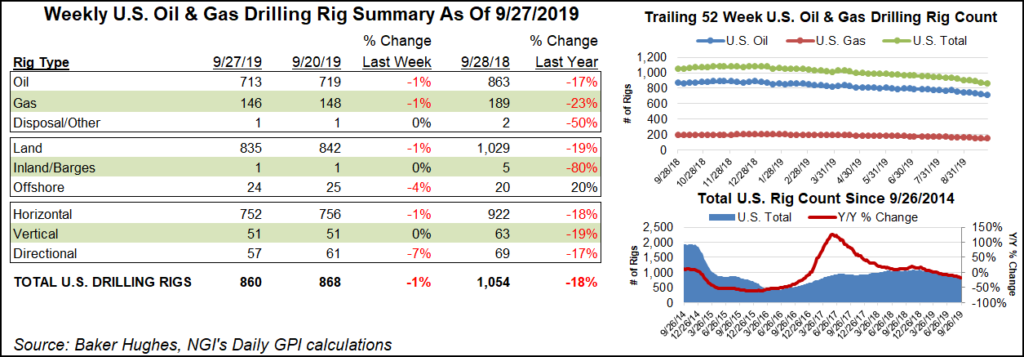

The U.S. rig count fell two units to 146 during yet another down week for overall domestic drilling activity, according to data published Friday by Baker Hughes, a GE Company (BHGE).

Six oil-directed rigs also departed in the United States, helping to drop the overall U.S. count to 860. This marks the sixth straight week of contraction for the U.S. count, which now lags nearly 200 units behind the 1,054 active rigs in the year-ago period.

Most of the declines occurred on land, while one rig exited the Gulf of Mexico. Four directional units and four horizontal units packed up for the week, while the number of vertical rigs in action remained the same.

The Canadian rig count, meanwhile, moved higher for the week, adding eight units in total to reach 127, versus 178 a year ago. The gains on the week included six oil-directed rigs and two gas-directed. That left the combined North American rig count unchanged week/week at 987, down from 1,232 at the same time last year.

Among major plays, the Permian Basin saw the largest decline week/week, with three rigs departing to drop its total to 414, versus 486 a year ago. The Cana Woodford added two rigs for the week to reach 38, versus 67 in the year-ago period.

Also among plays, the Denver Julesburg-Niobrara, Eagle Ford Shale and Granite Wash each dropped one rig.

Amid the slowdown in the Permian, Texas dropped five rigs in total on the week, putting the state at 418 active rigs, down from 529 a year ago. Colorado, Louisiana and Wyoming each dropped one rig from their respective totals.

Oil and natural gas activity declined during the third quarter across Texas, parts of New Mexico and Louisiana, according to the Federal Reserve Bank of Dallas.

The Dallas Fed, as it is known, every quarter surveys executives of exploration and production and oilfield services companies that are within the Eleventh District, which includes Texas, southern New Mexico and northern Louisiana. Many of the operators have national and global operations.

“Conditions in the oil and gas sector deteriorated in the third quarter, with overall activity and employment declining modestly,” senior research economist Michael Plante said. “Oilfield service firms were most affected, with a sharp drop in equipment utilization and operating margins.

“In general, the survey results suggest the second half of 2019 is going to be a tough one for the industry.”

Still, Permian operators got some good news during the week, as Kinder Morgan Inc. announced that its 2.0 Bcf/d Gulf Coast Express (GCX) pipeline from Waha to Agua Dulce near the Texas coast is fully in service.

GCX began initial flows in mid-August. The in-service is a welcome relief for Permian producers, which this past spring paid as much as $9/MMBtu for customers to take their gas as rampant growth in associated output from the oil-rich basin outstripped takeaway capacity.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |