EIA’s Triple-Digit Storage Surprise Pulls Rug Out From Natural Gas Futures

The Energy Information Administration (EIA) on Thursday reported a whopping 102 Bcf weekly injection into U.S. natural gas stocks, a figure that topped even the highest estimates among market observers, sending futures prices sharply lower.

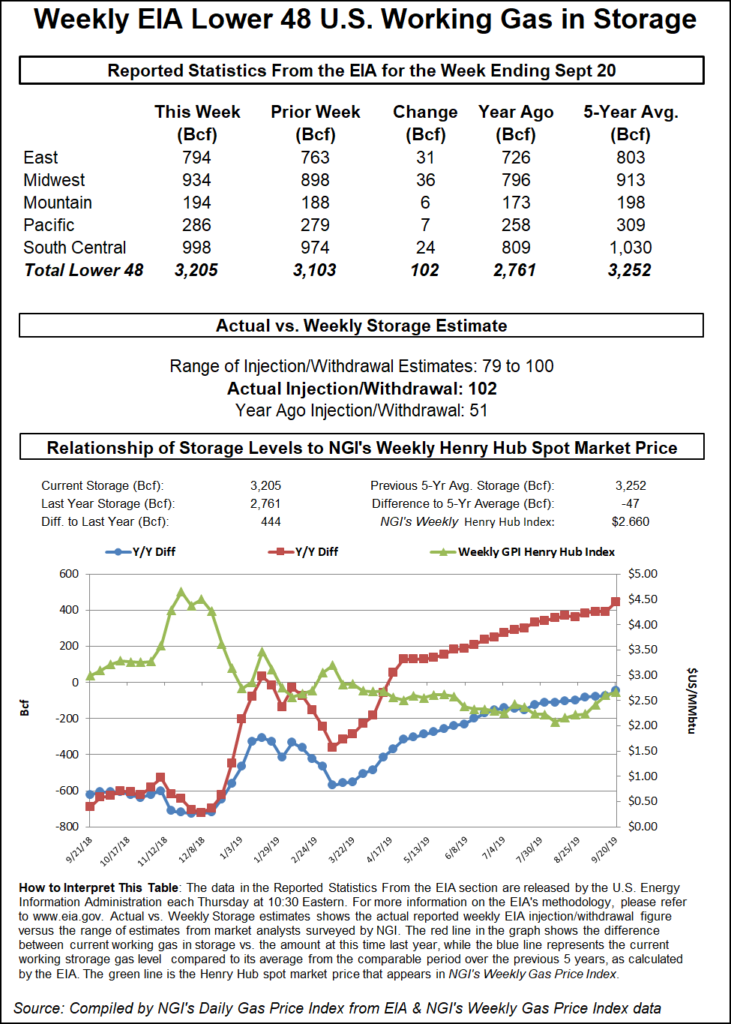

The 102 Bcf injection, recorded for the week ended Sept. 20, exactly doubles the 51 Bcf build EIA recorded in the year-ago period. It also easily tops the 74 Bcf five-year average.

In the lead-up to EIA’s 10:30 a.m. ET report, the October contract, set to expire Thursday, was hovering around $2.470-2.490. The minute the surprise number crossed trading screens, October dropped to as low as $2.408.

Over the next half hour as market observers attempted to digest the implications of such a hefty build, the front month briefly dipped below the $2.400 mark before recovering to around $2.410-2.430. By 11 a.m. ET, October was trading around $2.419, off 8.3 cents from Wednesday’s settle.

Prior to the report, major surveys had pointed to a build in the neighborhood of 89-92 Bcf, with responses ranging from 79 Bcf up to 100 Bcf. NGI’s model had predicted a 90 Bcf injection.

The 102 Bcf number was met with surprised reactions on Enelyst, an energy-focused chat platform. Participants in the weekly gas storage chat remarked on surprisingly large injections in the East, South Central and Pacific regions for the week.

“One thing I hadn’t considered in South Central storage is how much extra utilization may come from people who anticipate rising prices from the additional takeaway coming on,” NGI’s markets analyst Nathan Harrison said during the Enelyst chat. “If you expect prices will rise because of the timeline of takeaway projects and increased liquefied natural gas exports, you might store more gas than if you expected prices to remain steady.”

Genscape Inc. analyst Eric Fell pointed to “more production” as the likely culprit behind the high-side injection, along with “weak” industrial demand. “Most industrial demand is hidden,” he told the other Enelyst participants. “Most of the production growth is behind intrastate systems as well and very hard to track.”

Total Lower 48 working gas in underground storage ended the week at 3,205 Bcf, 444 Bcf (16.1%) above year-ago levels but 47 Bcf (minus 1.4%) lower than the five-year average, according to EIA.

By region, the Midwest injected 36 Bcf for the week, while the East injected 31 Bcf. The Pacific region refilled 7 Bcf, while 6 Bcf was injected in the Mountain region. EIA recorded a 24 Bcf injection in the South Central region, including 16 Bcf into nonsalt stocks and 7 Bcf into salt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |