Natural Gas Futures Steady Ahead of EIA Report, October Expiry

Natural gas futures traders seemed to be keeping their powder dry Wednesday as they looked ahead to both a new round of government inventory data and the front-month expiration. After trading as high as $2.519/MMBtu and as low as $2.455, the October contract, set to expire Thursday, eventually settled close to even at $2.502, off a tenth of a penny. November settled 0.7 cents lower at $2.518.

In the spot market, strong heat in the Southeast was countered by cooler temperatures elsewhere, leaving NGI’s Spot Gas National Avg. at $2.110, down 3.5 cents on the day.

From a technical perspective, looking at the continuation chart, the market could be in the fourth wave correction of an Elliott Wave pattern going back to the low established in early August, according to Powerhouse Executive Vice President David Thompson.

If the market is indeed in a fourth wave correction, then prices would be due for “another little push higher at some point in time to finish off this move,” Thompson told NGI, noting that he wouldn’t expect any move higher to go much above $2.700. “The more that fourth wave correction, meaning bearish move, goes lower, the more that deteriorates the idea that there’s another leg up to go.”

Prices tend to be “bullishly biased until we get into late October or early November” when the market gets a better read on what to expect from winter, he added.

The mid-day Global Forecast System (GFS) data dropped some demand from the outlook for Oct. 6-10, according to NatGasWeather.

“To our view, after Oct. 5-6 the risk is greater toward colder trends over the East instead of warmer,” the forecaster said. “Prices are still lower on the week even though a decent amount of demand has been added since last week.”

Even with the added weather-driven demand, upcoming weekly builds are still likely to print near- or above-normal, which could explain the muted price reaction to recent forecasts, according to NatGasWeather.

Estimates ahead of Thursday’s Energy Information Administration (EIA) storage report showed the market anticipating an injection in the upper 80s or low 90s Bcf for the week ended Sept. 20. A Bloomberg survey produced a median 92 Bcf, with estimates from 79 Bcf to 100 Bcf. A Wall Street Journal survey showed an average 89 Bcf, with a range of 83 Bcf to 96 Bcf. A Reuters survey also landed on 89 Bcf, with responses from 79 Bcf up to 96 Bcf.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 92 Bcf. NGI’s model predicted a 90 Bcf injection.

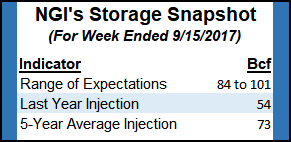

A build in line with market expectations this week would easily top both the 51 Bcf build EIA recorded for the year-ago period and the five-year average 74 Bcf injection.

Last Thursday, EIA reported an 84 Bcf injection for the week ended Sept.13, which fell on the bearish side of expectations.

Looking at the supply picture, the official start of full commercial service for the Gulf Coast Express pipeline this week has reaffirmed the prospect of additional associated gas supplies reaching the market in time for fall injections and the start of winter.

GCX had been in the commissioning phase, but backer Kinder Morgan Inc. announced late Tuesday that the 2 Bcf/d line officially began full commercial service from Waha to Agua Dulce starting Wednesday.

Analysts at Tudor, Pickering, Holt & Co. (TPH) said they’re modeling 1.2 Bcf/d of initial flows on GCX, with the line reaching capacity by 2Q2020. The rate at which the pipeline fills its capacity could have “significant impacts on natural gas inventories” through the fall and winter, they said.

“TPH’s estimated 2.0 Bcf/d of annual residue gas growth neatly matches additional takeaway capacity, lending itself to a status quo outlook,” analysts said Wednesday.

“The market will need to see progress on additional capacity late 2021/early 2022 to underwrite a more structural improvement in basin takeaway dynamics,” TPH analysts noted.

As an intrastate line, GCX does not report volumes, but Genscape Inc. analyst Colette Breshears said the firm has observed “strong signals from interstate receipt points,” along with other indicators, that support the company’s statements of increased throughput this month.

“GCX is expected to temporarily relieve production constraints in the Permian and has already relieved some of the pressure from interstate export pathways in the last few days during final commissioning stages,” Breshears said.

As the official start of full service on GCX got underway, spot prices in West Texas saw little uplift Wednesday, with trading locations declining amid broader discounts throughout the Lower 48. Waha fell 10.0 cents to average $1.595, while El Paso Permian dropped 15.0 cents to $1.615.

On the whole, Waha basis has improved noticeably since NGI first began observing evidence of GCX commissioning activities last month. At the start of August, Waha was trading at a more than $2 discount to Henry Hub. Over the past two weeks, Waha has on average traded around 91 cents below the benchmark.

Milder temperatures expected downstream in the Desert Southwest and Southern California to close out the work week may have also played a part in Wednesday’s West Texas discounts.

AccuWeather was calling for highs in Los Angeles to drop from the mid-80s Wednesday to the low 80s and mid-70s Thursday and Friday. Highs in Phoenix were expected to drop from the low 90s into the mid-80s, according to the forecaster.

Even as utility Southern California Gas (SoCalGas) is under pressure from regulators to increase injections ahead of the winter, prices at SoCal Citygate were discounted 22.5 cents to average $3.715. The utility was projecting modest demand on its system of around 2.2 million Dth/d for Thursday and Friday, down slightly from around 2.3-2.4 million Dth/d Tuesday and Wednesday.

Elsewhere in the region, SoCal Border Avg. slid 14.0 cents to $2.940, while Kern Delivery shed 14.5 cents to $2.970.

“An upper level low interacting with lingering moisture will continue to produce periods of heavy rain, with isolated severe winds and hail across the Southwest,” the National Weather Service (NWS) said Wednesday. “Flash flooding remains a concern across portions of interior Southern California, Arizona and far southern Nevada through Thursday.”

To the east, the NWS was calling for “summer-like temperatures” to continue over the next few days, including “well above-normal temperatures” from the southern Plains to the Southeast and along the East Coast Thursday.

“Record-breaking heat is expected across parts of the Southeast as temperatures climb well into the 90s across some portions of the region Thursday and Friday,” the forecaster said. “While the Southeast will remain warm, some cooling is forecast for parts of the Northeast and Mid-Atlantic as the front moves offshore on Friday. However, warm air surging north ahead of the next system will move from the Midwest on Friday into the eastern United States by the weekend.”

Despite the hot forecast, prices along the Gulf Coast and Southeast generally saw discounts Wednesday. Transco Zone 4 eased 4.0 cents to $2.520.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |