E&P | NGI All News Access | NGI Mexico GPI

Mexico Experts Warn of Lost Oil, Natural Gas E&P Opportunities — Bonus Coverage

Editor’s Note: Please enjoy this bonus coverage from NGI’s Mexico Gas Price Index, which includes daily prices, analysis and coverage of the emerging natural gas market in Mexico.

Editor’s Note: Please enjoy this bonus coverage from NGI’s Mexico Gas Price Index, which includes daily prices, analysis and coverage of the emerging natural gas market in Mexico.

Request a Trial | Subscribe

By limiting the private sector’s role in oil and gas exploration and production (E&P), Mexico is missing out on opportunities that may not come around again, industry experts told the senate last week.

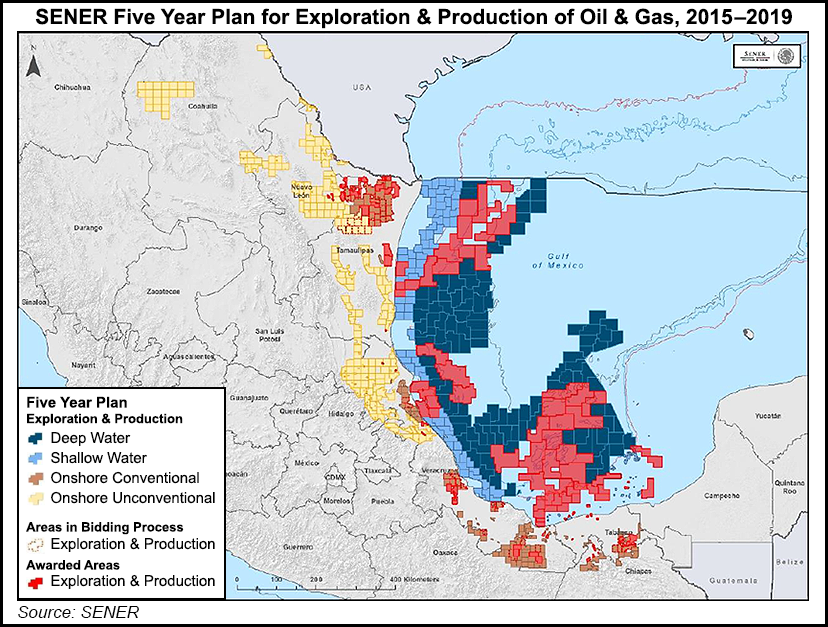

As part of the energy security and sovereignty forum, prominent figures from the public and private energy sectors implored the government to resume bid rounds, promote unconventional drilling, and embrace partnerships with the international oil industry.

The 111 contracts awarded so far through bid rounds, farmout tenders, and service contract migrations under Mexico’s 2013-2014 constitutional energy reform can reasonably be expected to add 500,000 b/d of oil production by 2027, said Asociación Mexicana de Empresas de Hidrocarburos (AMEXHI) director Merlin Cochran.

AMEXHI is a trade group representing oil and gas companies in Mexico.

However, Cochran said, “if Mexico does not continue exploring new areas, production will fall. It’s simply the nature of the industry.”

Since taking office last December, President Andrés Manuel López Obrador has halted the rounds, farmout tenders for operating stakes in acreage held by state oil company Petróleos Mexicanos (Pemex), and the migration of oilfield services (OFS) contracts to license or production sharing contracts.

Pemex’s 2019-2023 business plan instead relies heavily on integrated exploration and extraction services contracts, known by their Spanish initials as CSIEEs.

Under this model, the OFS contractor assumes the totality of capital expenditures (capex) and operating expenditures (opex) for the life of a given project, while Pemex retains a 100% operating interest.

The OFS provider is paid a per-barrel fee for oil production and a per-million cubic foot fee for natural gas output.

These arrangements “are not partnerships,” said Miguel Cervantes, founding partner of the energy-focused law firm MCM Abogados.

To read the full article and gain access to more in-depth coverage including natural gas price and flow data surrounding the rapidly evolving Mexico energy markets, check out NGI’s Mexico Gas Price Index.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 | ISSN © 2158-8023 |