Infrastructure | E&P | NGI All News Access

Seven Natural Gas Rigs Exit Patch as U.S. Count Continues to Plummet

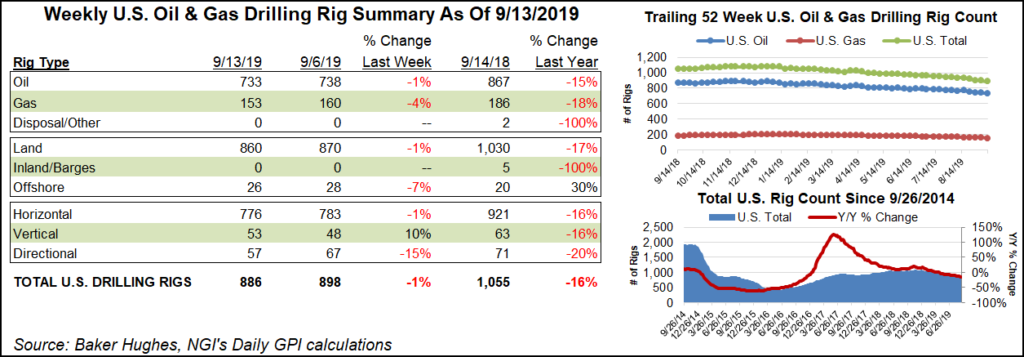

The U.S. natural gas rig count fell seven units to 153 for the week ended Friday, furthering recent declines in domestic drilling activity, according to the latest data from Baker Hughes, a GE Company (BHGE).

With five oil-directed rigs also departing for the week, the combined U.S. rig count fell to 886 for the week, its lowest level since May 2017 and down from 1,055 rigs running at this time last year, BHGE data show.

Two offshore rigs departed, including one from the Gulf of Mexico, dropping the region’s total to 25 rigs, according to BHGE. Seven horizontal units and 10 directional units exited the patch, partially offset by the addition of five vertical rigs.

The Canadian rig count also declined on the week, falling by 13 units to 134. The declines included nine oil-directed rigs and four gas-directed. The combined North American rig count fell to 1,020, 261 units below year-ago levels.

Among plays, the Permian Basin saw the largest week/week drop at eight, leaving the West Texas/southeastern New Mexico producing region with 419 rigs as of Friday, down from 483 a year ago. Three Cana Woodford rigs departed for the week, along with two Marcellus Shale rigs, while the Barnett Shale posted a net increase of three rigs, according to BHGE.

Also among plays, the Denver Julesburg-Niobrara, Eagle Ford Shale and Utica Shale each dropped one rig, while the Haynesville Shale and Williston Basin each added one.

Among states, mirroring the Permian declines, Texas dropped eight rigs to fall to 430 total, down from 525 a year ago. West Virginia saw three rigs exit overall, while Louisiana dropped two. Pennsylvania added two rigs for the week.

Also among states, North Dakota and Oklahoma each gained one rig on the week, while Alaska, California, Colorado and Ohio each dropped one.

Permitting to develop oil formations in the Lower 48 recovered slightly in August month/month, and natural gas permitting remained healthy even with commodity price volatility, according to a recent compilation of state and federal data by Evercore ISI.

In its monthly permit roundup, Evercore analysts led by James West said permits for gas formations climbed 16% from July to 395, with improvement in the Marcellus and Haynesville shales.

“The Marcellus rose to 185,” or 24 higher than in July, “as operators implemented more permits in Pennsylvania (up by 10) and West Virginia (up by 18),” West said. Most of the increase in the Marcellus was driven by more permits for horizontal wells, up by 20 from July, and directional gas wells, which climbed by three.

Meanwhile, potential natural gas reserves in the United States were an estimated 3,374 Tcf at the end of 2018, a record high, according to a biennial report conducted by the Potential Gas Committee (PGC).

It was the highest resource evaluation in PGC’s 54-year history, and larger than the group’s 2016 assessment by about 20%, said the American Gas Association. The increase was because of reassessments of shale gas resources in the Northeast and Midcontinent areas and conventional and tight gas in the Midcontinent and Rocky Mountain areas.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |