Markets | NGI All News Access | NGI The Weekly Gas Market Report

Top North American Natural Gas Marketers Report 2Q2019 Decrease, First Since 4Q2017 NGI Survey

Natural gas sales reported by leading marketers declined in the second quarter compared to the year-ago period, halting at least temporarily an upward trend which had been in place since late 2017, according to NGI‘s 2Q2019 Top North American Natural Gas Marketers rankings.

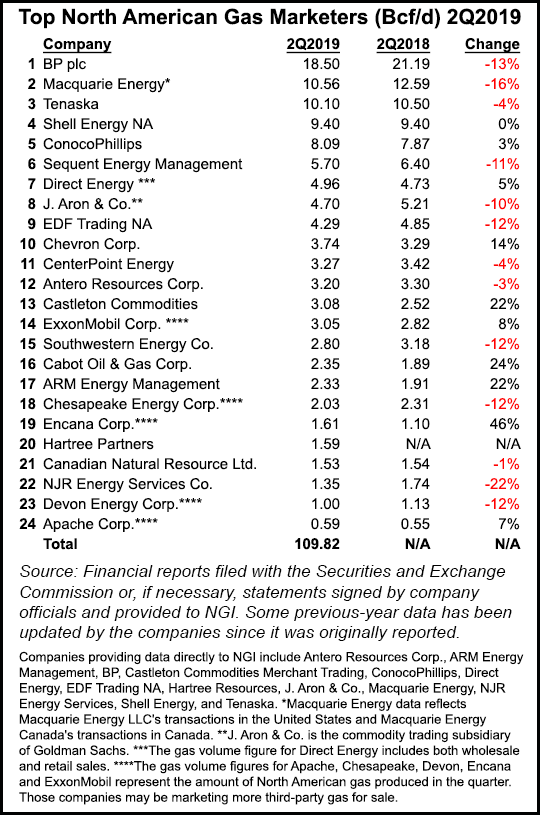

A total of two dozen participating gas marketers reported combined sales transactions of 109.82 Bcf/d in 2Q2019. The 22 companies that participated in both the most recent survey and NGI‘s 2Q2018 survey reported a total of 105.03 Bcf/d, a 5% year/year decline.

The decrease comes after six consecutive NGI quarterly surveys in which marketers reported year/year increases, including a 4.29 Bcf/d (4%) increase in gas sales in 1Q2019 compared with 1Q2018, a 5% increase in 4Q2018, a 7% increase in 3Q2018, a 9% increase in 2Q2018, an 8% increase in 1Q2018 and a 7% increase in 4Q2017.

In the latest survey, six of the survey’s Top 10 marketers, including the top three, and 13 companies overall reported lower numbers in 2Q2019 than in the year-ago period.

Longtime No.1 BP plc reported 18.50 Bcf/d in 2Q2019, a 13% decrease compared with 21.19 Bcf/d in 2Q2018. The London-based super major reported better-than-expected results in the second quarter, in part on a strong showing in the Lower 48, with synergies from a $10.5 billion transaction to take nearly all of BHP’s Lower 48 portfolio ensuring a strengthening U.S. business.

No. 2 Macquarie Energy reported 10.56 Bcf/d in 2Q2019, a 16% decline compared with 12.59 Bcf/d in 2Q2018, and No. 3 Tenaska reported 10.10 Bcf/d in 2Q2019, a 4% decline compared with the year-ago period. Shell remained steady at 9.40 Bcf/d, the same amount it reported in 2Q2018.

Top-10 companies reporting increases were ConocoPhillips (8.09 Bcf, a 3% increase compared with 2Q2018), Direct Energy (4.96 Bcf/d, a 5% increase) and Chevron Corp. (3.74 Bcf/d, a 14% increase).

Whether the 2Q2019 decline is the beginning of a downward trend remains to be seen, but there are indications that it may instead be a momentary correction. Participants in the surveys have warned in the past about placing too much emphasis on the numbers from a single quarter. And while there have been some indications globally of a coming recession, most U.S. economic indicators so far remain more upbeat.

Total energy consumption in the United States was more than 101 quadrillion Btu last year, a record high, with the use of natural gas — the second largest source of energy in the country — also soaring to new heights, according to the Energy Information Administration (EIA). Natural gas consumption in 2018 totaled 29.96 Tcf, up from 27.13 Tcf in 2017, according to EIA. And through the first five months of the year, 2019 is outpacing 2018 consumption.

Rising domestic production of natural gas is easily meeting all that demand, EIA said. U.S. gas production is forecast to average 91.4 Bcf/d this year, up by 8 Bcf/d from 2018, EIA said this week.

Monthly average gas production is likely to grow in late 2019 and then decline slightly during 1Q2020 as the impact of low gas prices helps to curb volumes. However, EIA expects production to pick up in 2Q2020, with next year’s volumes estimated to average 93.2 Bcf/d.

The unrelenting onslaught in Lower 48 supplies and the possibility of lower demand prompted Goldman Sachs recently to reduce its forecast for natural gas and liquids prices for 2020-2021. Analysts now assume an average natural gas price of $2.50/MMBtu in 2020-2021 from a previous forecast of $2.75.

Looking ahead, permitting to develop oil formations in the Lower 48 recovered slightly in August month/month, and natural gas permitting remained healthy even with commodity price volatility, according to a compilation of state and federal data by Evercore ISI.

Joining NGI‘s survey for the first time is Appalachian pure-play Antero Resources Corp., which reported 3.20 Bcf/d for 2Q2019. Antero recently said that it is targeting annual production growth of 10% in coming years and up to 120 completions in 2020, versus the 125 slated for this year. Also joining NGI‘s survey is Hartree Partners, previously known as Hess Energy Trading Co. Hartree reported 1.59 Bcf/d for 2Q2019.

Other highlights of NGI’s 2Q2019 survey were Castleton Commodities reporting 3.08 Bcf/d, a 22% increase compared with 2.52 Bcf/d in 2Q2018; ExxonMobil Corp. reporting 3.05 Bcf/d (an 8% increase); Cabot Oil & Gas Corp. reporting 2.35 Bcf/d (a 24% increase); ARM Energy Management reporting 2.33 Bcf/d (a 22% increase); Encana Corp. reporting 1.61 Bcf/d (a 46% increase); and Apache Corp. reporting 0.59 Bcf/d (a 7% increase).

Dropping out of the survey this quarter is Anadarko Petroleum, which was taken over last month by Houston-based Occidental Petroleum Corp. in a transaction valued at $55 billion. Also leaving the survey was CFE International.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |