Markets | NGI All News Access | NGI Data

EIA Report Below Consensus; Natural Gas Futures See Small Bump

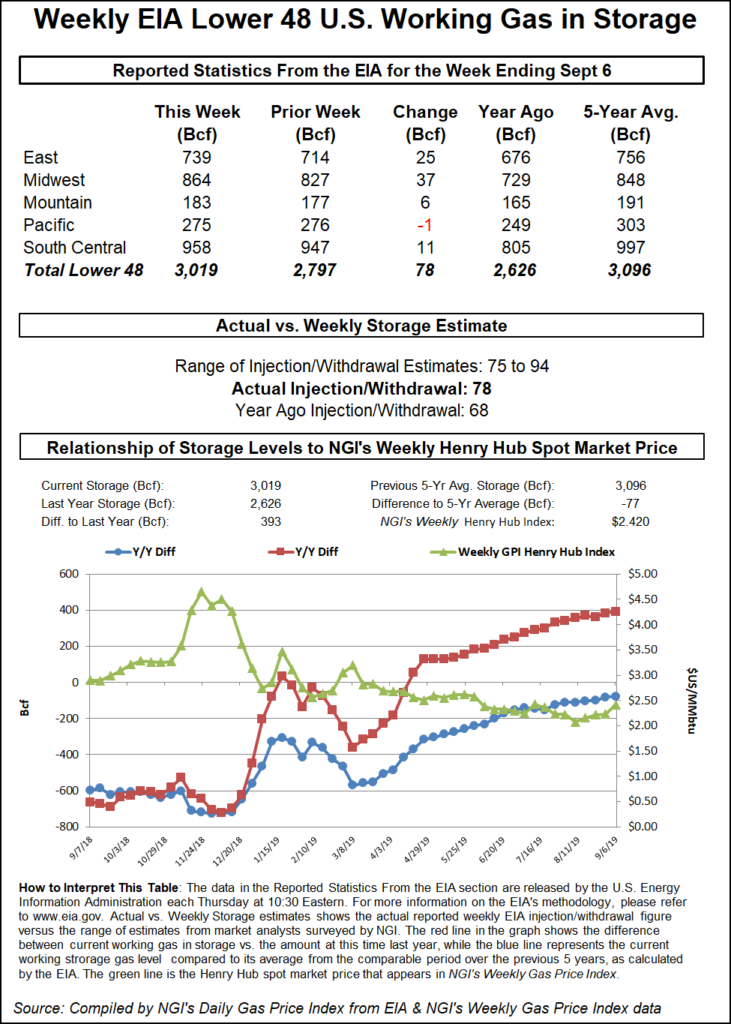

The Energy Information Administration (EIA) on Thursday reported a leaner-than-expected 78 Bcf build into U.S. natural gas stocks, injecting a little upward movement into a futures market that had sold off in recent sessions.

The 78 Bcf injection for the week ended Sept. 6 tops both the 68 Bcf build recorded for the year-ago period and the five-year average 73 Bcf injection. But market consensus had pointed to a net build somewhat higher, in the low 80s Bcf.

Shortly after EIA’s report crossed trading screens at 10:30 a.m. ET, the October Nymex contract climbed from around $2.536 up to as high as $2.578. By 11 a.m. ET, the front month was trading around $2.561, up almost a penny from Wednesday’s settle and several cents higher versus the pre-report trade.

Predictions had ranged from around 75 Bcf up to 94 Bcf, with major surveys centering around 81-82 Bcf for this week’s report, which reflected impacts from the Labor Day holiday and also demand-dampening effects from Hurricane Dorian.

While on the low end of the market’s expectations, “we still consider this ”neutral’ overall” partly because “it could be a small make-up for a higher number last week, but also because of all the complicating factors involved last week with the holiday” and “some very strong heat/demand in the South,” Bespoke Weather Services said. “Rather than searching for a big takeaway from this report, we prefer to see how things shake out from here.”

Total Lower 48 working gas in underground storage stood at 3,019 Bcf as of Sept. 6, 393 Bcf (15.0%) more than year-ago levels but 77 Bcf (minus 2.5%) shy of the five-year average, according to EIA.

During a discussion on Enelyst, Het Shah, managing director for the energy-focused chat platform, observed that between “huge production” on one hand and liquefied natural gas demand growth on the other, “it’s hard to say what end-of-season storage level keeps us comfortable” heading into the winter.

By region, EIA reported a 37 Bcf weekly build in the Midwest, with a 25 Bcf injection in the East. The Pacific withdrew 1 Bcf on the week, while 6 Bcf was refilled in the Mountain region. In the South Central, EIA recorded a net 2 Bcf injection into salt stocks for the week, with a 10 Bcf build in nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |