Bulls Get Their Groove Back in Week of Strong Gains for Natural Gas Futures, Cash

After being on the defensive for much of the summer, natural gas bulls asserted themselves during the trading week ended Sept. 6, as both the cash and futures markets rallied. Heat out West and in the southern part of the Lower 48 helped push NGI’s Weekly Spot Gas National Avg. 17.5 cents higher to $2.150/MMBtu.

Points in California posted the strongest gains during the week as maintenance-related import constraints combined with heat to produce elevated prices. SoCal Citygate surged 64.0 cents to average $3.930 on the week. In Arizona/Nevada, Kern Delivery shot up 42.5 cents to $3.380.

Heat over the southern United States contributed to healthy gains across much of Texas and the Gulf Coast. Houston Ship Channel climbed 21.5 cents to $2.375, while Texas Eastern S. TX added 18.0 cents to $2.370.

Elsewhere, comfortable conditions further north saw more modest weekly gains at a few Northeast hubs. Algonquin Citygate picked up 10.0 cents to $2.015.

The natural gas futures market capped off a bullish week in fitting fashion Friday, rallying for the third time in four sessions to test the psychologically and technically significant boundary around $2.500/MMBtu. The October Nymex contract gained 6.1 cents to $2.496 after trading as high as $2.505. The front month rallied more than 20 cents during the holiday-shortened trading week, even as forecasters and analysts expressed plenty of skepticism as to whether the fundamentals merited such gains.

Noting that open interest has been falling as prices have been going up, Powerhouse LLC President Elaine Levin described it as a “classic short-covering rally.”

“I think the market got very, very oversold,” Levin told NGI. “It looked like some of the specs were about as short as they’d been in a long time.”

The question moving forward will be whether new money enters the market to build on the momentum created by the short-covering rally, she said. From a technical standpoint, if the front month can settle above $2.500, a resistance level that, looking at the continuation chart, held firm back in July, then the next target for the bulls would be around $2.700, according to Levin.

“Fundamentally, there’s a lot of gas around, but even bear markets have corrections,” Levin said. “This is the start of one. The question is does it turn into something more substantial.”

Recent developments on the fundamentals side have offered a few “catalysts that could have aided gains,” including new liquefied natural gas (LNG) exports coming online and hotter trends in the forecast, NatGasWeather said Friday.

“We have a hard time believing major players see this rally to $2.50 as being justified, but when prices move strongly against a hefty imbalance of speculators, fundamentals often don’t matter.”

As for the latest guidance, data as of mid-day Friday continued to show hotter trends for the week ahead over the southern and eastern parts of the country, according to NatGasWeather. Guidance, however, “was little changed Sept. 14-20, where the pattern still isn’t hot enough” given national cooling degree day (CDD) totals would “ease to lighter levels.” Even if guidance adds heat to the outlook over the weekend “it still isn’t likely to result in smaller than normal builds.”

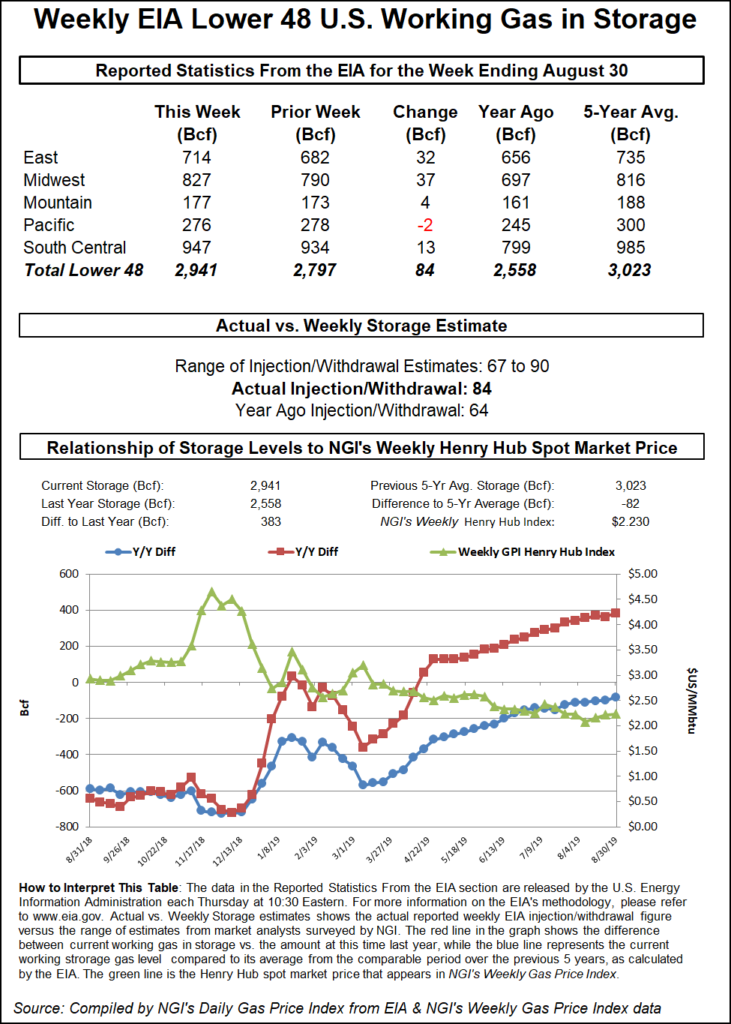

The Energy Information Administration (EIA) on Thursday reported an 84 Bcf weekly injection into U.S. natural gas stocks, on the high side of expectations and higher than both the 64 Bcf injection recorded last year and the five-year average build of 66 Bcf.

Prior to Thursday’s report, estimates had been pointing to a build in the upper 70s to low 80s Bcf. Surveys from Bloomberg and Reuters had both landed on a 78 Bcf injection, with expectations ranging from 67 Bcf to 90 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 76 Bcf. NGI’s model predicted an 80 Bcf injection.

Total Lower 48 working gas in underground storage stood at 2,941 Bcf as of Aug. 30, 383 Bcf (15.0%) above year-ago levels but 82 Bcf (minus 2.7%) below the five-year average, according to EIA.

By region, EIA recorded a 37 Bcf injection in the Midwest and a 32 Bcf build in the East for the week. The Mountain region refilled 4 Bcf, while the Pacific saw a net pull of 2 Bcf. In the South Central, a 13 Bcf injection into non-salt stocks was partially offset by a 2 Bcf withdrawal from salt, according to EIA.

With the latest injection the market “continues to reflect oversupplied conditions,” according to Tudor, Pickering, Holt & Co. (TPH) analysts. Based on this week’s EIA data, they calculated a 1 Bcf/d oversupply after adjusting for weather.

“After a slow start, degree days for this year’s injection season now sit almost dead in-line with the five-year average, but despite the neutral weather, cumulative injections are 44% ahead of norms and are mirroring the trajectory of 2015,” the TPH team said. “For gas bulls, 2015 is not a comparison you want, as rapid injections that year resulted in sub-$2 pricing the following spring.

“In our view, the rally in gas prices this week is not backed by fundamentals, as most supply/demand inputs are trending bearish. On a week/week perspective, supply is up 0.2 Bcf/d,” LNG feed gas demand is down about 0.5 Bcf/d, and Canadian imports are up 0.5 Bcf/d.

Genscape Inc. analysts viewed the 84 Bcf injection as indicating 0.9 Bcf/d of slack in the market versus the five-year average when taking into account degree days and normal seasonality.

“A large decline in CDDs versus the prior week drove total power demand/generation lower and reduced gas burn by more than 5 Bcf/d week/week,” senior natural gas analyst Rick Margolin said.

After heat and import constraints helped drive elevated pricing in Southern California earlier in the week, points in the region saw hefty discounts Friday as demand was expected to drop-off going into the weekend.

Utility Southern California Gas (aka SoCalGas) was forecasting demand on its system of around 2 million Dth/d over the weekend, down sharply from just under 3 million Dth on Thursday and an estimated 2.8 million Dth on Friday.

SoCal Citygate plunged $1.105 Friday to average $2.970. Elsewhere in the region, SoCal Border Avg. shed 65.5 to $2.530, while El Paso S. Mainline/N. Baja dropped 81.5 cents to $2.570.

Over the weekend, NatGasWeather was calling for “comfortable conditions” to continue across the Midwest and Northeast, including highs of 60s to 80s, resulting in light demand for those areas.

“The southern U.S. will be hot with highs of 90s and 100s as high pressure rules for strong demand,” the forecaster said Friday. “Hurricane Dorian will bring showers to the Mid-Atlantic and Northeast coast the next few days,” while the West was expected to cool over the weekend and into the upcoming week. “Overall, decent national demand due to the hot southern U.S., but not exceptional with the northern U.S. not participating.”

Much like in California, Rockies locations also saw widespread discounts Friday. Kern River fell 12.5 cents to $2.100.

Over on the East Coast, prices in the Southeast and Mid-Atlantic generally saw small gains as Dorian was lashing the Carolinas Friday.

Transco Zone 5 added 3.5 cents to average $2.535.

Dorian as of 2 p.m. ET Friday was about 125 miles northeast of Cape Hatteras, NC, according to the National Hurricane Center (NHC). The storm was moving toward the northeast near 21 mph, a general motion “with an additional increase in forward speed…expected through Saturday night.”

Dorian was expected to move away from the North Carolina coast Friday before approaching “the southeast of extreme southeastern New England” Friday night into Saturday, “and then across Nova Scotia late Saturday or Saturday night.”

Price moves in the Northeast were mixed Friday. Algonquin Citygate slid 4.0 cents to $1.885.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |