Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Lower 48 Rig Count Still Falling as Activity Slows in Oklahoma, Texas

Drilling activity in the U.S. onshore continued on its downward trajectory during the week ended Friday, according to the latest rig data from Baker Hughes, a GE Company (BHGE).

The United States saw another six rigs exit the patch to end the week at 898 units, down from 1,048 a year ago. With the latest tally, 37 domestic rigs have now packed up shop over the past three weeks, BHGE data show.

The oil and gas split for the week showed four oil-directed rigs departing alongside two gas-directed rigs. Declines included three directional units, two vertical units and one horizontal rig. Activity in the Gulf of Mexico held steady at 26 rigs, up from 17 a year ago.

The Canadian rig count fell by three — all oil-directed rigs — to finish the week at 147, down from 204 a year ago. The combined North American rig count slid nine units to 1,045, lagging the 1,252 rigs running at this time last year.

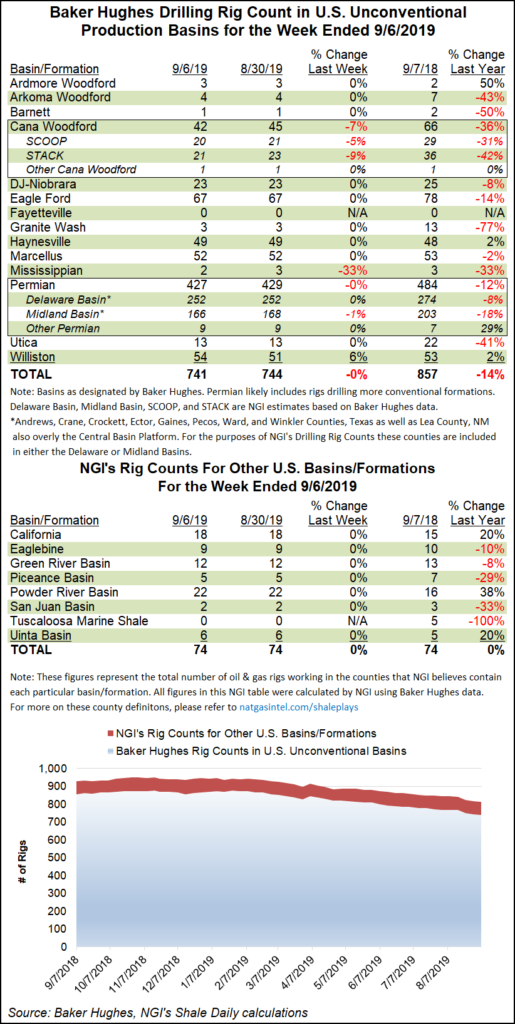

Among plays, the Cana Woodford saw the largest drop for the week, with three rigs exiting. The Cana Woodford’s 42 rigs as of Sept. 6 were down from 66 rigs in the year-ago period. The Permian Basin dropped two rigs from its total to fall to 427, while the Mississippian Lime dropped one rig, leaving it with two active units.

Conversely, the Williston Basin saw its drilling activity grow during the week, picking up three rigs to end at 54, up slightly from 53 rigs a year ago.

Among states, Oklahoma was the hardest hit for the week, seeing a net decline of five rigs. That leaves the Sooner State with 75 active rigs, well shy of the 137 rigs running at this time last year. Texas saw three rigs pack up, while one departed in Alaska. Consistent with the gains in the Williston, North Dakota added three rigs overall.

Tulsa-based Helmerich & Payne Inc. (H&P), which warned in July that Lower 48 drilling still had room to decline, recently revealed that it has reduced its capital spending through the rest of the year.

H&P, one of the leading unconventional drillers in North America, had expected fiscal 2019 capital expenditures (capex) to be at the low end of its $500-530 million guidance. However, it now expects total capex to be $5-15 million below the low end of that range, “with the final outcome dependent on the timing of certain procurement activities in late fiscal 2019 and early fiscal 2020.”

Meanwhile, surging onshore oil production wrested from wells using unconventional drilling techniques may have reached its maximum level and could decline as producers deal with well interference and “rock quality deterioration,” according to a recent analysis.

Raymond James & Associates Inc. analysts have said previously that they believe the single most important longer-term driver of oil prices and energy markets over the next five years would be changes in U.S. well productivity.

That productivity finally appears to be leveling off. In fact, it may be tracking far below the Raymond James model, an underperformance that could reflect a “significant inflection point in future global oil supply/demand balances,” said the team led by Marshall Adkins.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |