Markets | NGI All News Access | NGI Data

EIA Injection Misses High at 84 Bcf, Sends Natural Gas Futures Lower

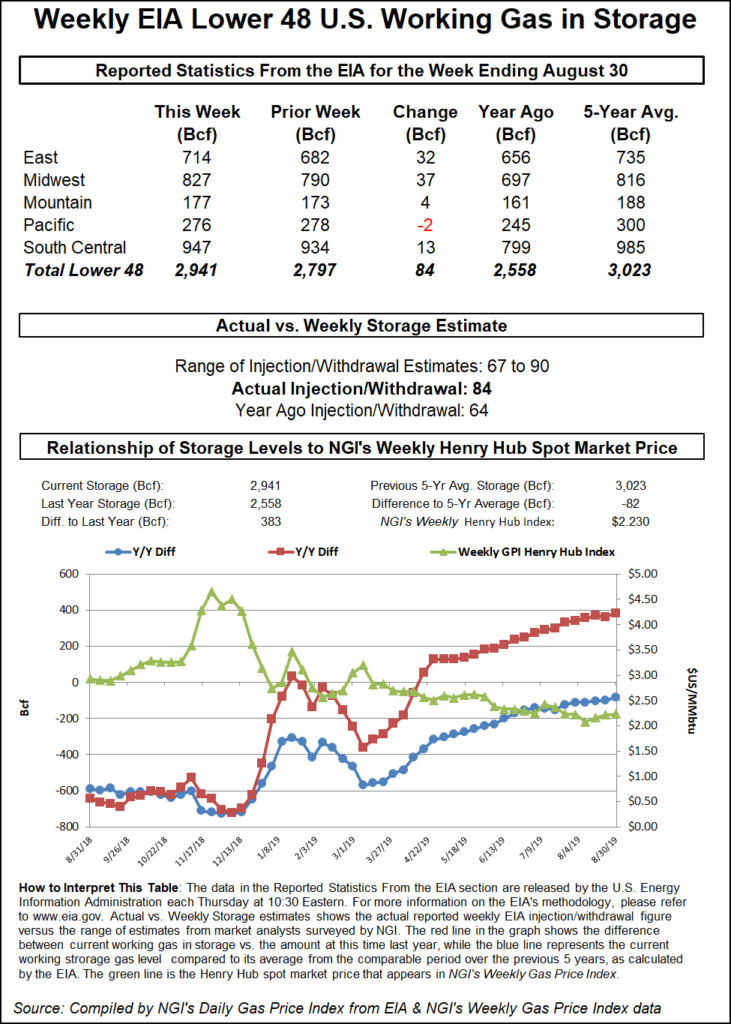

The Energy Information Administration (EIA) on Thursday reported a larger-than-expected 84 Bcf weekly injection into U.S. natural gas stocks, and futures prices promptly sold off several cents on the news.

The 84 Bcf build, recorded for the week ended Aug. 30, also comes in higher than both the 64 Bcf injection recorded last year and the five-year average build of 66 Bcf.

As the figure crossed trading screens at 10:30 a.m. ET, the October Nymex futures contract quickly fell from around $2.430/MMBtu down to as low as $2.398. By 11 a.m. ET, the front month was trading around $2.404, off 4.1 cents from Wednesday’s settle and down about 3 cents from the pre-report trade.

Prior to Thursday’s report, estimates had been pointing to a build in the upper 70s to low 80s Bcf. Surveys from Bloomberg and Reuters had both landed on a 78 Bcf injection, with expectations ranging from 67 Bcf to 90 Bcf. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at a build of 76 Bcf. NGI’s model predicted an 80 Bcf injection.

“While it was a high-side miss, we view it more or less as neutral” given the relatively small margin, Bespoke Weather Services said. “It was still tighter than last week’s report” but “did not show quite as much tightening as we had expected. End of season storage levels remain on pace to climb over the 3.7 Tcf level, or wind up not far from the five-year average.”

Total Lower 48 working gas in underground storage stood at 2,941 Bcf as of Aug. 30, 383 Bcf (15.0%) above year-ago levels but 82 Bcf (minus 2.7%) below the five-year average, according to EIA.

“Current South Central non-salt levels are quite healthy,” Enelyst managing director Het Shah said during a weekly chat discussion of the EIA report. “It’s been tracking with the five-year average since early July. Salt, on the other hand, is sitting near the lows of the five-year bracket.” But this is “less concerning with production growth sitting on the sidelines to make up the high winter demand days.”

By region, EIA recorded a 37 Bcf injection in the Midwest and a 32 Bcf build in the East for the week. The Mountain region refilled 4 Bcf, while the Pacific saw a net pull of 2 Bcf. In the South Central, a 13 Bcf injection into non-salt stocks was partially offset by a 2 Bcf withdrawal from salt, according to EIA.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |