Markets | NGI All News Access | NGI Data

Stifling Heat Lifts California, Texas Natural Gas Weekly Prices; Dorian Set to Squash Demand

Suffocating conditions continued across California, the Southwest and Texas during the last week of August, leading to a rare storage withdrawal for this time of year in the Golden State as pipelines coped with strong demand. Mild, stormy conditions over the rest of the United States, however, left weekly prices mixed and the NGI Spot Gas Weekly Avg. up just 4 cents from Aug. 26-29. Gas traded on Thursday was for delivery Friday and Saturday.

Volatility was prevalent in California, where the sweltering heat sent cash prices up by more than $1 on Aug. 26 and 27 as Southern California Gas (SoCalGas) withdrew gas from its Aliso Canyon storage facility for the first time under the newly modified withdrawal protocol, which does not require that field to be treated as an asset of last resort.

Demand on the SoCalGas system reached a season-to-date high of 3.164 Bcf/d on Aug. 27, with the pipeline meeting about 75% with flowing supply and relying on storage withdrawals for the rest, according to Genscape Inc.

“The resulting 885 MMcf/d of net, systemwide withdrawals was also a summer-to-date high,” Genscape natural gas analyst Joseph Bernardi said.

Cash began to retreat the next day and took a more significant dive last Thursday, but prices remained well above the sub-$2 levels at the start of the week. For the Aug. 26-29 period, SoCal Border Avg. prices averaged $2.95, up 64.5 cents on the week. Malin was up 11 cents to $1.985.

The weekly gains extended across the Rockies as well, with Kingsgate climbing about 20 cents to $1.895.

Looking ahead, outlooks show hotter-than-normal conditions lingering through at least Sept. 12, with some areas of the Southwest continuing to see triple-digit highs.

The scorching conditions are also set to linger over Texas, likely leading to continued withdrawals from salt facilities in the South Central region. This week, the Energy Information Administration (EIA) reported that salts withdrew 6 Bcf during the week ending Aug. 23.

The ongoing pulls from salt facilities have inventories in the region struggling to move much above year-ago levels and remain well below the five-year average, EIA data show. Nevertheless, with the massive year/year growth in production, “salt is starting to become less relevant,” Enelyst managing director Het Shah said.

Meanwhile, analysts expect salt inventories to start increasing now that Texas Eastern Transmission has resumed partial service on the portion of its pipeline that was damaged in an Oct. 1 explosion.

On the pricing front, Houston Ship Channel was up 6 cents on the week to $2.16, while more significant increases were seen in West Texas.

Waha jumped 14.5 cents to average $1.135 amid strong demand and ongoing linepacking on Kinder Morgan Inc.’s Gulf Coast Express, due fully online in late September.

The strength in Waha prices could have been more pronounced had it not been for a series of pipeline maintenance events that restricted outflows from the Permian Basin, including work on El Paso Natural Gas, Northern Natural Gas and Transwestern Pipeline.

Prices across most of Louisiana and the Southeast were up no more than a nickel week/week, while markets in Appalachia and the Northeast softened due to the much milder weather that arrived in the region.

Texas Eastern M-3, Delivery fell about 10 cents to average $1.71, and Transco Zone 6 NY plunged 20 cents to $1.725.

After accumulating a record number of short positions earlier in August, speculative traders rushed to cover their positions just as long-range weather outlooks began hinting of returning heat. After a solid gain of nearly 8 cents on Monday alone, the stage was set for more volatility ahead of the September Nymex contract’s midweek expiration.

The September contract rolled off the board at $2.251, while October climbed 5.2 cents from Aug. 26 to settle Friday at $2.285.

The strength of the rally that began on Aug. 23, when the front-month contract bottomed out at $2.12, must be taken seriously, according to EBW Analytics Group. The firm is keeping a close eye on the October/January spread, with the January premium to October falling to only 32 cents on Thursday, the lowest since April 29. The premium shrank to about 30 cents on Friday.

“While the October contract leapt higher this week, adding 14 cents since Aug. 23, market conviction behind the move up appears to be lacking for the January contract,” EBW said.

That lack of conviction with the January contract suggests that bulls are not yet out of the woods and a relapse remains possible after Labor Day, according to EBW.

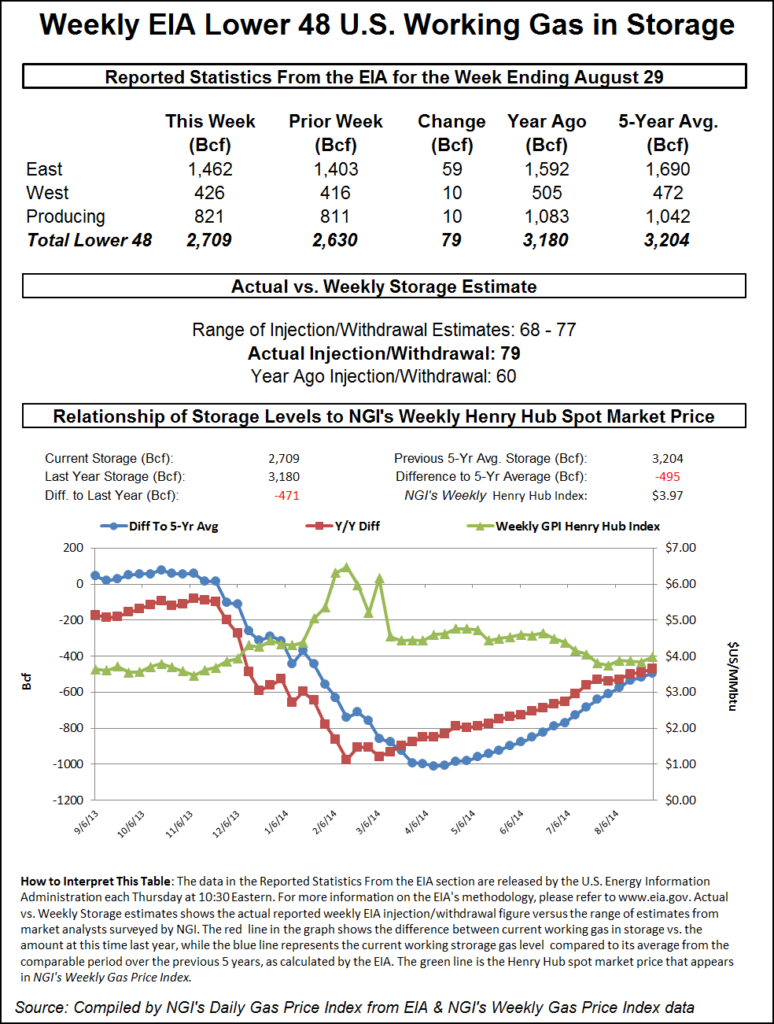

However, bulls were able to withstand pressure from yet another bearish stat from the EIA, which reported that Lower 48 storage inventories grew by 60 Bcf for the week ending Aug. 23. The build, which was on the high end of estimates, compared to last year’s last year’s 66 Bcf injection and the five-year average of 57 Bcf.

Total working gas in storage as of Aug. 23 stood at 2,857 Bcf, 363 Bcf higher than last year and 100 Bcf below the five-year average.

Compared to degree days and normal seasonality, the reported 60 Bcf injection appears loose by approximately 3.0 Bcf/d versus the prior five-year average, according to Genscape.

Looking ahead to the next EIA storage report, early estimates are pointing to an injection in the high 70s Bcf to low 80 Bcf.

Mobius Risk Group indicated that daily storage data was only marginally higher week/week, despite the much milder weather across the high demand regions of the United States. If Thursday’s EIA storage data were to be lower than an 85 Bcf build, and the Labor Day reporting period managed to be sub-triple digits, “a short covering rally could begin ahead of schedule.”

Meanwhile, the latest weather outlooks began hinting that heat may return by mid-September, given upper level pattern changes in the European ensemble weather data. This should shift the focus of above-normal temperatures from the West over into the central and eastern United States into the middle third of September, according to Bespoke Weather Services.

“As we’ve pointed out, however, it will take strong anomalies in these regions to move the needle much, but we cannot rule out some notable spikes relative to time of year,” Bespoke chief meteorologist Brian Lovern said.

The market will also be keeping a close eye on tropical activity during the next month, with Hurricane Dorian already making waves in the Carribean. In a midday update Friday, the National Hurricane Center (NHC) said the center of the storm, expected to strengthen to a Category 4 before striking land, was moving toward the northwest near 10 mph.

On its projected track, the storm was seen nearing the Florida peninsula late Monday. Georgia and Carolina also braced for potential impacts.

Despite the potentially devastating impacts to Florida’s infrastructure, Dorian’s potential impact on the natural gas market was seen as bearish because of the projected drop in demand associated with the storm. Florida utilities on Thursday began urging customers to prepare for the storm, and to pack their patience as widespread power outages were expected.

“Demand destruction from Dorian early in the week could make for a weaker overall picture, posing some downside risk,” Lovern said.

Spot gas, which traded Friday for delivery Sunday through Tuesday, was mixed as weather patterns varied across the United States.

Heat was set to return to California after a slightly milder Labor Day holiday, leading to steep double-digit gains across the state. SoCal Citygate jumped a region-leading 42 cents to average $3.15.

The Rockies also put up meaningful increases. The exception was at points along El Paso Natural Gas, which continued to restrict flows along portions of its system.

Permian Basin pricing was kept in check Friday as prices shifted less than a nickel higher across the region. Similarly small gains were seen across the rest of Texas, while cash moved lower in most of the Midcontinent.

Prices softened across the Midwest, where Chicago Citygate fell 4.5 cents to $1.99.

Interestingly, only modest losses of a few pennies were seen in much of the Southeast, although Florida Gas Zone 3 dropped a more significant 8 cents to $2.26, a small discount to benchmark Henry Hub. Dominion Energy Cove Point tumbled 13 cents to $1.95 despite stable intake at the LNG export terminal.

Appalachia prices were down mostly between 10 and 15 cents, while Transco Zone 6 NY fell 6 cents to $1.575.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |