Infrastructure | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Oil Count in Freefall as BHGE’s U.S. Rig Tally Drops for Second Straight Week

Activity in the U.S. oil patch was in rapid decline as of Friday, with the rig count falling by double-digits for a second straight week, according to data published by Baker Hughes, a GE Company (BHGE).

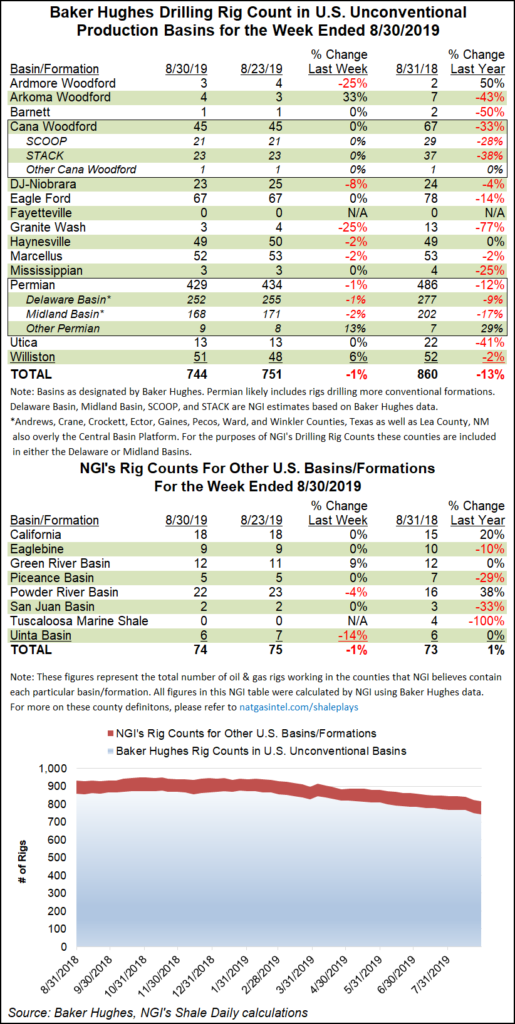

The U.S. rig count fell 12 units — all oil-directed — to finish the week ended Aug. 30 at 904 rigs, down from 1,048 in the year-ago period. U.S. natural gas-directed drilling finished flat at 162 rigs. In the previous week, 16 rigs exited the domestic oil patch. Since last November, the total number of active U.S. oil rigs has fallen from 888 to 742.

Most of the domestic declines occurred on land. One rig departed inland waters, while Gulf of Mexico activity held steady at 26 active rigs, up from 16 a year ago. One directional rig was added for the week, while 13 horizontals packed up shop.

The Canadian rig count increased by 11 rigs to end the week at 150, including the addition of 10 oil-directed units and one gas-directed. The combined North American rig count stood at 1,054 as of Friday, down from 1,276 a year ago.

Among major plays, the Permian Basin posted the largest weekly decline, falling five rigs to 429 from 486 a year ago. The Williston Basin, meanwhile, added three rigs to its total to finish at 51, off by one from a year ago.

The Denver Julesburg-Niobrara dropped two rigs on the week, while the Ardmore Woodford, Granite Wash, Haynesville Shale and Marcellus Shale each dropped one. One rig returned to action in the Arkoma Woodford during the week, according to BHGE.

Among states, the decline in Texas mirrored the drop in the Permian as five rigs exited the Lone Star State. Oklahoma saw a net decline of two rigs, while Colorado, Kansas, Louisiana, New Mexico, Pennsylvania, Utah and Wyoming each dropped one rig.

Matching the increase in the Williston Basin, North Dakota picked up three rigs on the week, while Alaska added one.

Looking back at the broader themes from second quarter results in the U.S. oil and gas sector, efficiencies improved production even on lower spending, but operators still are treading cautiously on erratic commodity prices and a dearth of capacity dogging development in regions like the Permian.

The bottom line: capital expenditures are more likely to be reduced than increased, and oil and natural gas production gains may be modest.

“Producers are doing a good job staying within their previously announced capital budgets, yet many increased their 2019 production guidance, thanks to efficiency gains,” said NGI’s Patrick Rau, director of strategy and research. “Some of those gains are simply the result of lower” oilfield services (OFS) “pricing, but sustainable efficiency improvements are no small part of that, either.

“None seem to be too worried about their ability to achieve further non-OFS price related efficiency gains in 2020 either.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |