NGI The Weekly Gas Market Report

Markets | Forward Look | NGI All News Access

Natural Gas Forwards Rally as Technicals, LNG and Cash Drive Markets

After accumulating a record number of short positions earlier in August, speculative traders drove natural gas futures prices sharply higher for the Aug. 23-28 period. Strong cash prices and a dip in production further fueled forward markets this week, with double-digit gains seen across most of the country, according to NGI’s Forward Look.

The majority of pricing hubs followed in step with Nymex futures, which saw the September contract jump about 10 cents during that time to expire Wednesday at $2.251. October, which took its position at the front of the curve on Thursday, rose by around 6.5 cents to $2.222. The winter (November-March) and summer 2020 (April-October) strips were up just 4 cents each to $2.45 and $2.34, respectively.

Futures trading action was more erratic than usual given that demand was rather light across most of the United States during the week. Only California, the Southwest and Texas continued to experience heat that was intense enough to boost demand above normal.

“It is not yet clear whether this new strength for gas is due to technical factors and short-covering or attributable to other factors,” EBW Analytics Group said.

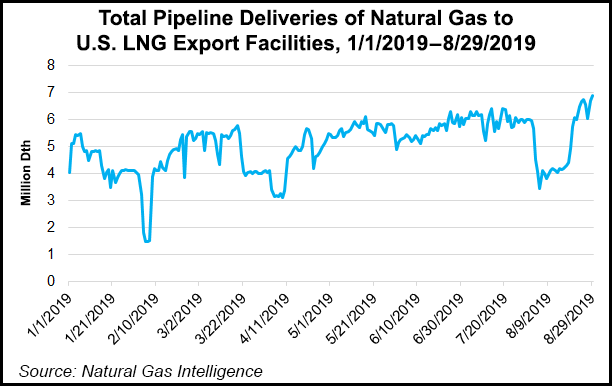

Nevertheless, strong cash prices and record feed gas deliveries to liquefied natural gas (LNG) facilities helped put the market on solid footing for much of the Aug. 23-28 period. Meanwhile, production took a significant dip midweek, shaving off more than 1 Bcf of output and giving bulls some optimism for another leg higher.

On Thursday, October opened the session about a penny higher and then shot up another nickel or so as weather models finally started adding back in some heat to September outlooks. The overnight weather models trended hotter for next week and the 11- to 15-day period, according to Bespoke Weather Services.

“The upper level pattern in the overnight ensembles suggests risk for higher temperatures/gas-weighted degree days (GWDD) that we currently show in the back of the 11- to 15-day with a stronger eastern U.S. ridge,” Bespoke chief meteorologist Brian Lovern said. “But they’ve been inconsistent lately, so we stayed a little cautious for now, though we think that’s where the pattern should go.”

However, the market is approaching the time of year where it will take strong anomalies to move the needle, according to Bespoke. “We wouldn’t rule that out, but we are not there yet.”

Market analysts said Thursday’s storage report could set the tone for prices for the rest of this week and, for a little while, it did.

The Energy Information Administration (EIA) reported a 60 Bcf injection into inventories for the week ending Aug. 23. The reported build was on the high end of expectations that ranged from 45 Bcf to 61 Bcf and compared with last year’s 66 Bcf injection and the five-year average of 57 Bcf.

Bespoke said the reported build was “quite bearish” in terms of balances, which are loose based on the 60 Bcf print. Although prices held up at around $2.28 after the print crossed screens at 10:30 a.m. ET, the firm said it “wouldn’t be surprised to move back to the $2.25 level later today, given the weak number.”

By 11 a.m., prices had slipped to $2.262, but then bounced back and surged as high as $2.31 before going on to settle at $2.296, up 7.4 cents on the day. November climbed 6.8 cents to $2.342.

Broken down by region, the EIA reported a 30 Bcf injection in the Midwest and a 22 Bcf build in the East. The Mountain region added 5 Bcf to stocks, while the Pacific added 4 Bcf. In the South Central region, a net 1 Bcf withdrawal was reported, which included a 6 Bcf draw from salt facilities and a 6 Bcf injection into nonsalts, according to EIA.

With salt facilities continuing to withdraw, inventories appear to be struggling to move much above year-ago levels and remain well below the five-year average, analysts said. As of Aug. 23, salts had 199 Bcf in stock, compared to 188 Bcf last year and the 248 Bcf five-year average, according to EIA.

“Salt seems low, but it’s still sitting above last year’s levels,” said Het Shah, managing director of energy chat room Enelyst. “With the massive year/year growth in production, salt is starting to become less relevant.”

Shah said the extra deliverability that salt facilities provided from January to March would be made up by production growth during the upcoming winter, although he noted that increased LNG exports and exports to Mexico should also be considered.

Meanwhile, analysts expect salt inventories to start increasing now that Texas Eastern Transmission has resumed partial service on the portion of its pipeline that was damaged in an Oct. 1 explosion.

Total working gas in storage as of Aug. 23 stood at 2,857 Bcf, 363 Bcf higher than last year and 100 Bcf below the five-year average.

With only nine weeks left in the traditional injection season, it will be exceedingly difficult for the market to veer far off the path toward 3.75 Tcf in storage by the end of October, according to Energy Aspects. The firm’s short-term supply/demand balances show weekly injection rates near 90 Bcf or above starting the week ending Sept. 6 through the week ending Oct. 18.

“The market could even be contending with seven injections in September-October that are 100-plus Bcf or near that psychologically large mark,” Energy Aspects said. “As a result, sentiment could turn even more bearish once again.”

The firm’s weekly balances also show potential for injection activity to last through at least mid-November, which would tip storage north of 3.8 Tcf by the time storage activity flips to withdrawals.

Over the next month, the market will also be keeping a close eye on tropical activity, with Hurricane Dorian already making waves in the Carribean. In a Thursday morning update, the National Hurricane Center (NHC) said the center of the Category 1 storm was moving toward the northwest near 13 mph (20 km/h), and this general motion is expected to continue through Friday. A west-northwestward motion was forecast to begin by Friday night and continue into the weekend.

On this track, Dorian should move over the Atlantic well east of the southeastern and central Bahamas Thursday and Friday, approach the northwestern Bahamas Saturday and move near or over portions of the northwest Bahamas on Sunday, the NHC said.

Strengthening is forecast during the next few days, and Dorian is expected to become a major hurricane on Friday, and remain “an extremely dangerous hurricane” through the weekend.

For now, Dorian remains mostly a Florida threat Sunday night into Monday, according to Bespoke, with any impacts seen as bearish for the market due to cloud cover and power outages.

However, a change in Dorian’s projected path from Wednesday’s forecast now has the storm tracking northwestward. Updated forecasts still lack high degrees of confidence but indicate the possibility for the storm to move across the Florida peninsula and enter the Gulf of Mexico.

California forward prices were on the rise this week as sweltering heat continued to bake the Golden State, sending up cash prices by more than $1 on Monday and Tuesday. The extreme temperatures also prompted Southern California Gas (SoCalGas) to withdraw gas from its Aliso Canyon storage facility for the first time under the newly modified withdrawal protocol, which does not require that field to be treated as an asset of last resort.

The withdrawal began during the first hour of Wednesday’s gas day following a season-to-date demand high of 3.164 Bcf/d of sendout on Tuesday, according to Genscape Inc. SoCalGas met about 75% of that demand with flowing supply, relying on storage withdrawals for the rest.

“The resulting 885 MMcf/d of net, systemwide withdrawals was also a summer-to-date high,” Genscape natural gas analyst Joseph Bernardi said.

Demand fell back to around 2.5 Bcf/d for Wednesday’s gas day, however, these conditions allowed for Condition 1 of the new Aliso Canyon Withdrawal Protocol to be met, which is a low operational flow order (OFO) having a severity of at least stage 2.

California cash markets responded accordingly with sharp $1-plus gains from Monday-Tuesday, and although prices retreated a bit on Wednesday, they remained well above the levels they were at to start the week.

Looking ahead, Genscape meteorologists are forecasting temperatures to stay roughly even with seasonal norms for the next four days, with hotter-than-normal weather expected for Sunday, Monday and Tuesday.

The lingering summer heat and strong cash prices boosted forward markets as well. SoCal Citygate September prices shot up 35 cents from Aug. 23-28 to reach $2.914, and October jumped 32 cents to $2.601. The winter strip climbed 22 cents to $3.46, while next summer rose just 2 cents to $2.65, according to Forward Look.

Over in the Permian Basin, near-term forward pricing continued to be heavily influenced by pipeline maintenance going on in and around the region, which led to extreme cash price swings throughout the week.

One of those maintenance events was occuring on El Paso Natural Gas (EPNG), which started a three-day emergency shutdown test on Wednesday and sent regional cash prices plunging on Tuesday. In addition, EPNG has continued to restrict flows to zero at its “CRANEWNK” throughput meter in Ward County, TX, after discovering a faulty weld on its Line 2000 on Tuesday. EPNG said it expected the repairs to be completed by Friday.

CRANEWNK had flowed an average of 86 MMcf/d in the 30 days preceding this maintenance, according to Genscape.

Even with increasing linepack ahead of Gulf Coast Express’ scheduled late-September in-service, Permian forward prices were generally weak. Waha September dropped a nickel between Aug. 23 and 28 to reach $1.213, but October climbed 6 cents to $1.548 and the winter rose a more substantial 8 cents to $1.78, Forward Look data show.

Given rampant oil-directed drilling in the Permian, the start of commercial operations for Kinder Morgan Inc.-sponsored Gulf Coast Express may only bring temporary relief to regional prices, according to BTU Analytics LLC. With nearly 10% of total Permian gross gas production being flared, the pipeline is expected to fill quickly, while continued drilling is expected to release even more associated gas into the market.

Indeed, Permian pure-play Pioneer Natural Resources Co. executives believe the Delaware sub-basin is being aggressively drilled, with Tier 1 acreage being exhausted “at a very quick rate.” Flaring data utilized by BTU backs up this theory, as flaring levels are highest in that portion of the basin.

As such, Pioneer, which is contracted to move 300 MMcf/d on Gulf Coast Express, has lowered its expectations for the Permian, though it remains convinced that production will reach 8 million b/d, just “at a much slower pace.” It sees the Midland sub-basin as the only one growing after 2024.

This could help Permian gas prices in the years ahead, as Kinder Morgan is set to bring online its Permian Highway pipeline in October 2020 and has announced plans for a third gas pipeline, though a final investment decision has not yet made.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 | ISSN © 1532-1266 |