Markets | NGI All News Access | NGI Data

EIA Reports ‘Quite Bearish’ 60 Bcf Injection; October Natural Gas Trims Gains

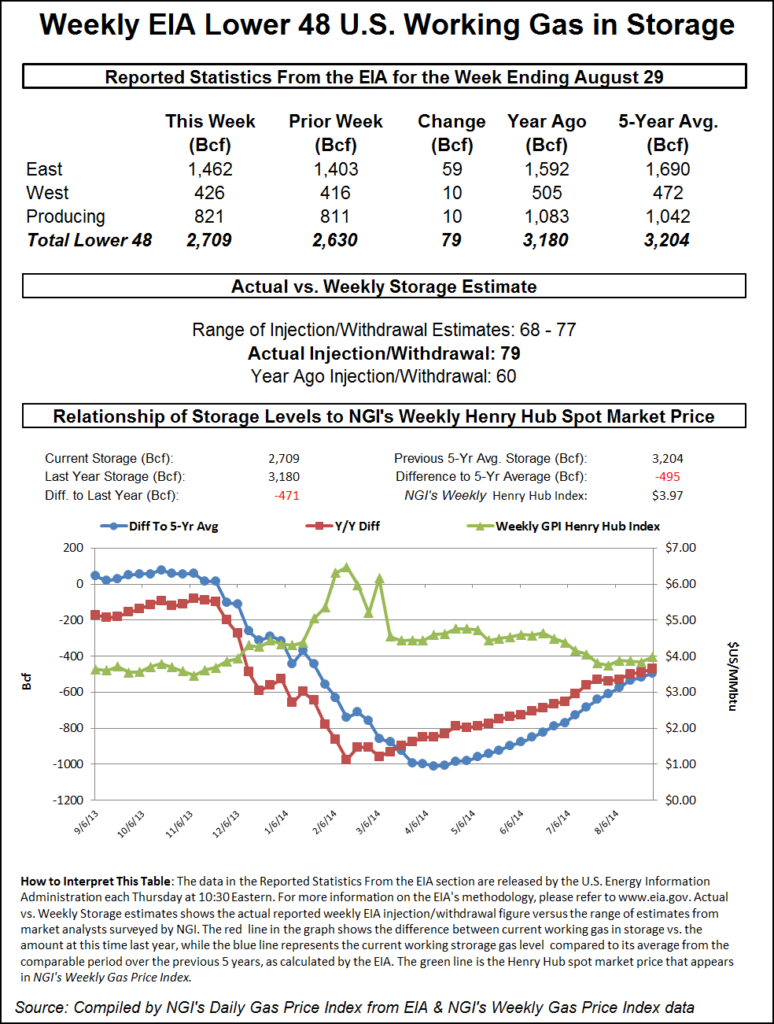

The Energy Information Administration (EIA) reported a 60 Bcf injection into storage inventories for the week ending Aug. 23.

The reported build was on the high end of expectations that ranged from 45 Bcf to 61 Bcf and compared with last year’s 66 Bcf injection and the five-year average of 57 Bcf.

Bespoke Weather Services said the reported build was “quite bearish” in terms of balances, which are loose based on the 60 Bcf print.

“The market so far is hanging on well though, thanks to very strong cash in today’s trading session, and some tightening more likely for next week’s report given the production dip and record liquefied natural gas (LNG),” Bespoke chief meteorologist Brian Lovern said. “Still, we wouldn’t be surprised to move back to the $2.25 level later today, given the weak number.”

Indeed, the bulls appeared to lose their grip on the momentum they built Wednesday, when the September Nymex gas futures contract expired a nickel higher. October, which took over the prompt-month position on Thursday, opened the session at $2.235.

Before the EIA report was released, the October contract was trading near $2.28, up more than 5 cents day/day. Prices held at that level as the print hit the screen at 10:30 a.m. ET, but then dropped to $2.262 by 11 a.m.

Broken down by region, the EIA reported a 30 Bcf injection in the Midwest and a 22 Bcf build in the East. The Mountain region added 5 Bcf to stocks, while the Pacific added 4 Bcf. In the South Central region, a net 1 Bcf withdrawal was reported, which included a 6 Bcf draw from salt facilities and a 6 Bcf injection into nonsalts, according to EIA.

Ahead of the EIA report, some market observers on Enelyst, an energy chat room hosted by The Desk, expected the South Central region to be the “problem child” given the lack of transparency in pipeline data in Texas. However, the reported withdrawal was in line with expectations.

Nevertheless, with salt facilities continuing to withdraw, inventories appear to be struggling to move much above year-ago levels and remain well below the five-year average, analysts said. As of Aug. 23, salts had 199 Bcf in stock, compared to 188 Bcf last year and the 248 Bcf five-year average, according to EIA.

“Salt seems low, but it’s still sitting above last year’s levels,” said Enelyst managing director Het Shah. “With the massive year/year growth in production, salt is starting to become less relevant.”

Shah said the extra deliverability that salt facilities provided from January to March would be made up by production growth, although he noted that increased LNG exports and exports to Mexico should also be considered.

Meanwhile, analysts expect salt inventories to start increasing now that Texas Eastern Transmission has resumed partial service on the portion of its pipeline that was damaged in an Oct. 1 explosion.

Total working gas in storage as of Aug. 23 stood at 2,857 Bcf, 363 Bcf higher than last year and 100 Bcf below the five-year average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |