Argentine Primary Election Results Resurface Interventionist Fears in Energy Sector — Bonus Coverage

Editor’s Note: Please enjoy this bonus coverage from NGI’s Mexico Gas Price Index, which includes daily prices, analysis and coverage of the emerging natural gas market in Mexico.

Request a Trial | Subscribe

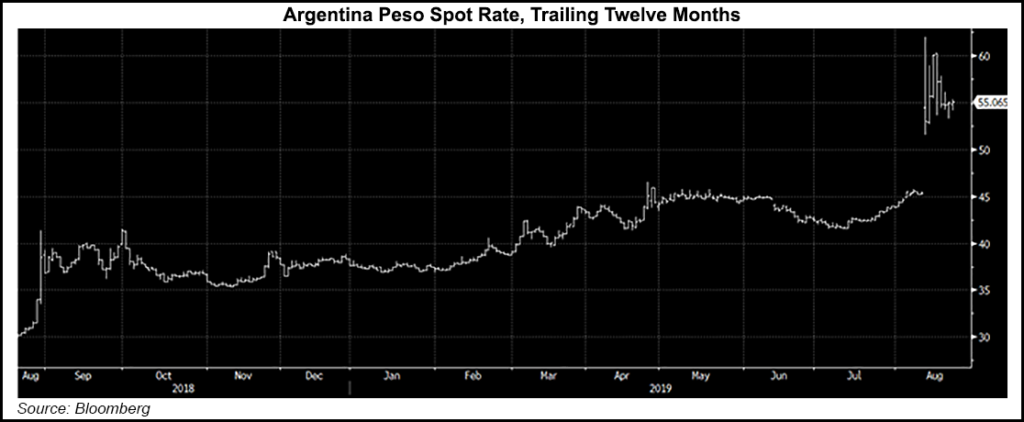

The resounding defeat for President Mauricio Macri in the Argentine primary elections earlier this month had an immediate financial impact: the peso lost 25% of its value against the dollar, and the stock market plunged. It also led many in the Argentine energy sector to fear the uncertainty of what is to come.

“An opposition victory in November would mean a return to interventionist policy,” Wood Mackenzie’s upstream Latin American analyst Fernanda Pedó told NGI’s Mexico GPI.

After the August 11 primaries, in which Macri lost by 16 percentage points to a left-wing coalition led by Alberto Fernández and former president Cristina Kirchner, an opposition victory in the general election slated for October 27 does look to be the likely result.

Business-friendly Macri has had a tumultuous time as president, with the economy in recession and inflation soaring, but he has also been credited with turning around the country’s energy fortunes, in particular in the prolific Vaca Muerta shale deposit where oil and gas production is booming.

In the wake of the shocking primary defeat and the ensuing financial turmoil, Macri went against his policy of market liberalization and imposed a 90-day freeze on oil prices. Crude is now capped at $59/bbl by government decree, with an exchange rate for crude sales fixed at 45.19 pesos per dollar, far below the current weakened rate of around 55 pesos per dollar.

To read the full article and gain access to more in-depth coverage including natural gas price and flow data surrounding the rapidly evolving Mexico energy markets, check out NGI’s Mexico Gas Price Index.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |