Arkansas Natural Gas Output Continuing to Decline

Arkansas natural gas production for July is likely to see a drop after flooding from Tropical Storm Barry worked its way across the state and into the Arkansas River Valley.

“I think it definitely will have had an impact in the River Valley,” said Executive Director Rodney Baker of the Arkansas Independent Producers and Royalty Owners (AIPRO). July flooding was more impactful in the Arkoma Basin in the western part of the state than in the Fayetteville Shale, which lies further north, he said.

Some operators have only been able to bring affected wells back online in the last two-to-three weeks because of equipment that was damaged or lost to the floods, Baker added.

The Arkansas Oil and Gas Commission (AOGC) publishes monthly gas production data, with June and July figures not yet completed. Baker expects July data will show the effects of well shut-ins and equipment damage.

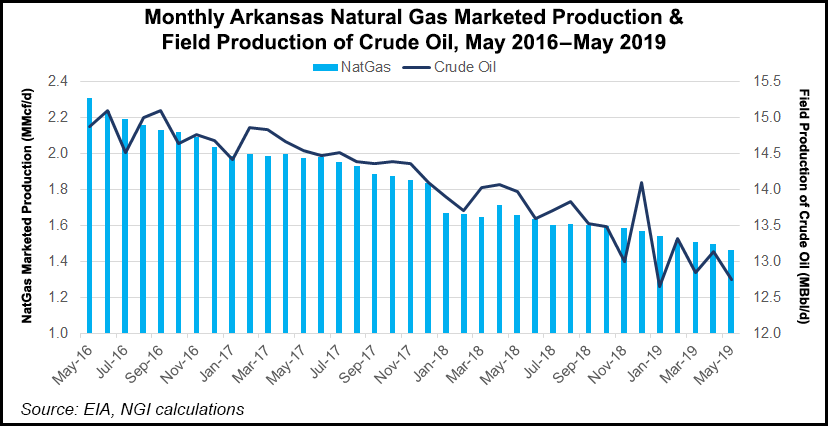

The expectation for low output in July is set against a backdrop of steady production declines in general. Statewide natural gas production through the first five months of 2019 was 226.4 Bcf, down by 10% from the same time last year, according to the latest AOGC data.

Annual gas production in the state has been in steady decline for the past four years, falling from 1 Tcf in 2015. In 2018, volumes slid 15% year/year to 593.2 Bcf.

Steady yearly declines in gas production came to a head at the end of 2018 when Southwestern Energy Co., once the state’s largest gas producer, completed the $1.87 billion sale of Fayetteville Shale assets to Flywheel Energy LLC. Southwestern, which was central in developing the Fayetteville, has since pivoted toward its Appalachian portfolio.

More Fayetteville assets changed hands earlier in 2018 when BHP sold its stake in the play to Dallas-based Merit Energy Co. Merit and Flywheel are optimizing operations to hold production level, which could contribute to a slight leveling off in the statewide output declines in the future, Baker said. He said there are more than 60 oil and gas operators in the state that are actively producing.*

Despite the year/year decline in Arkansas gas production, revenues from gross natural gas severance taxes have increased. For the fiscal year ending June 30, severance tax revenue totaled $38.3 million, up by 4.8% year/year, according to the latest report from the Arkansas Department of Finance and Administration.

The Bureau of Economic Geology at the University of Texas at Austin in December updated research for leading gas fields that included the Fayetteville. Accounting for developments in drilling technology, researchers estimated there were roughly 1,600 square meters of 2,700 analyzed that could be developed, which include 12,500 potential future wells and 12 Tcf in total remaining recoverable resources.

*Correction: The original story included an inaccurate count of currently active oil and gas operators in the state of Arkansas. There are more than 60 active oil and gas operators in the state, according to AIPRO executive director Rodney Baker. NGI regrets the error.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |