Infrastructure | NGI All News Access

Stabilis Seeks to Grow Distributed LNG Business in Mexico

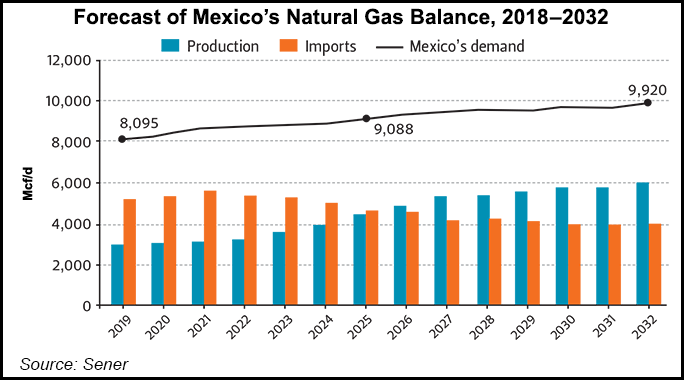

Mexico’s growing appetite for natural gas and relatively underdeveloped pipeline network make the country an ideal candidate for distributed liquefied natural gas (LNG) delivered by truck, according to Stabilis Energy CEO James Reddinger.

“Mexico is one of the most attractive LNG markets we’ve seen,” Reddinger told investors last Thursday during a conference call to discuss two transactions that will expand the firm’s Mexico footprint.

Beaumont, TX-based Stabilis is seeking to grow its distributed liquefied natural gas (LNG) and compressed natural gas (CNG) businesses in Mexico through the acquisition of Diversenergy, LLC, and through a joint venture investment vehicle with CryoMex Investment Group, LLC.

Diversenergy provides LNG marketing and distribution marketing services to customers in Mexico “that use LNG as a fuel in mobile high horsepower applications and to customers that do not have natural gas pipeline access,” Stabilis said.

The joint venture with CryoMex will operate as EnergÃa Superior Gas Natural LLC, and “plans to invest in LNG and CNG production, transportation, storage, and regasification assets that serve multiple end markets throughout Mexico, including the industrial, mining, pipeline, utility, marine and over-the-road transportation markets.”

“The joint venture plans to begin immediately evaluating LNG and CNG asset development opportunities throughout Mexico, including in the Monterrey, Sonora, and Mexico City regions,” Stabilis said, adding that “these assets could include LNG liquefaction facilities, cryogenic rolling stock equipment, CNG compression stations, and pressurized rolling stock equipment, among others.”

CryoMex is a subsidiary of Monterrey, Mexico-based Grupo Clisa, which last year brought the Nueva Era Pipeline, LLC project into service with Howard Midstream Energy Partners LLC. Nueva Era was built to transport gas from the Eagle Ford shale play to markets in northern Mexico.

“Mexico has a large and thriving economy, that has ever-expanding energy needs,” Reddinger said. “However, the country lacks the robust natural gas pipeline network to service many energy consumers.”

For context, Reddinger cited that the United States has about 950 miles of natural gas pipelines per million people, compared to about 100 miles per million people in Mexico. The latter figure includes pipelines that are not yet in service, Reddinger said.

“While the country’s pipeline build-out has accelerated recently, we expect that the last-mile pipeline connections to many significant energy consumers could take many years to complete,” he said.

Mexican state power utility Comisión Federal de Electricidad (CFE) is seeking to modify the terms of the natural gas transport services contracts that it holds with the developers of seven pipeline projects that have faced delays. The conflict appears poised to push back the projects’ in-service dates even longer.

The Wall Street Journal reported Sunday that CFE was close to resolving the most high-profile of the seven disputes, pertaining to the 2.6 Bcf/d Sur de Texas-Tuxpan subsea pipeline.

Reddinger said that even in the United States, “particularly in higher-growth areas in South Texas,” there is demand for distributed LNG, explaining that, “we’re seeing the same thing in Mexico, where you’ve got city centers that may have natural gas pipelines but you can be very close to those and still need to have supplemental…LNG because you don’t have access or you don’t have sufficient access.”

Another reason why distributed LNG is an attractive option for Mexico is that dirtier alternative fuels such as diesel, heavy fuel oil and propane are more expensive in Mexico than they are in the United States.

“A number of the opportunities we’re looking at are for power [generators] that were fuel oil and are now in the process of converting [to natural gas],” Reddinger said.

Reddinger also said that Mexico regulations allow for larger loads of the fuel to be transported by road, which in turn “creates economies of trucking that increase the range that you can economically deliver LNG from a production facility.”

In a presentation last week, Elvira Daniel Kabbaz, general director of Mexico’s national pipeline grid operator Centro Nacional de Control del Gas Natural (Cenagas), said that Cenagas will seek to promote the supply of gas to zones without pipelines via “virtual pipelines,” i.e. LNG transported by truck.

This strategy will promote industrial growth in the country’s poorest zones, she said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |