Markets | E&P | NGI All News Access

Australia Natural Gas Supply Outlook Improves; Headwinds Remain

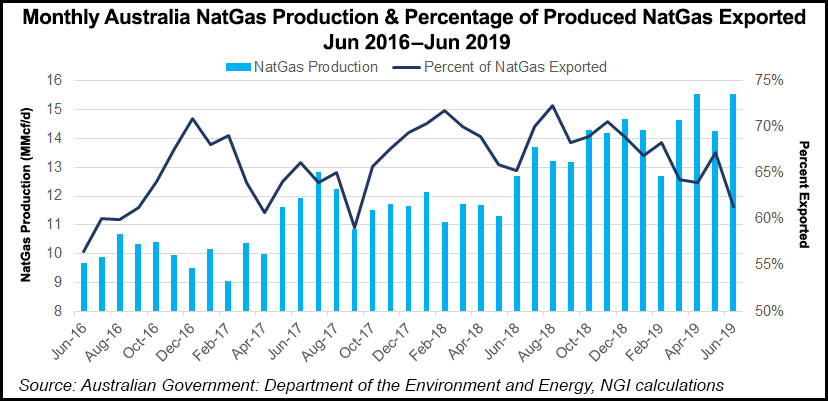

Actions taken by Australia’s oil and gas industry to bring more natural gas into the domestic market seem to be working, according to an interim report by the Australian Competition and Consumer Commission (ACCC).

The immediate supply-demand outlook in the east coast gas market has improved since the ACCC’s report last December. Under new projections, there’s unlikely to be a gas supply shortfall in 2020.

The more upbeat assessment comes as producers working in the east coast area are expected to produce 1988 petajoules (PJ) of gas in 2020, compared with 1875 PJ in 2019, largely because of an increase in expected production by Queensland liquified natural gas (LNG) producers and Victorian producers in the Gippsland Basin.

The new assessment also comes amid a projected downturn in east coast demand from gas-powered generation (GPG) from 88 PJ in 2019 to 72 PJ of gas in 2020. LNG producers expect to require 1295 PJ to meet their commitments under long-term export contracts, compared with 1281 PJ in 2019. Meanwhile, Australia’s LNG producers expect to have 168 PJ of excess gas in contractual commitments in 2020, compared with 76 PJ.

Australia’s southern states have been facing higher gas prices because of a lack of local supply, however. Recent gas price offers have fallen in Queensland with declining netback since prices for spot LNG have dropped significantly this year, but this has not occurred in the south. The averages of prices offered by retailers in the southern states appear quite high relative to the expected LNG netback prices, according to the ACCC.

Data indicates that in 2020 sufficient gas is expected to be produced in the south to meet demand in the region, but supply could remain tight. It is still uncertain how much gas from the Cooper Basin may flow south and how much will be needed by GPG.

The Cooper Basin, spanning the borders of northeast South Australia and southwest Queensland, contains more than 200 onshore producing fields. These fields contain about 700 producing gas wells and more than 360 producing oil wells, according to operator Santos Ltd. The basin has estimated resources of 482 million bbl of oil and 29.8 Tcf of gas.

The Australian Exploration and Production Association (APPEA), which represents more than 60 exporters and producers, offered a mixed view of the ACCC report.

“The ACCC has highlighted that [domestic] prices have eased since early 2017, with most price offers now stable in the range of $10-12/gigajoule,” said CEO Andrew McConville. “Producers — particularly LNG producers — have made significant volumes of additional gas available to the domestic market.”

However, McConville raised concerns that customers in the southern states of New South Wales and Victoria continue to pay more for gas because of government restrictions on developing gas resources.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |