E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Pennsylvania Sees Sharp Decline in New Natural Gas Wells

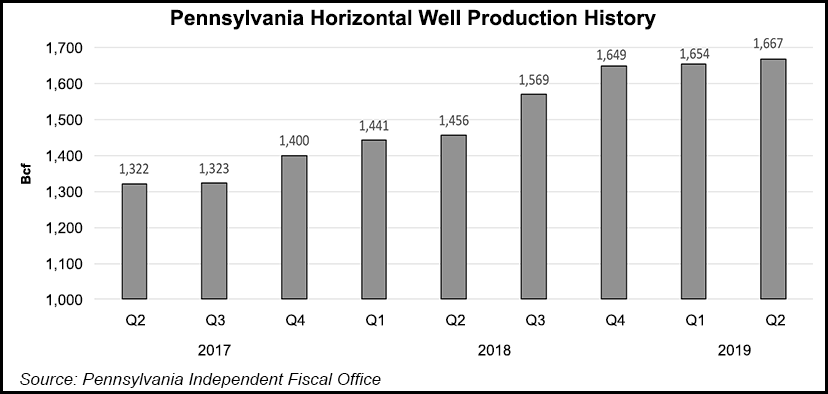

Unconventional natural gas production in Pennsylvania increased year/year by 14.5% in the second quarter, but the number of new horizontal wells drilled during the period hit the lowest point in two years as operators curbed their activity in response to volatile commodity prices.

According to the state’s Independent Fiscal Office (IFO), 163 horizontal wells were spud during the second quarter, down by nearly 24% from the year-ago period. IFO said it was the lowest number of new wells spud since 3Q2016 when 146 were drilled. Activity declined across the state and elsewhere throughout 2016 as the industry continued to deal with a commodities downturn that had set in two years earlier.

While second quarter production increased to 1.669 Tcf from 1.458 Tcf in the year-ago period, growth was more subdued compared to 1Q2019 volumes of 1.655 Tcf. Per-well production during the second quarter averaged 507 MMcf.

IFO noted that the well inventory, which includes shut-in wells or those drilled but uncompleted, declined by nearly 3% year/year in the second quarter to 1,481.

Heading into the year Appalachian operators signaled a slowdown as gas prices declined, investors searched for better returns and the pipeline buildout slowed. Many have since tightened the purse strings further, announcing more spending cuts and continuing to guide for moderate single-digit production growth next year.

IFO said all of the second quarter growth came from wells spud in 2017 and 2018. Those wells comprised more than one-third of all production for the quarter.

Despite less activity, the state remains the nation’s second largest gas producer behind Texas, and it has seen increases in unconventional production for 12 consecutive quarters.

Producing wells also increased during the second quarter to 9,372, compared to 8,680 at the same time last year. Nonproducing wells increased by 1.4% to 2,695.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |