Markets | NGI All News Access | NGI Data

EIA Reports Ho-Hum 59 Bcf Natural Gas Storage Injection; Futures Quiet

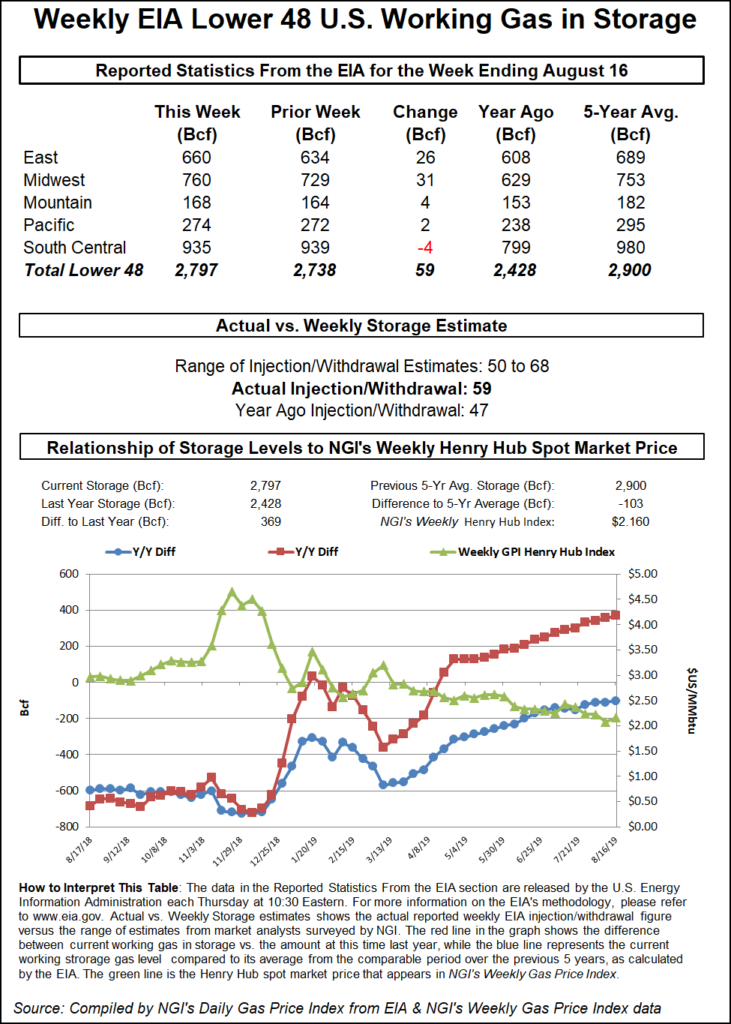

The Energy Information Administration (EIA) reported a 59 Bcf injection into storage inventories for the week ending Aug. 16, which fell well within the range of estimates, though a few Bcf below several highball projections.

The reported build compared with last year’s 47 Bcf injection and the five-year average injection of 51 Bcf.

Given the on-target injection, natural gas futures had a rather muted response to the EIA data, with the September Nymex gas contract trading at $2.18 before the EIA report’s 10:30 a.m. ET release and then bumping up less than a cent as the print crossed the screen.

“Market still pretty blah,” said natural gas coordinator Donnie Sharp of Huntsville Utilities, who noted it was “up a few pennies at ”bullish’ number,” but “struggling. Looks like this ”move’ is winding down.”

Indeed, by 11 a.m., the prompt month was trading at $2.179, up nine-tenths of a cent on the day, but off earlier highs.

Bespoke Weather Services said the 59 Bcf injection was not the complete rejection of last week’s hugely bearish storage stat that a lot of the market seemed to fear, given fewer gas-weighted degree days (GWDD) for the week, but was a little looser. With liquefied natural gas (LNG) resuming full operations, the firm said next week’s number could “certainly be in the 40s, perhaps under our early guess of 49 Bcf, which would be a tighter number if that pans out.”

Ahead of the EIA report, a Bloomberg survey of 13 analysts showed a build between 50 Bcf and 68 Bcf, with a median of 56 Bcf. A Reuters poll had the same range, but a median of 60 Bcf. NGI had also called for a 60 Bcf build.

Broken down by region, the Midwest injected 31 Bcf, while the East added 26 Bcf. Small builds were seen in the Mountain and Pacific region, and the South Central posted a net 4 Bcf withdrawal after salt facilities withdrew 9 Bcf and nonsalts injected 5 Bcf, according to EIA.

Total working gas in storage as of Aug. 16 stood at 2,797 Bcf, which is 369 Bcf more than last year at this time but still 103 Bcf below the five-year average, EIA data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |