Natural Gas Futures Steady Ahead of Fresh EIA Storage Data; Cash Recedes

Natural gas futures were rather volatile on Wednesday as weather models remained relatively intact, with some datasets hotter and others cooler. Traders also weighed the impact of expectations for yet another larger-than-normal storage injection on Thursday. The September Nymex gas futures contract fluctuated in a roughly 8-cent range before going on to settle just four-tenths of a cent lower at $2.143. October slipped a half-cent to $2.154.

Spot gas prices also retreated at most market hubs Wednesday as cool weather systems were forecast to sweep across the Midwest and Northeast through the weekend, keeping highs in the 70s and 80s. Temperatures in the hottest states, including Texas, were also expected to ease slightly, dropping back from the record levels experienced earlier this week. However, with stout gains continuing in West Texas, the NGI Spot Gas National Avg. rose 1.5 cents to $2.00.

Despite the modest changes in the overall long-term weather outlook, models diverged somewhat, with the European model coming in hotter and the American model a little cooler, according to Bespoke Weather Services. “The two essentially have switched places, with the European now the hotter of the two.”

Bespoke viewed the changes as mostly “noise”, with the overall theme remaining the same, which is a hot-biased pattern for the foreseeable future. The firm could see a dip down close to normal in the back of the 11- to 15-day, but it still believes the pattern will generally run hotter than normal into September.

“What does change is the regional breakdown, as the focus now starts to shift from anomalous heat in the South to stronger heat into the Midwest and East, and even back in the West,” Bespoke chief meteorologist Brian Lovern said. “Any cooling appears most likely to be in the Rockies/Plains, having little impact on the major population centers of the nation.”

However, NatGasWeather said the Aug. 25-30 pattern still isn’t as hot as needed in most datasets since there’s likely to be numerous weather systems that weaken the hot upper ridge, including across the southern United States and Texas. The midday data on Wednesday reinforced this view as the Global Forecast System model was slightly hotter for next week, but then cooler for the last week of August.

“If the data trended a little hotter for the last week of August, it would be noteworthy and needs watching,” NatGasWeather said.

The net result of the coming pattern is weekly storage builds continuing to be larger than normal for the next two weeks, but then with the potential to be a little smaller than normal for the following report due to projected widespread heat, the forecaster said. Even with above-normal cooling degree days (CDD), storage injections still won’t be larger than normal unless CDDs are much above normal, “highlighting production simply remains too strong versus demand.”

Production on Tuesday was finalized around 1 Bcf off highs, according to Bespoke, but the drop in output is tied to pipeline maintenance and not indicative of any sustained weakness. Meanwhile, power burns on a weather-adjusted basis were a bit weaker on Wednesday, and feed gas deliveries to liquefied natural gas terminals remained low, even though intake has been coming in slightly higher in the last few days.

“Nonetheless, weather does remain quite supportive for the foreseeable future, and these are still historically low prices in a market that is heavily short, so it doesn’t take much to move prices higher,” Lovern said.

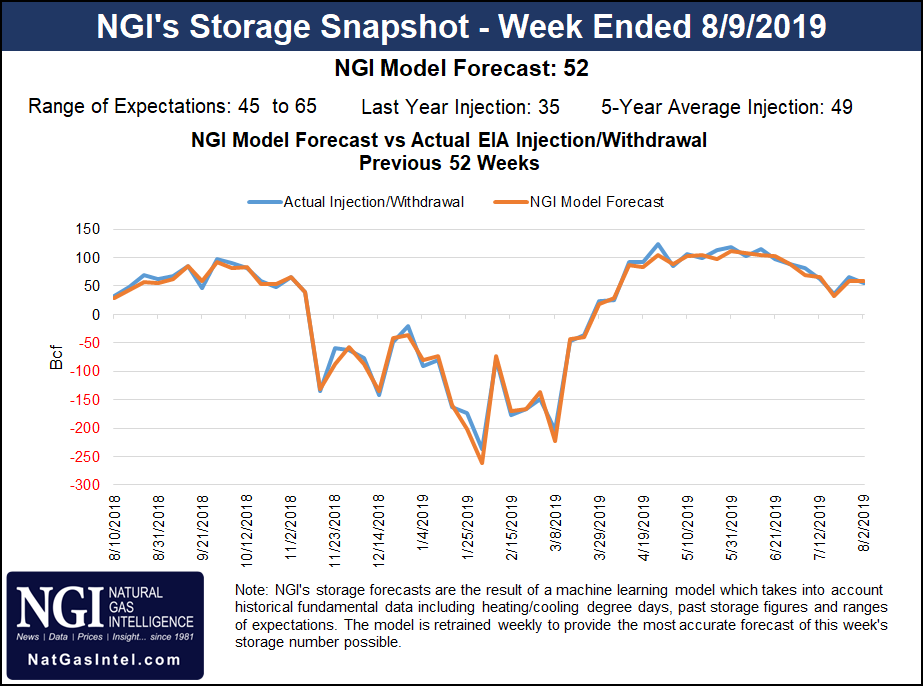

As for Thursday’s storage report, the majority of analysts are looking for the Energy Information Administration (EIA) to report an injection in the high 50s Bcf. That would compare with last year’s 35 Bcf injection and the 49 Bcf five-year average, according to EIA.

A Bloomberg survey of 11 analysts had an injection range of 45 Bcf to 65 Bcf, with a median of 58 Bcf. A Reuters poll produced the same range and median, while NGI projected a smaller 52 Bcf injection.

“Given how cash has performed this week, the market may test the $2.20 resistance level in the September contract, but we’d be surprised at any higher, at least until we see where tomorrow’s EIA number lands,” Lovern said.

On a more macro level, there’s little reason to be broadly bullish on prices, according to Tudor, Pickering, Holt & Associates (TPH). Despite commitments from several operators to move toward maintenance capital (or even declines) in 2020, the firm continues to see limited pricing upside, with prices capped in the $2.50 range.

“Our revised estimates have total U.S. production growth of just 1.9 Bcf/d in 2020, with Appalachia moving to maintenance and the Haynesville experiencing slight declines in proved developed producing output,” TPH analysts said.

On the demand side, the firm is forecasting growth of around 3.5 Bcf/d, which should tighten the market by roughly 1.5 Bcf/d, largely eroding the oversupply and bringing the market into balance in 2H20. However, with demand growth expected to fall to about 2 Bcf/d in 2021-2022, and associated gas expected to grow at approximately the same rate, “we believe gas-directed growth will continue to be priced out of the market.”

As such, the firm sees a ceiling on price in the $2.50 range for fiscal years 2021 and 2022, relative to the current Nymex strip at $2.48 and $2.54, respectively.

Cash Eases with Heat

Spot gas prices across most of the United States retreated Wednesday as weather systems moving across the eastern half of the country were expected to keep conditions rather mild through the weekend. Even a slight drop in temperatures forecast for Texas was enough to send prices in the state down a few notches.

On Tuesday, the state’s electric grid operator implemented an energy emergency level 1 for the first time in more than five years as demand soared. The Electric Reliability Council of Texas (ERCOT) set a record peak power demand level of 74,531 MW on Monday and projections had called for an even higher peak load on Tuesday.

However, demand topped out at 74,181 MW, and ERCOT kept the lights on across the state as operating reserves plunged to 2,121 MW, less than 3% of total demand. Still, the thin cushion sent real-time power prices in the region surging to the regulatory-imposed cap of $9,000/megawatt hour.

“The heat index in Houston reached 108 degreees, while in Dallas it hit 112,” EBW Analytics said. “Rolling brownouts were narrowly avoided, but extremely tight conditions potentially reignited ERCOT summer futures contracts and spurred extremely inefficient generation to keep the lights on, driving power sector gas demand sharply higher.”

Wednesday brought some modest relief to the state as a weak cool front moved in, with temperatures for most of the area expected to crest under 100 degrees, though heat advisories were still posted for areas along the Gulf Coast.

While next-day gas prices across most of Texas slipped a couple of cents, West Texas points continued to strengthen considerably. El Paso Permian jumped 24 cents to $1.355, with similarly steep increases seen across the region and every transaction pricing at or above $1.

However, with demand set to wane in the coming weeks as fall approaches, prices could return to the bargain-basement levels seen last year once Kinder Morgan Inc.’s 2 Bcf/d Gulf Coast Express (GCX) pipeline enters service and unleashes even more gas into the market.

GCX has been consistently receiving gas from El Paso Natural Gas (EPNG) near the Waha Hub in West Texas since first posting nominations on Aug. 8, according to Genscape Inc. After averaging about 84 MMcf/d during the past weekend, scheduled volumes have climbed to 260 MMcf/d as of the timely cycle.

“This marks the first material deliveries from any interstate pipeline to the new intrastate pipeline, which is currently flowing interim volumes prior to coming fully online in late September,” Genscape analyst Colette Breshears said.

Genscape’s proprietary infrared monitoring of the Waha Header System continues to show elevated levels of compression at the facility, while exports to Mexico from West Texas have remained steady, “suggesting that additional volumes are likely being rerouted from intrastate systems and local gathering lines onto GCX.”

Genscape-tracked receipts of production onto Permian-area interstate pipelines are still posting below early July averages by around 150 MMcf/d, though this has recovered from minimums posted in late July of about 250 MMcf/d.

Over in the Southwest, easing pipeline restrictions in the region sent prices lower across the region, with Kern Delivery shedding 21.5 cents to average $2.865.

Losses were less pronounced in California, where SoCal Citygate cash fell 8.5 cents to $3.18.

Rockies prices slipped only a few cents on the day, as did those in the Midwest and Midcontinent.

Louisiana spot gas prices were mixed, but only ANR SE moved more than a nickel, jumping 8.5 cents to $2.09 due to the end of a one-day maintenance on the pipeline on Wednesday.

Prices barely budged in Appalachia, although Texas Eastern Transmission on Tuesday issued another update regarding the Danville explosion force majeure. As part of its continuing investigations on the 30-inch diameter line, the pipeline has shut in the Casey County, KY, interconnect with Tennessee Gas Pipeline.

“This meter has not consistently flowed since April 2019, but has seen a recent spike in receipts as locations downstream of Danville look for alternative supply, nominating as much as 98 MMcf/d since the Aug. 1 explosion,” Genscape analyst Josh Garcia said.

There is still no estimated return to service for this line.

Prices were stronger in the Northeast, with most pricing hubs picking up around a nickel or more day/day. Transco Zone 6 non-NY climbed 7 cents to $1.91.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |