Lower 48 Still Dominating Oil Markets but Global Picture Said Fragile

Oil output from the Lower 48 states continues to overwhelm worldwide production, albeit at a slower pace, but a continuing trade war and a gloomier economic outlook may pose hurdles into 2020, the International Energy Agency (IEA) reported Friday.

In its Monthly Oil Market Report (MOMR), the global energy watchdog pointed to the expected slowdown in U.S. output, in part as producers heed the call of capital discipline. Through the first five months of this year, U.S. oil output climbed by only 75,000 b/d.

Domestic production fell in May by 25,000 b/d from April, while in July, an estimated 80,000 b/d was cut from GOM output when Hurricane Barry blew through, more than offsetting a marginal increase in onshore supply.

“Despite hurricane shut-ins, the U.S. dominated total growth, contributing 1.5 million b/d,” IEA noted.

The biggest onshore gainer was in New Mexico, home to a large slice of the Permian Basin, where production increased by 33,000 b/d to 900,000 b/d, “a new high and 255,000 b/d (or 40%) up on a year earlier,” according to the MOMR.

“Texas registered a 16,000 b/d increase, but at 4.97 million b/d was still 755,000 b/d (or 18%) above a year ago. Production in Colorado rose by 12,000 b/d, in Oklahoma it dropped by the same amount, and in North Dakota output was essentially unchanged.”

Meanwhile, U.S. natural gas liquids production over the period rose by 50,000 b/d in May from April to 4.8 million b/d, “up 515,000 b/d year/year and 360,000 b/d higher than end-2018 levels.”

The “imminent start-up of more than 2 million b/d of new pipeline capacity in the Permian, and a strong uptick in fracturing activity in June, is expected to spur further growth in output and exports from the Gulf Coast.”

U.S. producers, however, remain cautious, with few signs they plan to accelerate drilling activity.

“During July, operators reduced the number of rigs targeting oil by a further 18, so that in early August there were 770 rigs in operation, 115 fewer than at end-2018,” IEA noted.

Slowing activity also is taking its toll on the oilfield service sector. Schlumberger Ltd. and Halliburton Co. each reported sharp declines in North American revenues for the second quarter “and presented a weaker outlook for exploration and production for the remainder of 2019 as independents continue to put greater emphasis on capital discipline rather than output growth.”

Researchers acknowledged that with the independents in retreat, the majors led by ExxonMobil and Chevron Corp., “and to a lesser extent Shell and BP plc, are using their scale and deep pockets to shore up their shale footprint” in the Lower 48.

Potential storm impacts to GOM oil production are a concern for the next few months as hurricane season ramps into full gear. Increased storms are in the forecast for the Atlantic Basin, forecasters at the National Oceanic and Atmospheric Administration said Thursday in their hurricane forecast. A fading El Nino — warmer-than-normal water temperatures in the Pacific Ocean near the equator — signals an increased chance for more tropical storms.

Barry shut in more than 1.3 million b/d at one point and reduced average GOM crude production by roughly 300,000 b/d for the month, according to researchers.

“Supply should recover sharply in August and subsequently unless storms force further shut-ins.”

Meanwhile, the start up of Royal Dutch Shell plc’s 175,000 b/d Appomattox deepwater project ahead of schedule in May “is expected to take Gulf of Mexico production to new records next year,” researchers said.

In Canada, IEA estimated oil production rose by an estimated 125,000 b/d in June to 5.4 million b/d, as Albertan producers pushed oilsands output higher.

“Synthetic crude oil supplies increased 100,000 b/d from a month earlier while raw bitumen output rose by 65,000 b/d. In addition, offshore production inched up 20,000 b/d on higher flows from the Hibernia field,” researchers said.

“Canadian production was 265,000 b/d above a year ago, but 310,000 b/d below December 2018 levels, before mandatory production curtailments were implemented.”

Because of lower oil storage levels and more volumes being shipped by rail, Alberta eased its oil curtailment program for September by an additional 25,000 b/d, reducing the required cuts to 125,000 b/d compared to 325,000 b/d mandated at the start of the year. “Companies can thus produce 3.76 million b/d from September, an increase of 135,000 b/d from June levels.”

Also of note, Mexican oil supply held steady in June at around 1.9 million b/d, but it was down by around 185,000 b/d from the same period a year earlier.

“Crude production, at 1.7 million b/d, was 155,000 b/d below the previous year, led by declines at the Xanab field in the Southeast offshore region,” which declined 90,000 b/d year/year, and from the Ku-Maloob-Zaap complex, off 60,000 b/d,” researchers noted.

“In contrast, output at the legacy Cantarell field held steady at around 150,000 b/d, a fraction of the peak rate of more than 2.2 million b/d seen in 2004.”

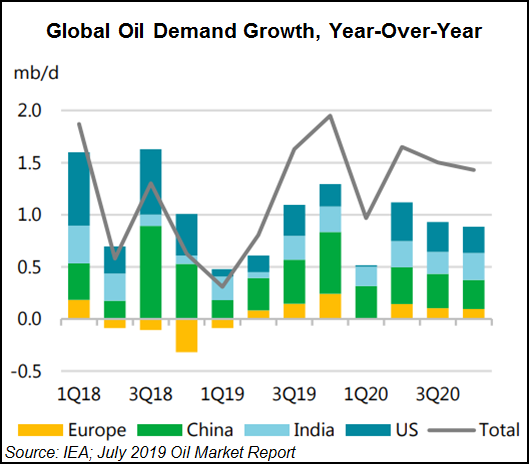

Overall, global oil demand fell by 160,000 b/d in May from the same period of 2018, the second annual decrease this year, according to IEA. From January to May, demand only climbed by 520,000 b/d, “the lowest increase for the period since 2008.”

IEA has reduced its total global growth forecasts for 2019 by 100,000 b/d to 1.1 million b/d, and for 2020 reduced growth by 50,000 b/d to 1.3 million b/d.

“There have been concerns about the health of the global economy expressed in recent editions of this report and shown by reduced expectations for oil demand growth,” researchers said.

“Now, the situation is becoming even more uncertain: the U.S.-China trade dispute remains unresolved and in September new tariffs are due to be imposed.”

In fact, tensions between the United States and China continue to escalate, “reflected in heavy falls for stock and commodity markets. Oil prices have been caught up in the retreat,” and they fell to under $57/bbl a few days ago.

“Meanwhile, the prospects for a political agreement between China and the United States on trade have worsened. This could lead to reduced trade activity and less oil demand growth.”

For the year as a whole, supply growth in countries not part of OPEC has been revised marginally lower, to 1.9 million b/d, on a slightly weaker forecast for Brazil.

“However, growth accelerates to 2.2 million b/d in 2020 as Brazil picks up speed and new projects start up in Norway and Guyana. The U.S., nevertheless, remains the largest source of growth, contributing a total of 1.7 million b/d in 2019 and 1.3 million b/d in 2020.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |