Lower-Than-Expected Storage Build Pushes Natural Gas Futures Higher; Cash Slips

Stoked early by increasingly hotter long-range weather forecasts, natural gas futures continued to rise Thursday after the Energy Information Administration (EIA) reported a storage injection that was slightly below what the market had expected.

After hitting an intraday high of $2.155/MMBtu, the September Nymex gas futures contract went on to settle at $2.128, up 4.5 cents on the day. October rose 4.7 cents to $2.146.

Spot gas prices, however, continued to retreat as mild weather blanketed much of the country outside of the southern states. Led by double-digit decreases in the Northeast, the NGI Spot Gas National Avg. dropped 5.5 cents to $1.875.

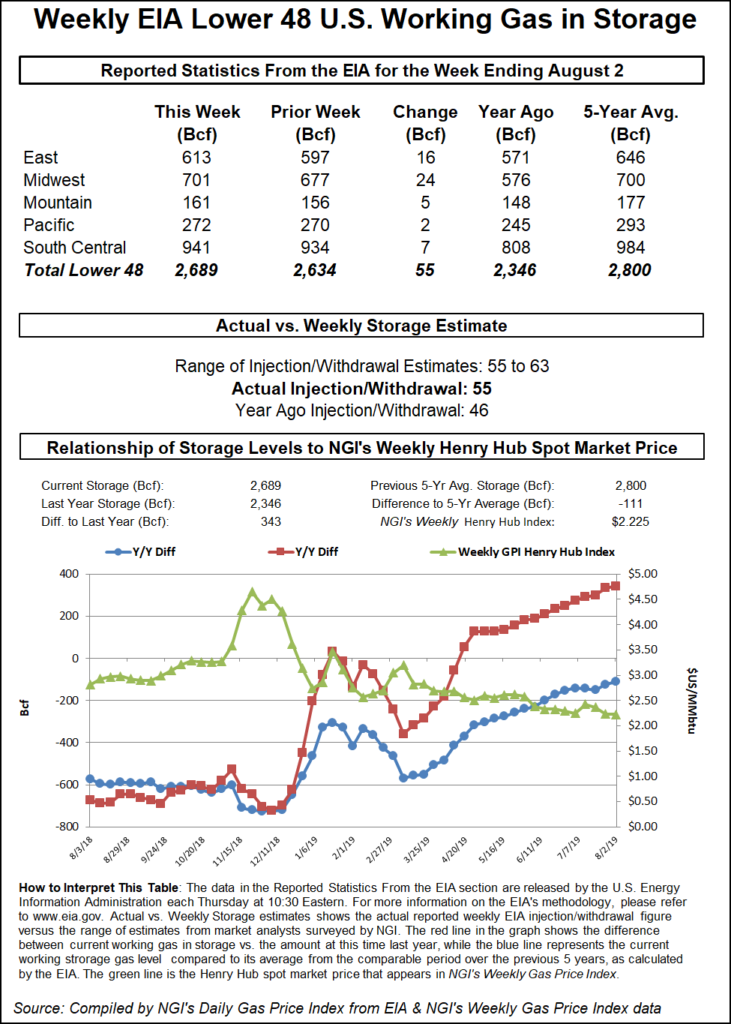

On the Nymex futures front, the prompt month was already a couple of cents higher early Thursday when the EIA reported a 55 Bcf injection into storage inventories for the week ending Aug. 2. The build came in 4 Bcf below consensus, but still was well above last year’s 46 Bcf injection and the five-year average injection of 43 Bcf.

As such, analysts struggled to call the report “bullish,” especially as more above-average storage injections were expected in the weeks ahead. With liquefied natural gas (LNG) demand expected to remain depressed for a few more weeks, analysts on energy chat room Enelyst searched for other signs of optimism for prices.

Flux Paradox President Gabriel Harris noted the continued decline in the rig count, with rigs now down to levels not seen since January 2018 and 14% below the peak at the start of this year.

“At some point, that is going to support a good buy opportunity,” Harris said.

Weather appears to be providing some hope for bulls as well, with models this week increasing heat in long-range outlooks during the last several runs. While analysts expect storage builds to continue coming in above normal in the next few weeks, some tapering off is expected by the end of the month.

The latest models show hot high pressure still favored to build across the Midwest and eastern United States Aug. 19-23, with daytime highs in the 90s potentially extending as far north as Chicago to New York City, according to NatGasWeather. This is where the pattern maintains a bullish tilt.

“But the data will need to prove heat can last for a prolonged period to meaningfully impact supplies, and where we view the data as needing to be more convincing since we see potential for cooling to return across the northern United States shortly after Aug. 23,” the weather forecaster said.

Thursday’s 55 Bcf injection confirms the idea that the record cool temperatures in the South a couple of weeks ago led to last week’s big bearish surprise, as most estimates were too high on the build in the South-Central region for today’s report, according to Bespoke Weather Services.

“Balance-wise, yes, tighter than last week, but still underwhelming in our view. All in all, a neutral report,” Bespoke chief meteorologist Brian Lovern said.

Broken down by region, the South Central injected a net 7 Bcf, which took into account a 5 Bcf draw from salt facilities, according to EIA. The Midwest added 24 Bcf into stocks, while the East injected 16 Bcf. Inventories in the Mountain region rose by 5 Bcf, while the Pacific increased by 2 Bcf.

Working gas in storage as of Aug. 2 stood at 2,689 Bcf, EIA said.

Weather aside, the market will also have to contend with growing production, which has reached fresh record highs this week and is poised to increase further in the months ahead, especially once Kinder Morgan Inc.’s Gulf Coast Express (GCX) enters service next month.

Production so far this month to date has been outperforming expectations, according to Genscape Inc. The firm’s August projection for Lower 48 production was 90.43 Bcf/d, but its daily scrape model is already running nearly 0.37 Bcf/d higher and has run as high as 91.55 Bcf/d.

“Production may be even higher than what our daily model is suggesting as storage injections continue to come in higher than our supply and demand projections on average,” Genscape senior natural gas analyst Rick Margolin said.

On the demand side, power burns and exports to Mexico and via liquefied natural gas (LNG) are all hitting new record highs, but that hasn’t been enough to pace supply growth. Heat in the Midwest, Pacific and South Central regions has generated about 2.8 Bcf/d more power burn than Genscape’s weather-normal forecast.

However, the recent shutdowns of LNG trains at Cheniere Energy Inc.’s Sabine Pass and Corpus Christi terminals have lopped off about 1.8 Bcf/d of LNG demand, and industrial sector demand is underperforming forecast by about 0.6 Bcf/d.

As a result, balances and injections continue their summer-long streak of looseness, according to Genscape senior analyst Eric Fell. “On a weather adjusted basis, injections have averaged 2.6 Bcf/d higher than the five-year over the last three months. With this, we see prompt-month prices testing lows not registered in at least the past 40 months.”

With cool air blanketing the Northwest, and comfortable temperatures moving across the Midwest and East, spot gas prices continued to slip Thursday.

Cash was hit especially hard in the Northeast, where Transco Zone 6 NY tumbled 21.5 cents to $1.85. Several other pricing locations in the region also registered double-digit declines.

Similar weakness was seen in Appalachia, where Transco Leidy Line next-day gas plunged 18.5 cents to $1.71. Columbia Gas was the lone outlier in the region, as spot gas there slipped only a few cents on the day.

Columbia Gas announced Wednesday that the planned maintenance by Texas Eastern Transmission (Tetco) at the Waynesburg Compressor Station has been postponed to a later date. As of Thursday afternoon, Tetco had not provided any information regarding the postponement.

“This is the second time that the event has been postponed just before it was scheduled to begin,” Genscape analyst Anthony Ferrara said.

Over in the Midwest, spot gas prices fell around a nickel or so at most market hubs, while Defiance dropped a dime to $1.915.

A similar trend was seen in the Midcontinent, where ANR SW’s nearly 10-cent drop due to a brief maintenance event bested other declines in the region by several cents.

Cash prices in Texas were mostly lower despite strong local demand. NGPL S. TX next-day gas fell about a nickel to $2.02.

Meanwhile, Genscape has lowered its forecast for U.S. pipeline exports to Mexico as seven major pipeline projects in Mexico are on hold, and there is great uncertainty around when the issues behind the delays will be resolved. The primary (and in most cases, exclusive) contract holder on these systems is Mexico’s state-run power agency, Comisión Federal de Electricidad (CFE).

“Progress on these pipelines has been halted because the CFE under the country’s new presidential administration is objecting to making capacity payments since the pipelines are not operational,” Genscape’s Margolin said.

All seven systems are under forces majeure, but the originally issued contracts oblige CFE to make payments under force majeure conditions. Negotiations between CFE and the pipeline developers — which include TC Energy, Sempra Energy’s Mexico subsidiary IEnova, Grupo Carso and Fermaca — are underway, “but the latest round of earnings calls and other actions within the Mexican market indicate resolutions are not close at hand,” Margolin said.

As such, Genscape has delayed its modelled in-service dates for three systems: the 2.6 Bcf/d Sur de Texas-Tuxpan system running from South Texas to Mexico’s Gulf Coast; the Wahalajara system, which will connect West Texas to central Mexican markets; and the Samalayuca-Sasabe system that will provide a secondary route for West Texas to reach northwestern Mexico and provide much needed debottlenecking relief to the Permian Basin.

“These delays increase our forecast of Mexican LNG sendout and reduce our forecast of U.S. pipeline exports to Mexico,” Margolin said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |