Chaparral, SandRidge Reduce Workforces but Pursue Different Strategies

Two Oklahoma City-based producers reduced their workforces in the second quarter in order to trim general and administrative costs, but one plans to ramp up Northwest Oklahoma exploration while the other looks to Colorado.

Chaparral Energy Inc. is planning a development project later this year in Canadian County, OK, management said. The Greenback development project includes two landing targets with three to four wells per landing zone. The results of the initial spacing and production tests are expected to influence the 2020 production outlook, which executives were hesitant to quantify on the quarterly earnings call Thursday.

Chaparral began its 11-well Foraker cube-style spacing test in March, and the results are spurring a decision to begin the new development.

Over a four-month period, initial production rates for oil in “Meramec and Woodford wells continue to outperform type curve at 148% and 101%, respectively,” said CEO Earl Reynolds. “We are reconfiguring our second-half drilling schedule based on these results and plan to begin drilling the Greenback, which is a Canadian County Meramec full section development in close proximity to the Foraker,” later this year.

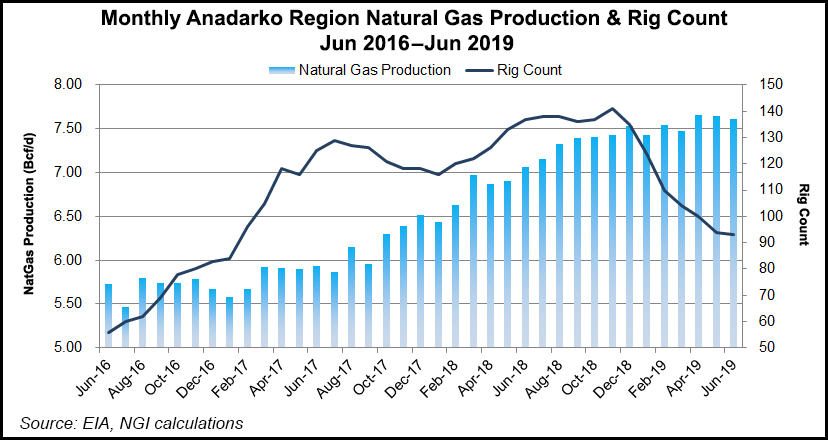

Both developments are in the northwestern part of the Sooner Trend of the Anadarko Basin mostly in Canadian and Kingfisher counties (STACK).

Chaparral also plans to drop one rig, bringing the total rig count to three. In addition it has reduced this year’s capital spending by 5% to $260-285 million.

Over the years, Chaparral has pivoted to oilier assets in Canadian and Kingfisher counties, but production growth is expected to continue despite noise from some operators that Oklahoma had lost its shine as a lucrative production zone.

Going forward, some cost savings are to be driven by improved operational efficiencies at the wellhead. More savings are expected from a workforce reduction and the sale of corporate headquarters in Oklahoma City.

Chaparral reduced its corporate workforce by 23% between January and July. It had 194 full-time employees at the end of 2018, according to a filing with the Securities and Exchange Commission. The company also sold its corporate headquarters, and it could be in the market for a new corporate facility or continue with a lease-back option.

Net losses in 2Q2019 totaled $45.2 million (minus 99 cents/share), down from a year-ago net loss of $22 million (minus 49 cents). Revenues grew by 14% year/year to $66.7 million, but costs also more than doubled to $125.2 million because of a one-time impairment of $63.6 million stemming from a drop in commodity prices.

Chaparral is not the only Oklahoma City-based company to slash costs through job cuts and other administrative reductions.

Sandridge Energy Inc. also cut back its workforce in 2Q2019, executives said Thursday during a quarterly conference call. It is the second consecutive quarter in which it has reduced the employee count, although it did not specify how many jobs were lost. The company had 310 full-time employees at the end of 2018.

Sandridge rejected a round of offers for a merger or acquisition in 2018, affirming its commitment to developing assets instead. CEO Paul McKinney repeated that sentiment during Thursday’s conference call.

“We can’t grow if we use our capital on share buybacks,” McKinney said, doubling down on a growth strategy that doesn’t include a short-term share-price boost.

During the quarter, Sandrige drilled the final three wells included in a drilling participation agreement from 2017. Sandridge secured a $200 million agreement with an undisclosed counterparty in 3Q2017 to jointly develop horizontal wells within the Meramec formation in the northwestern part of the STACK. Under the agreement, the counterparty paid most of the drilling costs in exchange for a majority working interest in the wells. The number of wells and exact location was left to Sandridge’s discretion.

The company said Thursday that altogether it had brought a total of seven wells to sales as part of the framework of the drilling participation agreement.

With the STACK drilling complete, Sandridge plans to turn its attention to its North Park Basin assets in Jackson County, CO.

“As we head into the final months of summer, we will finish completing the six wells of our 15-wells-per-section test drilled in North Park earlier this year, and continue the planning process for our future drilling and development programs,” McKinney said.

Sandridge produced 35,500 boe/d during the second quarter, a 10% increase from 2Q2018.

The company reported a second quarter net loss of $13.3 million (minus 38 cents/share) versus a net loss of $34 million (minus 97 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |