Infrastructure | NGI All News Access | Permian Basin

Qatar Takes $550M Stake in Permian Midstreamer Oryx

Oryx Midstream Services, the largest privately held crude midstream provider in the Permian Basin, said Qatar’s sovereign wealth fund plans to infuse $550 million into the company and help with future development.

An affiliate of Oryx sponsor Stonepeak Infrastructure Partners sold the stake to the Qatar Investment Authority (QIA).

“We believe that Oryx represents a strong midstream platform with tremendous growth potential, and we look forward to working with our new partners at Stonepeak,” QIA CEO Mansoor Al-Mahmoud said. “This acquisition is a further demonstration of QIA’s strategy to increase the size of our U.S. portfolio, and to invest more in major infrastructure projects.”

The partnership is the latest in a series of investments undertaken by QIA across the United States, where the state-owned fund plans to increase investments to $45 billion in the coming years.

“The significant investment and commitment from QIA alongside Stonepeak’s strong operational and capital support will allow us to continue to grow our footprint in the Permian Basin and deliver the highest level of service to current and future customers,” Oryx CEO Brett Wiggs said.

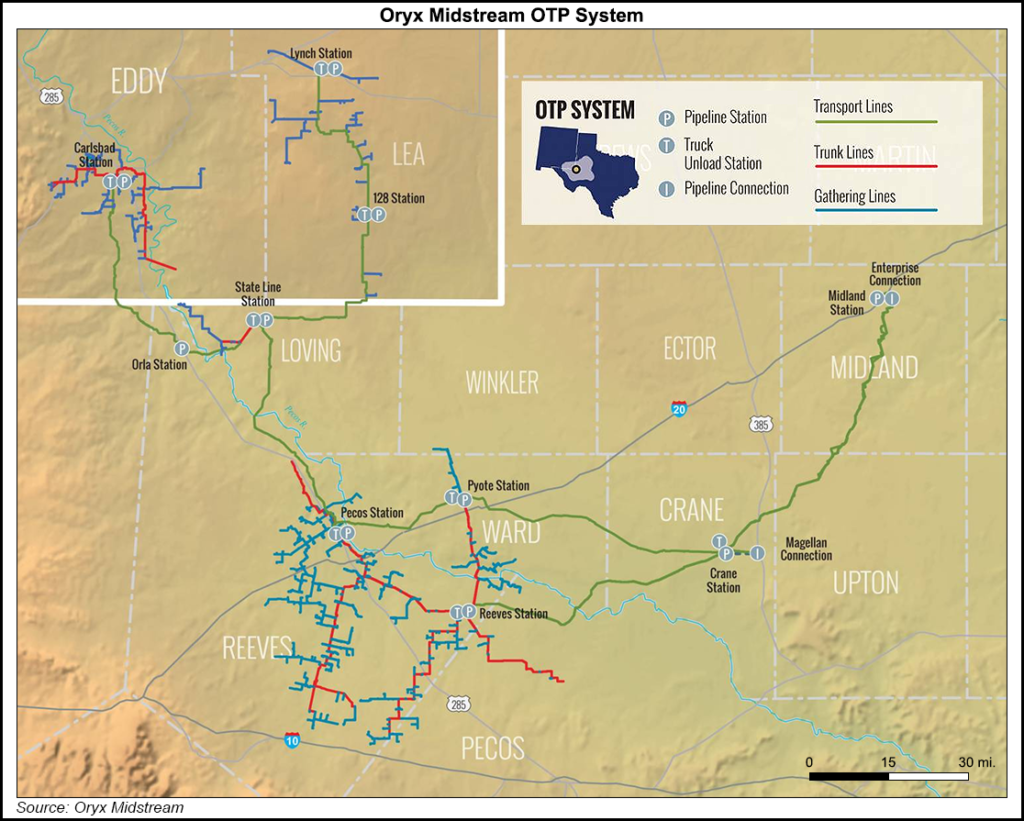

Since it was founded in 2013, Oryx has built a gathering and transportation system underpinned by nearly one million acres with long-term dedications from more than 20 customers. It has 2.1 million bbl of storage and about 1,200 miles of in-service and under construction pipeline that spans eight Texas counties and two counties in New Mexico.

A binding open season by Oryx to test support for additional Permian transportation options ended in June. Once it completes its latest expansion, it said total transportation capacity would exceed 900,000 b/d.

Stonepeak CEO Michael Dorrell said QIA’s infusion “meaningfully furthers” a goal to accommodate growing Permian production.

White & Case LLP served as legal adviser to QIA, while Stonepeak’s legal adviser was Sidley Austin LLP.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |