E&P | Haynesville Shale | NGI All News Access | NGI The Weekly Gas Market Report

Comstock Playing Defense as Haynesville Natural Gas Output Battles Weak Prices

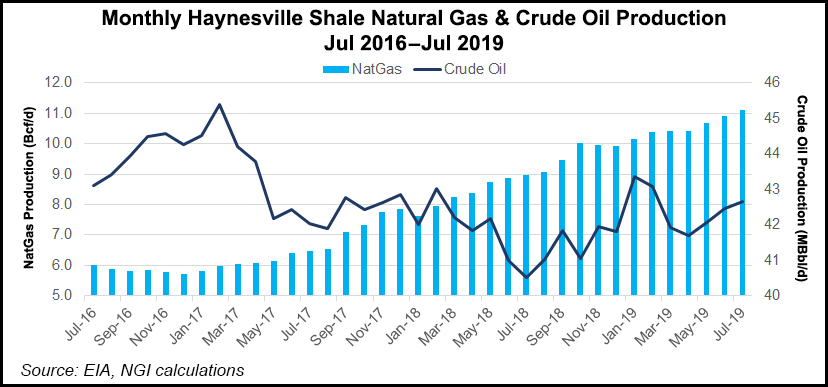

Comstock Resources Inc., which this year became the No. 1 operator in the natural gas-heavy Haynesville Shale, said second quarter output from the play was 88% higher than a year ago and 19% higher sequentially, but confronted with continued low prices, the company is playing defense.

Comstock’s $2.2 billion takeover of Haynesville peer Covey Park Energy LLC, financed in part by leading shareholder and Dallas Cowboys owner Jerry Jones, has given the producer an acreage and production advantage in East Texas and North Louisiana.

Breaking through the tricky offense mounted by low gas prices has been more difficult.

“With favorable proximity to the Gulf Coast demand and over 500 miles of our own gathering infrastructure, we have higher natural gas price realizations,” CEO Jay Allison said during the second quarter conference call.

The Covey Park assets “have higher gas price realizations than Comstock’s, and we’re currently negotiating new gathering contracts and marketing agreements to give us greater access to the premium Gulf Coast markets.”

Comstock’s average realized gas price, including hedging gains, decreased 13% from a year ago to $2.29/Mcf, while oil prices fell 9% to average $52.12/bbl. Covey Park’s average realized gas price in 2Q2019 was $2.68, with oil averaging $59.94.

Because of the Covey Park takeover, Comstock has boosted its 2019 annual drilling and completion (D&C) budget to $538 million. Data scientists are being added to perform a “tailored drawdown for every new well, which we feel will further improve the economics of the Haynesville wells.”

Ten Haynesville wells completed in 2Q2019 had average initial production (IP) rates of 24 MMcf/d with lateral lengths averaging 6,970 feet.

While production is strong, something had to give on the financing side. Faced with a way to pay for its expanded spending, consolidation has begun within the Dallas area corporate offices. Combined corporate staff overall is being downsized by 41%.

Going forward, Allison said, annual general/administration (G&A) costs are pegged at $30 million, about half of the combined annual for the two companies in 2018.

Even with the higher D&C spend and lower G&A, Comstock has reduced planned drilling activity in the Haynesville. It is releasing one or two rigs in the near term to “ensure we can hit our target to generate free cash flow in 2020 of approximately $100 million,” Allison said.

“We will also consider potential divestitures of our noncore assets in order to pay down our debt and improve our current liquidity.”

Completion of more than 60 net Haynesville/Bossier wells is scheduled by the end of the year. In addition, plans are to spend $21.2 million on oily Eagle Ford and Bakken shale properties. During the second quarter, the Frisco, TX-based independent produced a total of 40.9 Bcfe total, with oil production averaging 7,628 b/d, an increase of 990 b/d.

Last August Comstock completed transactions in which Jones, who controls about 75% of the company, contributed Bakken properties in exchange for the majority stakes.

Results for 2Q2019 include the Jones contribution, while results for 2Q2018 reflect the results before the Jones contribution. The combined results with Covey Park are to be included in 3Q2019 results.

For 2Q2019, Comstock’s net income was $21.4 million (20 cents/share), versus a year-ago net loss of $34 million (minus $2.22). The 2Q2019 results included an unrealized gain from derivatives of $12.8 million, as well as Covey Park merger-related transaction costs of $1.4 million.

Operating cash flow increased 151% to $66.3 million. Oil and gas sales more than doubled year/year to $130.1 million from $62.6 million.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |