Markets | Infrastructure | NGI All News Access

EIA Reports ‘Underwhelming’ 55 Bcf Natural Gas Storage Injection; Prices Jump

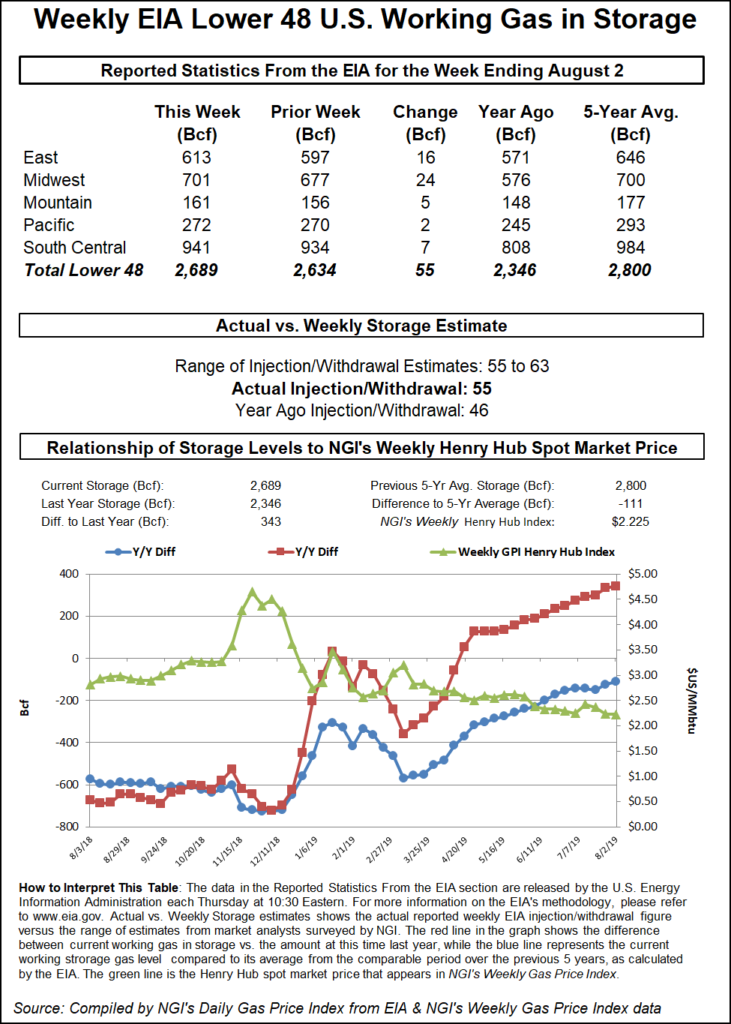

The Energy Information Administration (EIA) reported a 55 Bcf injection into storage inventories for the week ending Aug. 2, a figure that was on the low end of expectations and 4 Bcf below consensus.

However, the reported build was above last year’s 46 Bcf injection and the 43 Bcf five-year average, according to EIA. The surplus to stocks at this time last year rose to 343 Bcf while the deficit to the five-year average shrunk to 111 Bcf.

Analysts struggled to call the report “bullish” even though it came in slightly below expectations, but traders nevertheless moved prices higher after the print the screen. The September New York Mercantile Exchange gas futures contract was trading around $2.11 before the EIA’s 10:30 a.m. ET report, but then jumped to $2.13 immediately after its release.

“Market is so bottomed out it is behaving semi bullish,” said natural gas coordinator Donnie Sharp of Huntsville Utilities. “As much due to being oversold as anything. At a whopping $2.13.”

By 11 a.m. the prompt month was trading at $2.135, up 5.2 cents on the day.

With liquefied natural gas demand expected to remain depressed for a few more weeks, analysts on energy chat room Enelyst searched for other signs of optimism for prices. Flux Paradox President Gabriel Harris noted the continued decline in the rig count, with rigs now down to levels not seen since January 2018 and 14% below the peak at the start of this year.

“At some point, that is going to support a good buy opportunity,” Harris said.

Weather appears to be providing some hope for bulls as well, with models this week increasing heat in long-range outlooks during the last several runs. While analysts expect storage builds to continue coming in above normal in the next few weeks, some tapering off is expected by the end of the month.

As seen in last week’s EIA report, weather remains a key component of storage behavior. Thursday’s 55 Bcf injection confirms the idea that the record cool temperatures in the South a couple of weeks ago led to last week’s big bearish surprise, as most estimates were too high on the build in the South-Central region for today’s report, according to Bespoke Weather Services.

“Balance-wise, yes, tighter than last week, but still underwhelming in our view. All in all, a neutral report,” Bespoke chief meteorologist Brian Lovern said.

Broken down by region, the South Central injected a net 7 Bcf, which took into account a 5 Bcf draw from salt facilities, according to EIA. The Midwest added 24 Bcf into stocks, while the East injected 16 Bcf. Inventories in the Mountain region rose by 5 Bcf, while the Pacific increased by 2 Bcf.

Working gas in storage as of Aug. 2 stood at 2,689 Bcf, EIA said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |