Infrastructure | NGI All News Access

Mexico LNG Export Terminals Gather Steam as Pipeline Standoff Continues

While the Mexican government’s attempts to renegotiate contracts on seven pipelines temporarily stall the development of the local natural gas market, two export projects on the west coast continue to gather momentum.

This month, Mexico’s energy regulator Comisión Reguladora de EnergÃa authorized the construction of a liquefied natural gas (LNG) project on the Gulf of California in Sonora state.

The project’s developer Mexico Pacific Ltd. LLC (MPL) has received U.S. Department of Energy (DOE) permission to export the gas from Arizona to Mexico and from there to re-export LNG globally.

MPL is targeting buyers in Japan, South Korea and China given the project’s strategic geographic position.

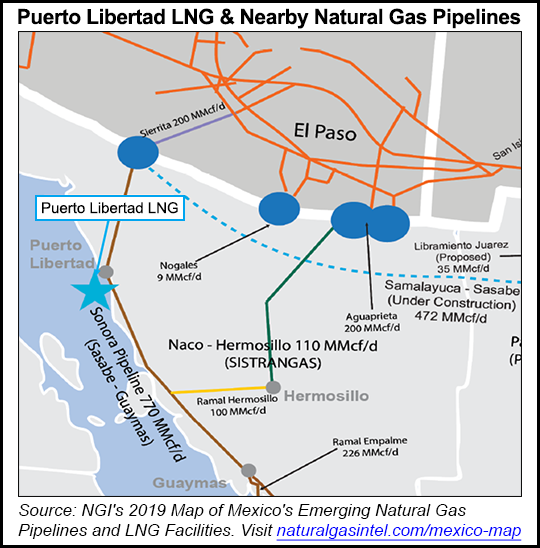

The facility at Puerto Libertad has the green light to export up to 12 million metric tons/year (mmty) for 20 years, with the gas shipped south from the United States via existing cross-border transmission lines, including Kinder Morgan Inc.’s Sierrita Gas Pipeline LLC, which extends from the border near Sasabe, AZ. The project foresees initial construction of up to 4 mmty using modular LNG technology.

MPL President Josh Loftus earlier this year said the company appreciated the “ongoing regulatory support of the U.S. and Mexican governments as we build momentum” toward making a final investment decision (FID) in the first half of 2020, with start up scheduled in the second half of 2023.

Meanwhile, Sempra Energy announced during its second quarter earnings call that it is on track to make an FID this year on the EnergÃa Costa Azul (ECA) liquefaction project in Baja California on the Pacific coast. Earlier this year, the project also received U.S. DOE authorizations allowing Sempra to export U.S.-produced natural gas to Mexico, to then re-export from Mexico globally.

The two-phase ECA liquefaction project, a joint venture between Sempra subsidiaries Sempra LNG and Mexico unit Infraestructura Energética Nova (IEnova), would be built adjacent to Sempra’s existing ECA LNG receipt terminal near the city of Ensenada.

Sempra is developing North American LNG export facilities capable of exporting 45 mmty. The first project, Cameron LNG in Louisiana, achieved first production from the first train in May. Sempra is also developing a second phase at Cameron and is developing Port Arthur LNG in Texas, along with ECA Phase 1 and Phase 2.

Late last year, Sempra subsidiaries clinched heads of agreement (HOA) with Total SA, Mitsui & Co. Ltd. and Tokyo Gas Co. Ltd. to take capacity from Phase 1 of the proposed project. The three companies each potentially could purchase 0.8 mmty from Phase 1.

The LNG export projects come amid a gas supply glut in the Permian Basin of West Texas and southeastern New Mexico driven by soaring production and insufficient takeaway capacity. The trend has driven spot natural gas prices in West Texas into the negatives at times during the past nine months.

However, the projects still must overcome some hurdles, such as midstream infrastructure.

One of the gas supply routes for MPL’s Sonora project is the 510 MMcf/d Guaymas-El Oro natural gas pipeline, which has been inactive since August 2017 after members of the Loma de Bácum faction of the indigenous Yaqui tribe removed a section of the pipe in protest of its construction.

IEnova continues to receive force majeure payments for the pipeline, despite it being one of the seven pipelines issued an arbitration request by anchor customer Comisión Federal de Electricidad (CFE). Even if it the issue were resolved soon, the arbitration could delay its reassumption further. The pipeline however is south of the LNG project, and will not impact gas flow from Arizona.

Meanwhile, Sempra would need to develop new pipeline infrastructure for Phase 2 of its ECA project to bring in gas from Waha hub in West Texas, which, given the current environment in Mexico, would not be without its complications.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |