Infrastructure | NGI All News Access

Enable Still in Talks on Gulf Run Gas Pipeline; Filing Delayed

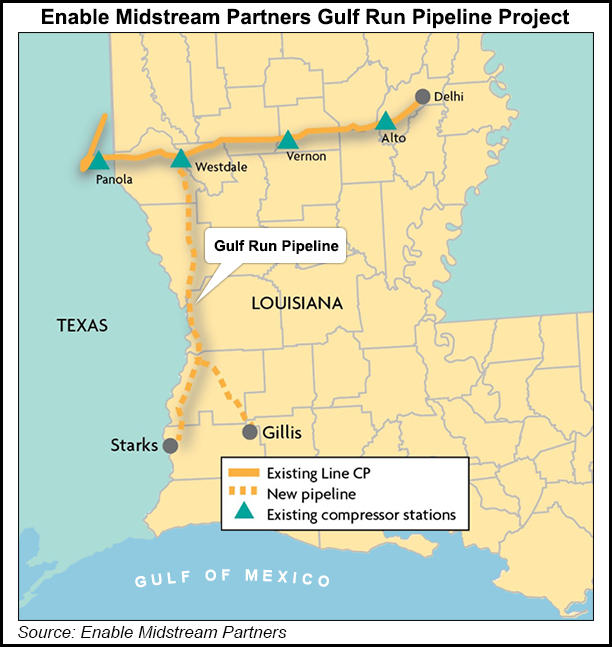

Oklahoma City-based Enable Midstream Partners LP has pushed back its certificate filing for a proposed pipeline that would move natural gas from northern Louisiana to the Gulf Coast in order to allow more time for “active discussions” with potential shippers for additional capacity commitments.

Enable now expects to file a formal certificate application at FERC for its 2.75 Bcf/d Gulf Run Pipeline in early 2020, rather than later this year as previously announced. The targeted late 2022 in-service remains intact, as management built in “a lot of front-end time” into its project timeline, CEO Rod Sailor said Tuesday on a call to discuss second quarter earnings.

As part of the Federal Energy Regulatory Commission pre-filing process, Enable hosted open houses for Gulf Run in May, and the Commission conducted public scoping meetings in June.

The $550 million project is backed by anchor shipper Golden Pass Liquefied Natural Gas (LNG), which has signed on to take 1.1 Bcf/d for 20 years. The 16 million metric tons/year export terminal to be built on the Texas coast was sanctioned in February by sponsors ExxonMobil Corp. and state-owned Qatar Petroleum.

Gulf Run would use existing Enable Gas Transmission LLC (EGT) transportation infrastructure, in which volumes during the quarter rose 14.4% year/year to 6.04 trillion Btu/d, to provide access to gas from the Haynesville, Marcellus, Utica and Barnett shales as well as the Midcontinent region.

During the second quarter, Enable contracted or extended more than 600,000 Dth/d of gas transportation capacity as “producers continue to request solutions to move Anadarko Basin natural gas production to market,” Sailor said.

The midstream operator said processed volumes in the quarter climbed 9% year/year to 2.54 trillion Btu, primarily because of higher processed volumes in the Anadarko and Ark-La-Tex basins. Natural gas gathered volumes in 2Q2019 increased 4.3% year/year to 4.62 trillion Btu, also from increased activity.

There were 44 rigs operating across Enable’s footprint that were expected to connect to its gathering systems. Thirty-three of the rigs were in the Anadarko, eight were in the Ark-La-Tex Basin and three were in the Williston Basin, according to management.

Crude and condensate gathered volumes rose 89,000 b/d during the quarter, largely because of last year’s acquisition of Enable Oklahoma Crude Services LLC’s gathering system in the Anadarko and a 29% increase in crude-gathered volumes in the Williston.

Management reaffirmed its guidance for 2019, indicating that it continues to see producers targeting more oilier areas in its footprint. Sailor maintained that, along with its 2018 Velocity Holdings LLC acquisition, management is “comfortable with the trajectory of the business.”

Enable’s performance led management to boost distribution for the first time since 2015. The company reported a quarterly cash distribution of 33.05 cents/share, up 4% from the 1Q2019 distribution.

The company reported 2Q2019 net income of $115 million (26 cents/share) for the second quarter, which was up $29 million year/year. Distributable cash flow was $197 million in 2Q2019, an increase of $26 million from 2Q2018.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |