Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

U.S. Natural Gas Exports Top 1 Tcf in 1Q2019, Says DOE

The United States left Canada behind as it claimed the title of North American champion natural gas exporter for the first three months of this year, according to the latest trade scorecard compiled by the U.S. Department of Energy (DOE).

U.S. exports jumped by 23% to 1.07 Tcf or 11.9 Bcf/d in 1Q2019, from 867.4 Bcf or 9.6 Bcf/d in the same period last year, reported DOE’s Division of Natural Gas Regulation.

Canadian gas exports suffered a 3.6% drop to 776.2 Bcf, or 8.6 Bcf/d from January through March, compared with 805.4 Bcf, or 8.9 Bcf/d during the first three months of 2018.

The United States gained on all export fronts year/year, according to DOE.

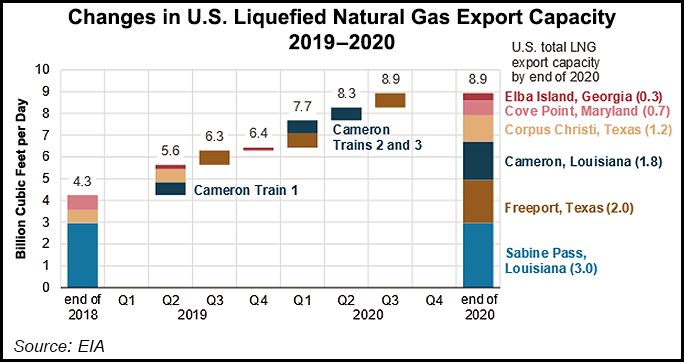

Volumes shipped from the United States as liquefied natural gas (LNG) surged by 51.8% to 360.4 Bcf, or 4 Bcf/d. Exports to Mexico grew by 10.1% to 434.3 Bcf, or 4.8 Bcf/d. Sales into Canada increased by 15.5% to 271.6 Bcf, or 3 Bcf/d.

Canadian exports still all go to the United States. Construction is only beginning on the first Canadian LNG export terminal on the northern Pacific coast of British Columbia at Kitimat, LNG Canada.

The United States is far ahead of Canada at establishing a global LNG presence. In 1Q2019 a trio of terminals — Cheniere Energy Inc.’s Sabine Pass and Corpus Christi, along with Dominion Cove Point — dispatched 105 ship cargos to 26 countries including Belgium, France, China, India and Turkey, DOE said.

Cross-border deliveries of Canadian gas fetched an average of $3.52/MMBtu in 1Q2019, up 22.6% from $2.88/MMBtu in the same period of 2018.

U.S. exports to Canada averaged $3.51/MMBtu in 1Q2019, up 5.2% from $3.34/MMBtu in the same period last year. The average price of U.S. gas exports to Mexico dropped by 8.2% to $3.08/MMBtu from $3.35/MMBtu. The DOE’s gas regulation division does not report LNG prices.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |