E&P | NGI All News Access | NGI The Weekly Gas Market Report

Canadian Oilsands Production Growth Forecast Said Boon for Natural Gas Demand

Cost control has made the Alberta oilsands, Canada’s star growth market for natural gas, “decidedly economic” and production will likely climb when pipeline projects clear regulatory delays, according to the Canadian Energy Research Institute (CERI).

Northern bitumen output is expected to rise from the 2018 average of 3 million b/d to 3.2 million b/d in 2020, 4 million b/d in 2030 and 4.7 million b/d in 2039 in the “reference case” rated most likely by CERI’s latest annual survey.

The forecasted new oilsands production would fill 1.8 million b/d in capacity increases by TC Energy, Enbridge and Trans Mountain pipeline projects currently seeking construction approvals in Canada and the United States.

After five years of paring expenses since prices fell from US$100-plus per barrel, CERI said “the relative position of oilsands projects against other crude oils is comparatively competitive, and as oil prices are expected to increase, so will the profitability of oilsands projects.”

Breakeven prices on the oilsands growth front, “in-situ” underground extraction, have been trimmed to C$40.61 ($30.45) per barrel for new projects and C$27.60 ($20.70) per barrel for additions to established operations, CERI said.

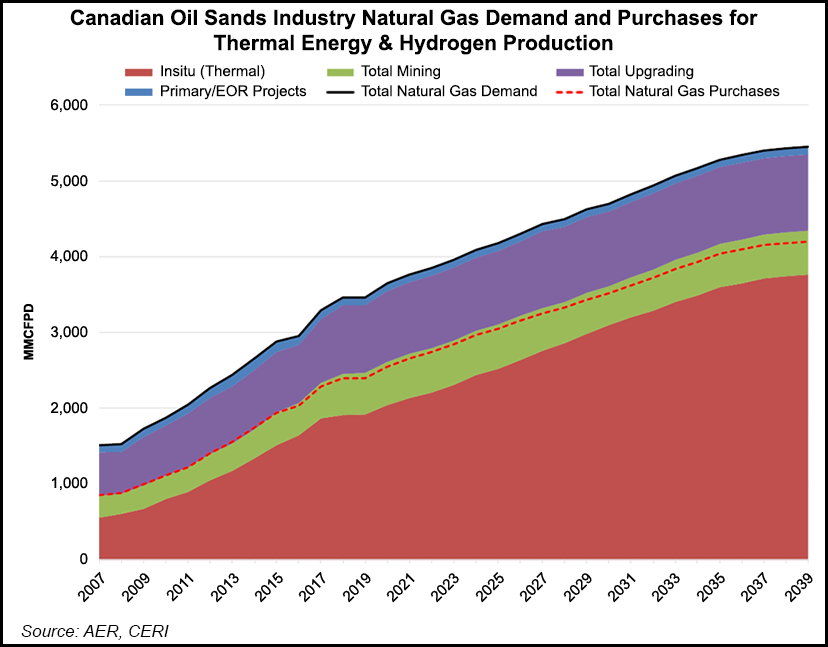

Natural gas consumption by oilsands heat processes and power generation is forecast to grow by 57% to 5.5 Bcf/d as of 2039 from the 2018 average of 3.5 Bcf/d.

Gas use climbs because in-situ bitumen extraction is a heavy user of fuel for steam-assisted gravity (SAG-D drainage, which uses twin or triplet sets of horizontal wells for simultaneous heat injection and oil production.

The underground SAG-D process has evolved into a lower-cost and less environmentally scarring oilsands method than the industry’s founding open-pit mines operated with the world’s biggest trucks and shovels.

But high SAG-D fuel use has a greater effect than mining on carbon emissions. In CERI’s reference case forecast, annual oilsands greenhouse gas output climbs by 38% to 94 million tons in 2039 from 68 million tons in 2018.

Carbon emissions make the oilsands stand out as a target, both for environmental control policies and industry cleanup projects.

CERI said at last count, “total Canadian emissions of carbon dioxide-equivalent were 732 million tons [per year] or 1.6% of global emissions. Of these emissions, 9.3% came from the oilsands sector. The effects of the sector on Canada’s total emissions and the ability to meet international commitments to greenhouse gas abatement are substantial.”

CERI notes that efficiency improvements cut the intensity or per-barrel carbon emissions of oilsands production but adds that rising total volume still causes overall increases. The institute made no attempt to guess eventual carbon reductions from current trials of substitutes for gas-fired steam, such as solvents and underground microwave heating.

The United States would share spin-off benefits if the industry grows, CERI said. “The U.S. benefits not only from importing oil and gas from Canada but also from supplying goods and services used by the Canadian industry.”

Oilsands industry spending in the U.S. is forecast to be US$15 billion and contribute to sustaining 133,000 supplier jobs over the next 10 years, with Texas alone receiving US$5 billion that supports nearly 37,000 jobs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |