Marcellus | E&P | NGI All News Access | Utica Shale

Antero to Rein in 2020 Spending as Natural Gas Continues to Weaken

Appalachian pure-play Antero Resources Corp. plans to hold drilling and completion (D&C) expenditures flat next year as it pushes through the latest commodity cycle with an eye on things management can control.

In a preliminary 2020 outlook released Thursday along with its second quarter results, the company anticipates D&C spending of $1.2-1.3 billion in 2020, essentially flat with the $1.3-1.375 billion its budgeted for the line-item this year. Overall, with another $75 million allocated to land, the company has budgeted up to $1.375 billion next year.

The company is on track to hit its 3.150-3.250 Bcfe/d 2019 production guidance. Management said Thursday that despite the latest downturn in prices, it’s targeting annual production growth of 10% in the coming years.

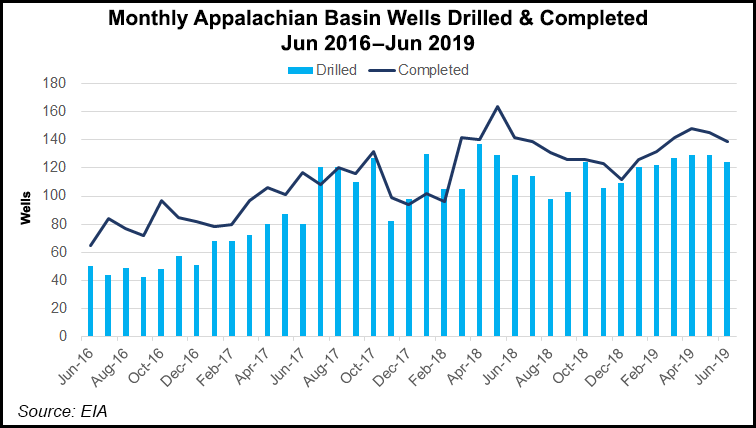

Antero is targeting up to 120 completions in 2020, versus the 125 slated for this year. Next year’s wells will be longer, however, with average lateral lengths of 12,100 feet compared with 10,200 feet this year.

“We remain highly focused on creating sustained value by prioritizing key initiatives dedicated to reducing costs, streamlining operations and strategically targeting favorably priced markets for our diverse product portfolio,” CEO Paul Rady said.

In recent quarters, Antero reviewed each expense related to its Marcellus Shale wells to cut costs as much as possible. Well costs have been reduced by $500,000 each since January and expects to reduce costs by another $950,000 in 2020, bringing overall savings of more than $1 million for each well compared to early 2019. This year’s reductions have come ahead of schedule on the service cost deflation that’s arrived on lower prices and less activity in Appalachia, along with sand logistics optimization and other operational efficiencies.

Overall, next year’s Marcellus well costs are targeted at $10.4 million each, mainly with water savings initiatives that include plans for a produced water pipeline, as well as completion design optimization.

The company’s hedge book is also expected to help it weather the low price environment. Management said Antero’s natural gas production is almost completely hedged for the remainder of 2019, all of 2020 and part of 2021 at an average price range of $2.87-3.39/MMBtu.

Antero produced 3.226 Bcfe/d in the second quarter, up 28% from the year-ago period. Liquids accounted for 29% of second quarter production as the company continued to focus on the wetter portions of the Marcellus in West Virginia.

The company exported 55% of its natural gas liquids volumes at a 19-cent premium to Mont Belvieu pricing during the second quarter. But year/year average realized prices, including hedges, still declined by 14% to $3.24/Mcfe.

The company reported net income of $42 million (14 cents/share), compared with a net loss of $136 million (minus 43 cents) in the year-ago period. Revenue was up 31% year/year to $1.3 billion.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |