Natural Gas Futures Rally Supported by Heat, Technical Factors

With the end of summer fast approaching, natural gas bulls seized their moment Wednesday as a hotter forecast helped to rally prices off a key support level. In the spot market, Gulf Coast prices followed futures higher; the NGI Spot Gas National Avg. climbed 4.5 cents to $2.000/MMBtu.

The September contract surged 9.6 cents Wednesday, going as high as $2.268 on the way to settling at $2.233. October settled 9.0 cents higher at $2.250, while November added 7.8 cents to $2.330.

While “probably justified” based on the heat in the Lower 48, Wednesday’s rally doesn’t seem likely to have lasting momentum behind it, according to Powerhouse Executive Vice President David Thompson.

This is partly “due to the amount of readily available supply,” he told NGI. “We’re also at the end of July, so we’re clearly well into the cooling season. That gives us August. By that point, that’s your last month of really being concerned about massive demand for cooling purposes.”

From a technical standpoint, this week saw the September contract form a double bottom with the lows going back to June 20, with prices dropping to around $2.10 on both occasions before recovering.

“Very symmetrical actions that both hit right around $2.10,” Thompson said. “That tells me a lot of people looked at it, checked their numbers and assessed their risk, and decided they’re comfortable being buyers at $2.10.” That it withstood tests on two separate occasions “reinforces its importance as a support level.”

NatGasWeather viewed hotter trends in the weather data heading into Wednesday’s trading as insufficient to justify the extent of the rally.

“It’s quite possible today’s spike is simply a short squeeze, as once prices began to move higher this morning, an abundance of shorts rushed for the exits to book profits after hitting multi-year lows to open the week,” the forecaster said.

The mid-day Global Forecast System came in “very little changed over the next 10 days, a touch hotter Aug. 10-12 but then cooler Aug. 13-15,” NatGasWeather said. “Most importantly, the data simply isn’t hot enough through Aug. 10, and even though” cooling degree days “are slightly above normal Aug. 11-15, they need to be much above/hotter than normal to be considered bullish.”

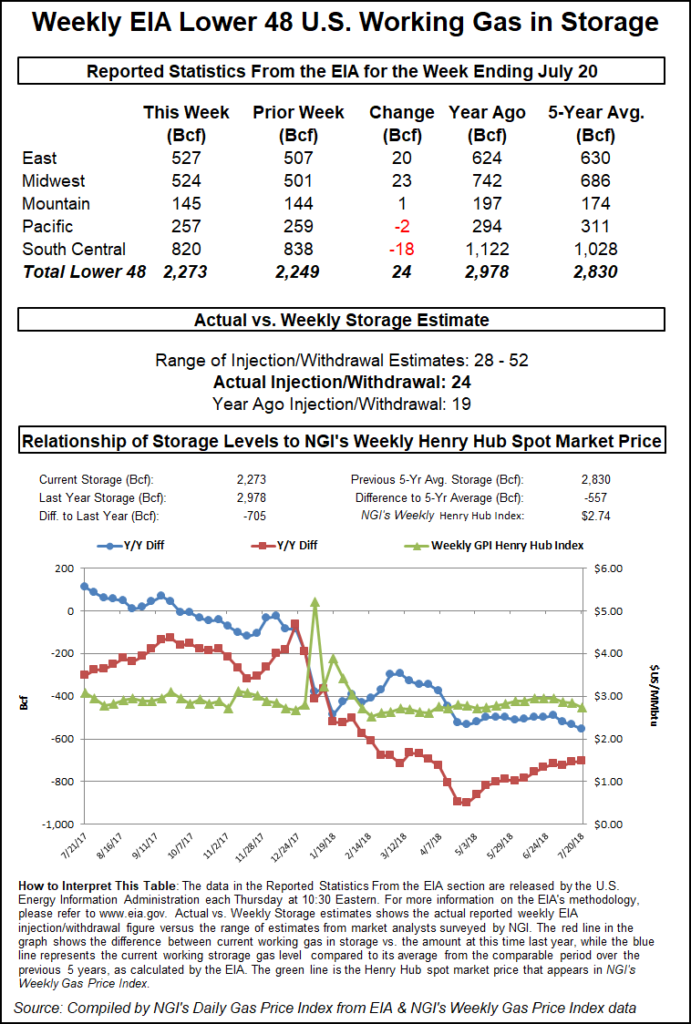

After recent heat helped break a long-running trend of above-average storage injections in the Energy Information Administration’s (EIA) weekly reports, Thursday’s injection number could move back into the above-normal range, based on estimates.

A Bloomberg survey as of Wednesday showed a median expectation for EIA to report a 59 Bcf build for the week ended July 26, based on estimates ranging from 52 Bcf to 67 Bcf. A Reuters survey pointed to a 57 Bcf injection, with predictions from 49 Bcf up to 67 Bcf.

Energy Aspects issued a preliminary estimate for EIA to report a 55 Bcf injection.

“A 2 Bcf/d week/week decline in gas power burn is the prime driver behind the increase in the pace of injections, followed by a 1 Bcf/d week/week recovery in production,” the firm said.

Intercontinental Exchange EIA Financial Weekly Index futures settled Tuesday at 60 Bcf for this week’s report. NGI’s model predicted a 58 Bcf injection.

Last year EIA recorded a 31 Bcf injection for the period, and the five-year average build is 37 Bcf.

Meanwhile, Kinder Morgan Inc.-backed Gulf LNG Liquefaction Co. LLC on Wednesday became the latest U.S. liquefied natural gas (LNG) developer to move forward in the permitting process, securing long-term, worldwide export authorization from the U.S. Department of Energy.

The Gulf LNG Liquefaction Project proposes converting the company’s existing Jackson County, MS, terminal into a bi-directional facility capable of exporting up to 11.5 million tons per year of LNG.

U.S. LNG exports have ramped up considerably as a share of demand for domestic natural gas supply, reaching a new peak of 4.7 Bcf/d as of May 2019, according to EIA figures.

“This year, the United States became the world’s third-largest LNG exporter, averaging 4.2 Bcf/d in the first five months of the year, exceeding Malaysia’s LNG exports of 3.6 Bcf/d during the same period,” EIA said. “The United States is expected to remain the third-largest LNG exporter in the world, behind Australia and Qatar, in 2019–20.”

The DOE approval follows FERC’s decision in mid-July to authorize siting, construction and operation of the facility.

Spot prices along the Gulf Coast mirrored the gains in the futures market Wednesday, with benchmark Henry Hub adding 6.5 cents to average $2.230, bringing it in line with the front month contract.

Still, forecasts suggest national demand won’t be “strong enough” overall through the end of this week and into next, according to NatGasWeather.

“Hot high pressure will rule the West and Plains with highs of upper 80s to 100s, hottest over the Southwest and Texas,” the forecaster said. Highs along the East Coast in the upper 80s to 90 degrees Wednesday were expected to cool by Thursday and Friday “as a weather system and associated cool front arrives out of the Midwest with comfortable highs of 70s and 80s.

“Additional weather systems with showers and cooling arrive next week yet again over the Midwest and East, while very warm to hot elsewhere.”

With more moderate temperatures on the way, prices in the Northeast were mixed. Transco Zone 6 NY added 4.0 cents to $2.160, while Algonquin Citygate sold off 8.0 cents to $2.215.

Elsewhere, NGPL Midcontinent prices continued to show signs of impact from maintenance restricting northbound flows on the Natural Gas Pipeline Co. of America (NGPL) system. Prices there sold off 10.0 cents to average 75.5 cents Wednesday.

In Tuesday’s trading, NGPL Midcontinent fell sharply after coming under pressure due to a force majeure on NGPL’s Amarillo mainline. Genscape Inc. estimated that the force majeure, scheduled to run through Monday (Aug. 5), impacts around 600 MMcf/d of throughput.

“The price drop is predicated by a similar set of circumstances that drove” negative pricing at NGPL Midcontinent back in May, Genscape analyst Matt McDowell said. “A lack of eastbound capacity out of the region toward the Gulf Coast mainline creates a situation where NGPL’s Permian supply can undercut the Midcontinent hub and fill the constrained Amarillo mainline first, leading to a reduction of 349 MMcf/d of nominations at receipt points on the pipeline.”

TC Energy Corp. CEO Russ Girling said in the company’s earnings call on Thursday that it is open to discussion as a way to solving the arbitration requests filed by Mexico’s Comisión Federal de Electricidad (CFE) over its Mexico pipelines.

The CFE seeks to renegotiate contract clauses for the 2.6 Bcf/d Sur de Texas-Tuxpan, 886 MMcf/d Tuxpan-Tula, and 886 MMcf/d Tula-Villa de Reyes pipelines.

Girling reiterated that the Sur de Texas-Tuxpan marine pipeline is ready for commercial operations, but they are waiting on CFE for approval to begin flowing gas. The pipeline is seen as a crucial takeaway for U.S. natural gas and to solving natural gas shortages in southern Mexico.

Meanwhile commencement of construction of the central segment of the adjoining Tula project has been delayed due to a “lack of progress by the Mexican government,” Girling said, adding that TC now expects that pipe to be completed in 2021. The company had targeted completion for 2020 in its first quarter earnings report.

Phased in-service of Villa de Reyes is expected to commence in late 2019, Girling said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2577-9966 |