Markets | Infrastructure | NGI All News Access

Bearish EIA Storage Miss Brings Abrupt Halt to Natural Gas Futures Rally

The Energy Information Administration (EIA) on Thursday reported a 65 Bcf weekly injection into U.S. natural gas stocks, on the high side of estimates, dealing a swift blow to surging futures prices.

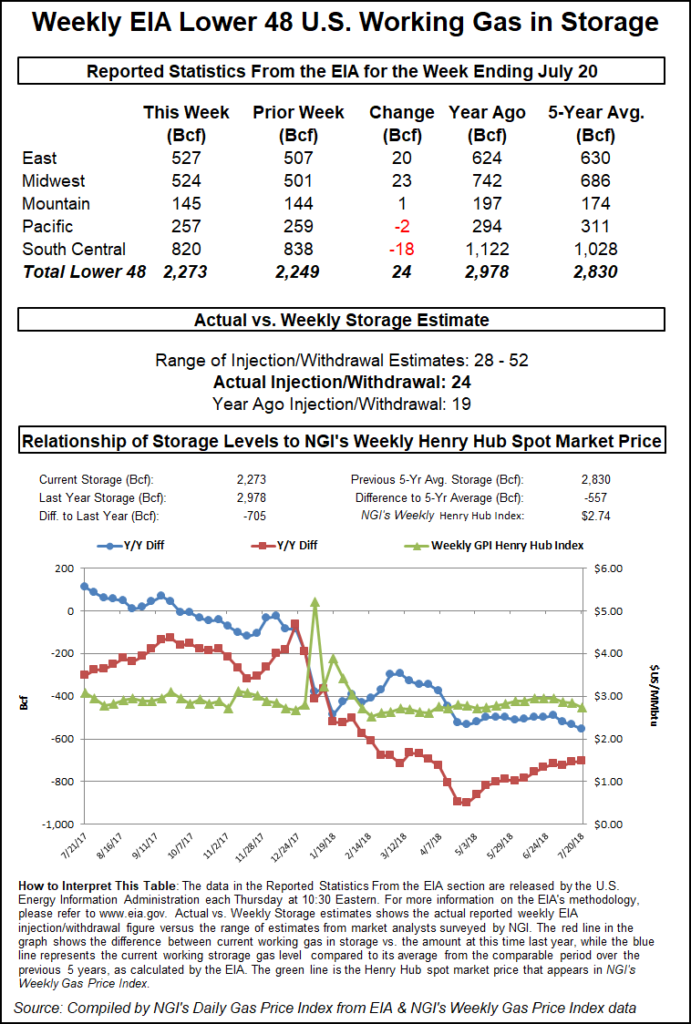

The 65 Bcf build, reflecting injections during the week ended July 26, compares to a 31 Bcf injection recorded in the year-ago period and a five-year average of 37 Bcf.

In the lead-up to EIA’s weekly data release, market observers had been monitoring reports of a fatal explosion on the Texas Eastern Transmission (Tetco) system in Kentucky. Tetco notified shippers early Thursday that north-to-south flows on its 30-inch diameter line south of the Danville Kentucky Compressor Station would be cut to zero. September futures were trading sharply higher early Thursday, up around $2.300-2.310 in the half hour before EIA’s latest storage number landed.

As the figure crossed trading screens at 10:30 a.m. ET, the front month quickly shed over a nickel, dipping down to around $2.240-2.250 over the next 10 minutes. By 11 a.m. ET, September was trading at $2.236, roughly flat with Wednesday’s settle but down around 7 cents from the pre-report trade.

Prior to Thursday’s report, estimates had been pointing to a build in the mid to upper 50s Bcf. A Bloomberg survey showed a median 59 Bcf build, while a Reuters survey pointed to a 57 Bcf injection. Intercontinental Exchange EIA Financial Weekly Index futures settled Wednesday at 60 Bcf. NGI’s model predicted a 58 Bcf injection.

The bearish miss confirms that balances remain loose versus the five-year average, Bespoke Weather Services said.

“The miss was mostly in the South Central region, and likely stems from record lows across Texas and many other southern locations having more of an impact than we accounted for in terms of gas usage,” Bespoke said. “Next week’s report will likely be tighter than this week’s, but overall, balances continue to underwhelm.”

Total Lower 48 working gas in underground storage stood at 2,634 Bcf as of July 26, 334 Bcf (14.5%) higher than last year’s stocks but 123 Bcf (minus 4.5%) lower than the five-year average, according to EIA.

By region, the Midwest injected 27 Bcf week/week, while the East injected 22 Bcf. Further west, the Mountain region refilled 5 Bcf, while the Pacific recorded a 1 Bcf withdrawal. In the South Central, a 16 Bcf weekly injection into nonsalt stocks was partially offset by a 3 Bcf withdrawal from salt, EIA data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |