Infrastructure | NGI All News Access

Equitrans Sees Benefits in EQT’s Combo Development Strategy

Equitrans Midstream Corp. CEO Thomas Karam said Tuesday he’s encouraged by the strategy EQT Corp.’s management team unveiled last week, saying it could partly insulate the company from a downturn if commodity prices continue to slide and curb more activity in the Appalachian Basin.

Toby Rice took over as CEO of EQT, Equitrans’ largest customer, after shareholders earlier in July voted to oust the management team.

“We’re very bullish about our ability to create a runway where we will be much more capital efficient over the next several years as this plan gets rolled out, which will be a tremendous mitigant to operating in a lower production environment,” Karam said of EQT’s new direction.

EQT is overhauling how it spends capital and implementing what it calls combo development, which emphasizes planning wells years in advance to improve midstream constraints and the costs associated with other services. Uneconomic wells pads are already being pulled from the schedule.

“We see opportunity for significant long-term value in the rigorous planning process and combo development strategy that EQT’s new management plans to implement,” Karam told financial analysts during a call to discuss second quarter results. “These large-scale, fully coordinated drilling plans will allow us to maximize capital efficiencies for future buildouts in gathering as well as water handling services.”

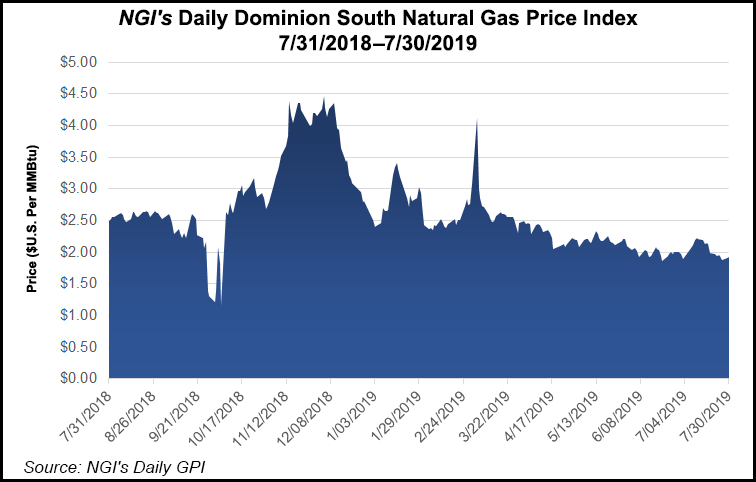

Equitrans management acknowledged that it’s beginning to see activity slow in Appalachia as gas prices remain low and supplies are high. The company was spun-off from EQT’s upstream business last year to become the third largest gas gatherer in the country. It is now renegotiating contracts with EQT, which management declined to discuss.

The company cut its outlook slightly for the water handling business, which it’s aiming to expand, as producers have modified well completion schedules and curbed activity.

Karam also dispelled talk in the market of EQT walking away from the Mountain Valley Pipeline (MVP), another key growth project that’s been beset by regulatory and legal issues. He described the notion as a “completely unfounded rumor” that is “untenable.” The contract, he said, would require EQT to pay upwards of $3 billion if it were to abandon its role as a major shipper.

EQT’s new management team made similar remarks during its second quarter call but noted that the $900 million stake in Equitrans could be sold to generate more cash.

Equitrans COO Diana Charletta said the schedule and cost estimate for MVP remains unchanged. While the project has repeatedly been delayed and costs have increased, the company is still guiding for a mid-2020 startup and a price tag of up to $5 billion. MVP, she said, is more than 85% complete.

In the face of legal challenges, approvals and permits for the project have been vacated and remain pending. For example, MVP still needs a Nationwide Permit 12 from the U.S. Army Corps of Engineers, which is expected later this summer.

Affiliate EQM Midstream Partners LP, which would operate the pipeline, submitted a land exchange proposal earlier this year that would give the federal government ownership of private lands near the Appalachian National Scenic Trail. In exchange, federal agencies would grant MVP an easement and right-of-way (ROW) to cross the trail under the swap, which is aimed at addressing a federal court ruling on the similarly routed Atlantic Coast Pipeline that found the U.S. Forest Service lacks authority to grant ROWs for oil and gas pipelines to cross the trail.

“We believe firmly that the land exchange is well within the discretion of the Department of the Interior,” Karam said of the proposal, which hasn’t been approved yet. “Our conversations with them have confirmed that…This is a viable and timely solution for us.”

The company said its Equitrans Expansion project is also on track to start partial operations in the coming days to move 600 MMcf/d to various markets via existing interconnects with Texas Eastern Transmission LP, Dominion Transmission Inc. and MVP. The project would offer only interruptible service until MVP comes online.

Another project that would move 1.2 Bcf/d from producing fields in southwest Pennsylvania to West Virginia is also expected to offer interruptible service by the end of the year. The 57-mile Hammerhead Pipeline, Charletta said, wouldn’t offer firm transportation until MVP enters service. When MVP is completed, Hammerhead would link up with it.

Equitrans also said that it gathered a record 7.9 Bcf/d in the second quarter.

The company reported second quarter net income of $74.5 million (29 cents/share), compared with $101 million (40 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |