Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report | Regulatory

FERC Inaction Delaying Cheyenne Connector to 1Q2020, Says Tallgrass

After more than a year of waiting for a federal permit, Tallgrass Energy LP is pushing back the expected startup for its Cheyenne Connector natural gas pipeline to early 2020, management said.

Speaking on a call Thursday to discuss 2Q2019 earnings, Tallgrass COO Bill Moler said the regulatory approval process at FERC “has become much slower than what we and others in the industry would like or have experienced in the past.”

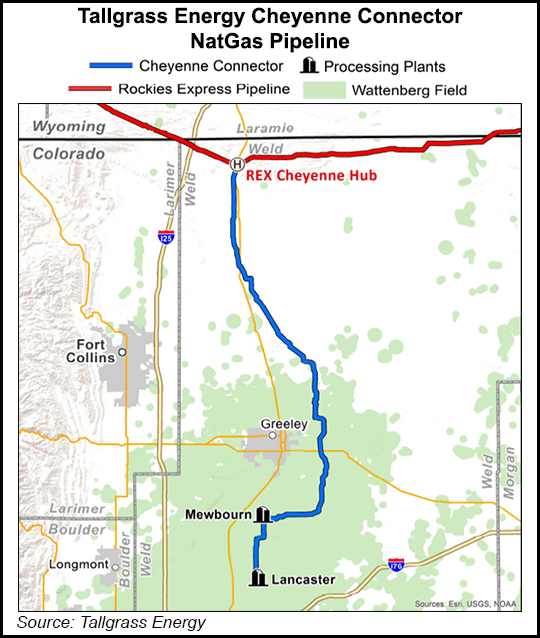

Tallgrass filed at the Federal Energy Regulatory Commission in March 2018 for the proposed pipeline and the related Cheyenne Hub Enhancement project, which would deliver about 600,000 Dth/d into Rockies Express Pipeline (REX) from processing plants in Weld County, CO. It had expected to begin commercial operations in October.

Tallgrass has “99.9%” of the materials on site and a contractor and equipment on hold, according to Moler. “The day that we get the certificate it’s hopeful we start excavating and moving forward.”

The estimated $213 million project includes building a 70-mile, 36 inch-diameter pipeline that would deliver gas into REX’s Cheyenne Hub, allowing access to markets in the Midwest, Midcontinent and Gulf Coast. The Cheyenne Hub Enhancement, expected to cost around $133 million, would increase capacity at REX’s existing facility by around 1 million Dth/d by adding 32,100 hp of compression via six booster units.

The projects each have 10-year commitments totaling 600,000 Dth/d from affiliates of Anadarko Petroleum Corp. and DCP Midstream LP.

“Our team has a long track record of creating opportunities and being able to navigate challenging environments and situations, while maximizing stakeholder value,” CEO David Dehaemers said. “Sometimes that value creation may take more patience than is comfortable from the outside looking in, but from the inside, we remain focused and confident in our ability to deliver once again.”

The gas transportation business segment saw REX western volumes return to near-normal levels with quarterly average throughput of about 1.4 Bcf/d. “We believe these increased volumes are a result of West Coast markets beginning to return to more normal conditions,” Moler said.

Meanwhile, Tallgrass continues to work on recontracting its existing assets and commercializing other projects. The midstreamer has extended open seasons for the proposed Pony Express expansion, the Seahorse Pipeline and the Plaquemines Liquids Terminal (PLT) to Wednesday (July 31) “in order to accommodate the meaningful progress we are making with shippers,” Moler said.

A joint open season was launched in November for crude transportation under a joint tariff between the Pony Express and Seahorse pipelines from Guernsey, WY, and Denver-Julesburg (DJ) Basin origin points to the St. James complex and PLT. A larger Pony Express system expansion of up to an additional 300,000 b/d was announced in January.

During the second quarter, Pony Express averaged about 348,000 b/d, which was up from 336,000 b/d in 1Q2019. The higher volumes occurred despite an eight-day shutdown during May as a result of flooding in central Oklahoma, which cut average May volumes to about 285,000 b/d. July volumes are estimated to average 374,000 b/d, while August nominations came in at about 370,000 b/d.

“We have a healthy market. We are touching a lot of places I think not all pipelines are going,” Dehaemers said.

An open season for Seahorse was first launched last August, but has been extended four times. Seahorse is a 700-mile, 800,000 b/d line that would carry crude from the Cushing hub in Oklahoma to the St. James, LA, refining complex and Tallgrass’ planned PLT in Louisiana.

As for PLT, Tallgrass is in discussions with an international exporter that could potentially take enough capacity to move that project forward to a final investment decision, Moler said. When complete, PLT is expected to offer up to 20 million bbl of storage for oil/refined products and export facilities capable of loading Suezmax and very large crude carriers vessels for international delivery.

Tallgrass brought online its Iron Horse Pipeline in the Powder River Basin during the second quarter. It also completed the mechanical construction of the Grasslands Terminal in the DJ, which would nearly double transportation capacity on its Plattsville Lateral to 80,000 b/d once the project is in service, expected in August.

Tallgrass reported second quarter earnings of $71.6 million (76 cents/share), up from a pro forma net income of $51.2 million (59 cents) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |